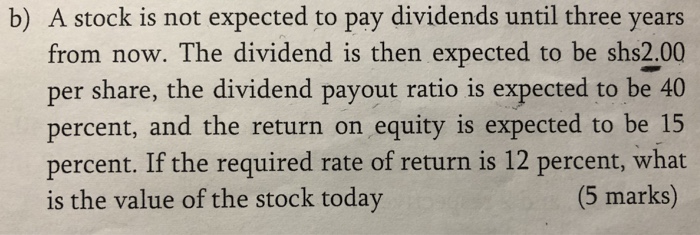

Question: b) A stock is not expected to pay dividends until three years from now. The dividend is then expected to be shs2.00 per share, the

b) A stock is not expected to pay dividends until three years from now. The dividend is then expected to be shs2.00 per share, the dividend payout ratio is expected to be 40 percent, and the return on equity is expected to be 15 percent. If the required rate of return is 12 percent, what (5 marks) is the value of the stock today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts