Question: B AND C ARE INCORRECT. please answer corrcetly it has been done wrong twice You manage a $12.9 million portfolio, currently all invested in equities,

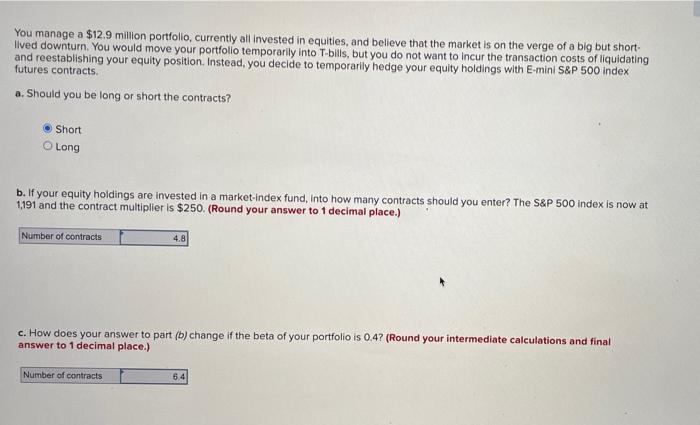

You manage a $12.9 million portfolio, currently all invested in equities, and believe that the market is on the verge of a big but shortlived downturn. You would move your portfolio temporarily into T-blils, but you do not want to incur the transaction costs of liquidating and reestablishing your equity position. Instead, you decide to temporarily hedge your equity holdings with E-mini S\&P 500 index futures contracts. a. Should you be long or short the contracts? Short Long b. If your equity holdings are invested in a market-index fund, into how many contracts should you enter? The S\&P 500 index is now at 1,191 and the contract multiplier is $250. (Round your answer to 1 decimal place.) c. How does your answer to part (b) change if the beta of your portfolio is 0.4 ? (Round your intermediate calculations and final answer to 1 decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts