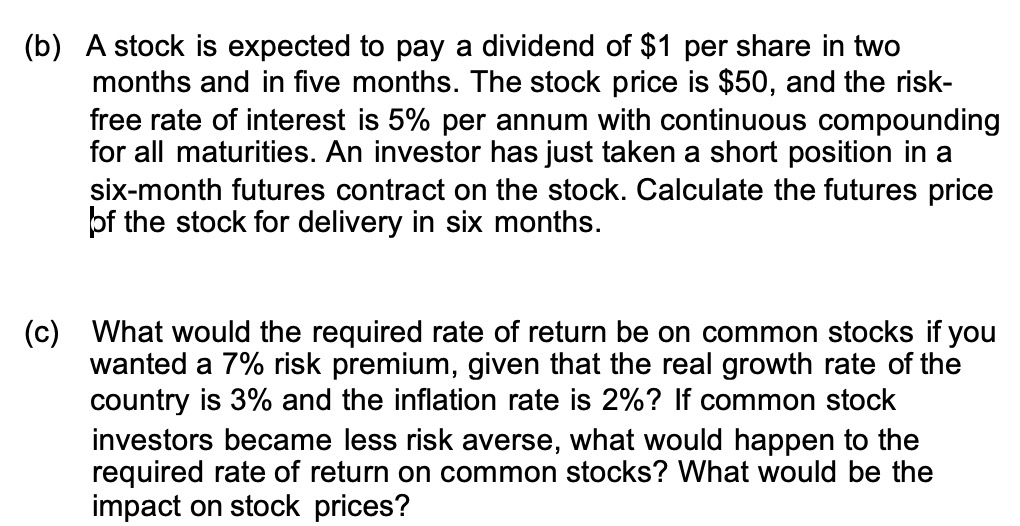

Question: ( b ) A stock is expected to pay a dividend of $ 1 per share in two months and in five months. The stock

b A stock is expected to pay a dividend of $ per share in two months and in five months. The stock price is $ and the riskfree rate of interest is per annum with continuous compounding for all maturities. An investor has just taken a short position in a sixmonth futures contract on the stock. Calculate the futures price bf the stock for delivery in six months.

c What would the required rate of return be on common stocks if you wanted a risk premium, given that the real growth rate of the country is and the inflation rate is If common stock investors became less risk averse, what would happen to the required rate of return on common stocks? What would be the impact on stock prices?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock