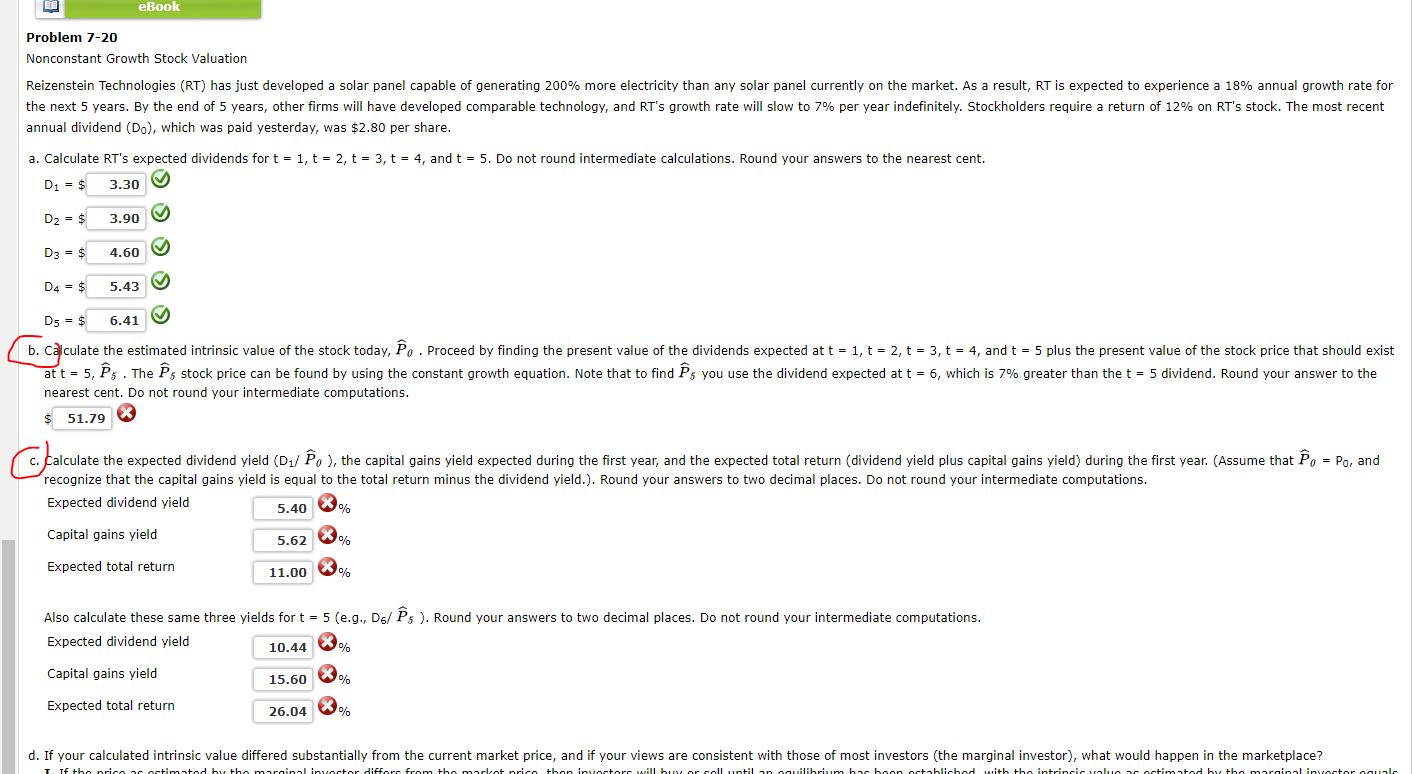

Question: B and C are incorrect and I don't understand wha the correct answere is.. Please solve annual dividend (D0), which was paid yesterday, was $2.80

B and C are incorrect and I don't understand wha the correct answere is.. Please solve

annual dividend (D0), which was paid yesterday, was $2.80 per share. a. Calculate RT 's expected dividends for t=1,t=2,t=3,t=4, and t=5. Do not round intermediate calculations. Round your answers to the nearest cent. D1=$D2=$D3=$D4=$D5=$ nearest cent. Do not round your intermediate computations. $ (3) recognize that the capital gains yield is equal to the total return minus the dividend yield.). Round your answers to two decimal places. Do not round your intermediate computations. Expected dividend yield 3% Capital gains yield % Expected total return \% Also calculate these same three yields for t=5 (e.g., D6/P5 ). Round your answers to two decimal places. Do not round your intermediate computations. Expected dividend yield Capital gains yield Expected total return 3% ) 3\% annual dividend (D0), which was paid yesterday, was $2.80 per share. a. Calculate RT 's expected dividends for t=1,t=2,t=3,t=4, and t=5. Do not round intermediate calculations. Round your answers to the nearest cent. D1=$D2=$D3=$D4=$D5=$ nearest cent. Do not round your intermediate computations. $ (3) recognize that the capital gains yield is equal to the total return minus the dividend yield.). Round your answers to two decimal places. Do not round your intermediate computations. Expected dividend yield 3% Capital gains yield % Expected total return \% Also calculate these same three yields for t=5 (e.g., D6/P5 ). Round your answers to two decimal places. Do not round your intermediate computations. Expected dividend yield Capital gains yield Expected total return 3% ) 3\%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts