Question: b) A share is expected to pay its first dividend of $1.20 in three years. After that, the dividend will remain unchanged for the foreseeable

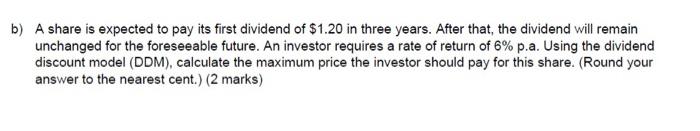

b) A share is expected to pay its first dividend of $1.20 in three years. After that, the dividend will remain unchanged for the foreseeable future. An investor requires a rate of return of 6% p.a. Using the dividend discount model (DDM), calculate the maximum price the investor should pay for this share. (Round your answer to the nearest cent.) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts