Question: (b ) A speculator writes a put option on a stock with an exercise price of $15 and receives a $3 premium. At what stock

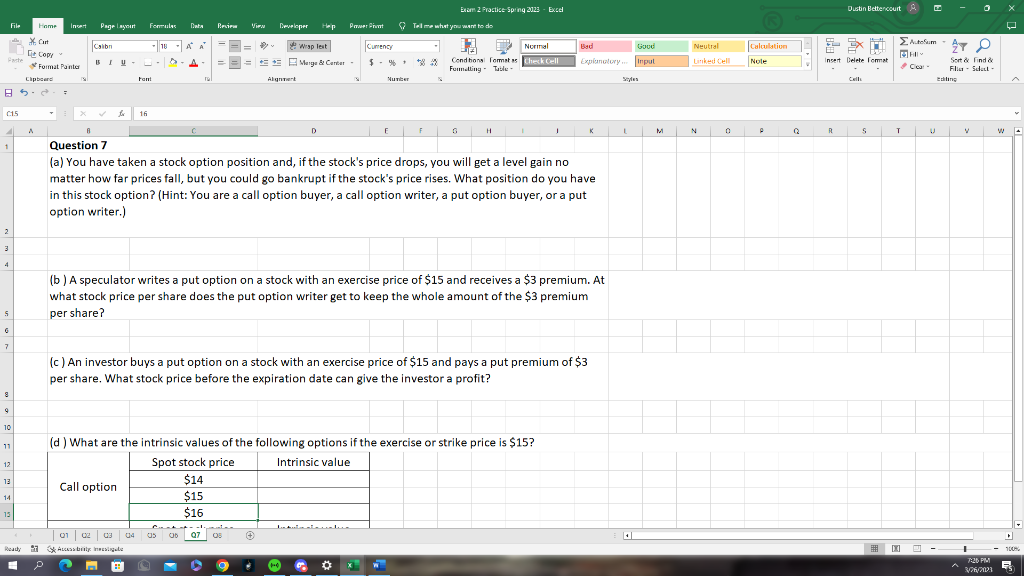

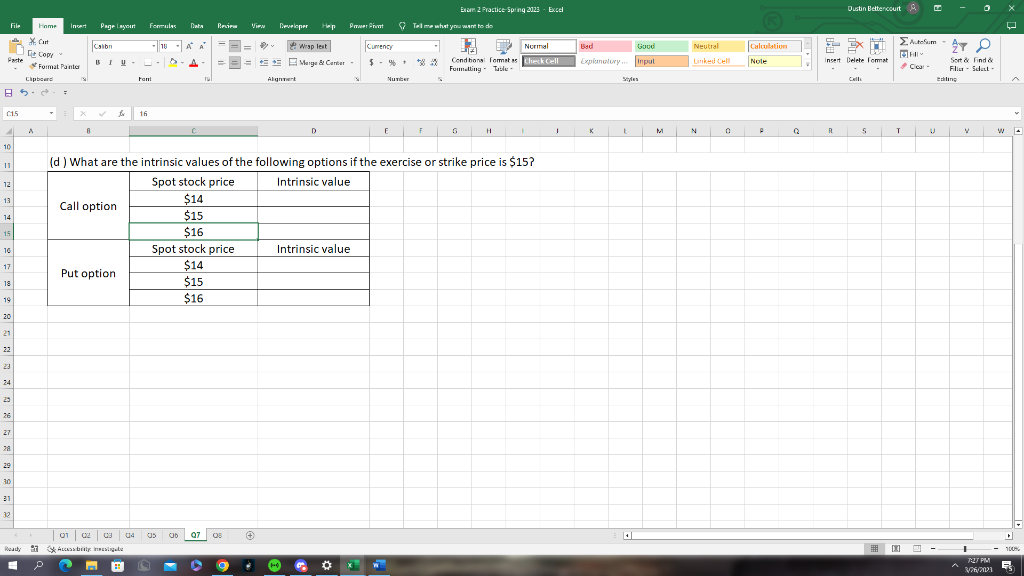

(b ) A speculator writes a put option on a stock with an exercise price of $15 and receives a $3 premium. At what stock price per share does the put option writer get to keep the whole amount of the $3 premium per share? (c) An investor buys a put option on a stock with an exercise price of $15 and pays a put premium of $3 per share. What stock price before the expiration date can give the investor a profit? (d) What are the intrinsic values of the following options if the exercise or strike price is $15 ? \begin{tabular}{|c|c|c|} \multirow{3}{*}{ Call option } & Spot stock price & Intrinsic value \\ \cline { 2 - 3 } & $14 & \\ \cline { 2 - 3 } & $15 & \\ \cline { 2 - 3 } & $16 & \\ \hline \end{tabular} (d) What are the intrinsic values of the following options if the exercise or strike price is $15 ? Call option Put option \begin{tabular}{|c|c|} \hline Spot stock price & Intrinsic value \\ \hline$14 & \\ \hline$15 & \\ \hline$16 & \\ \hline Spot stock price & Intrinsic value \\ \hline$14 & \\ \hline$15 & \\ \hline$16 & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts