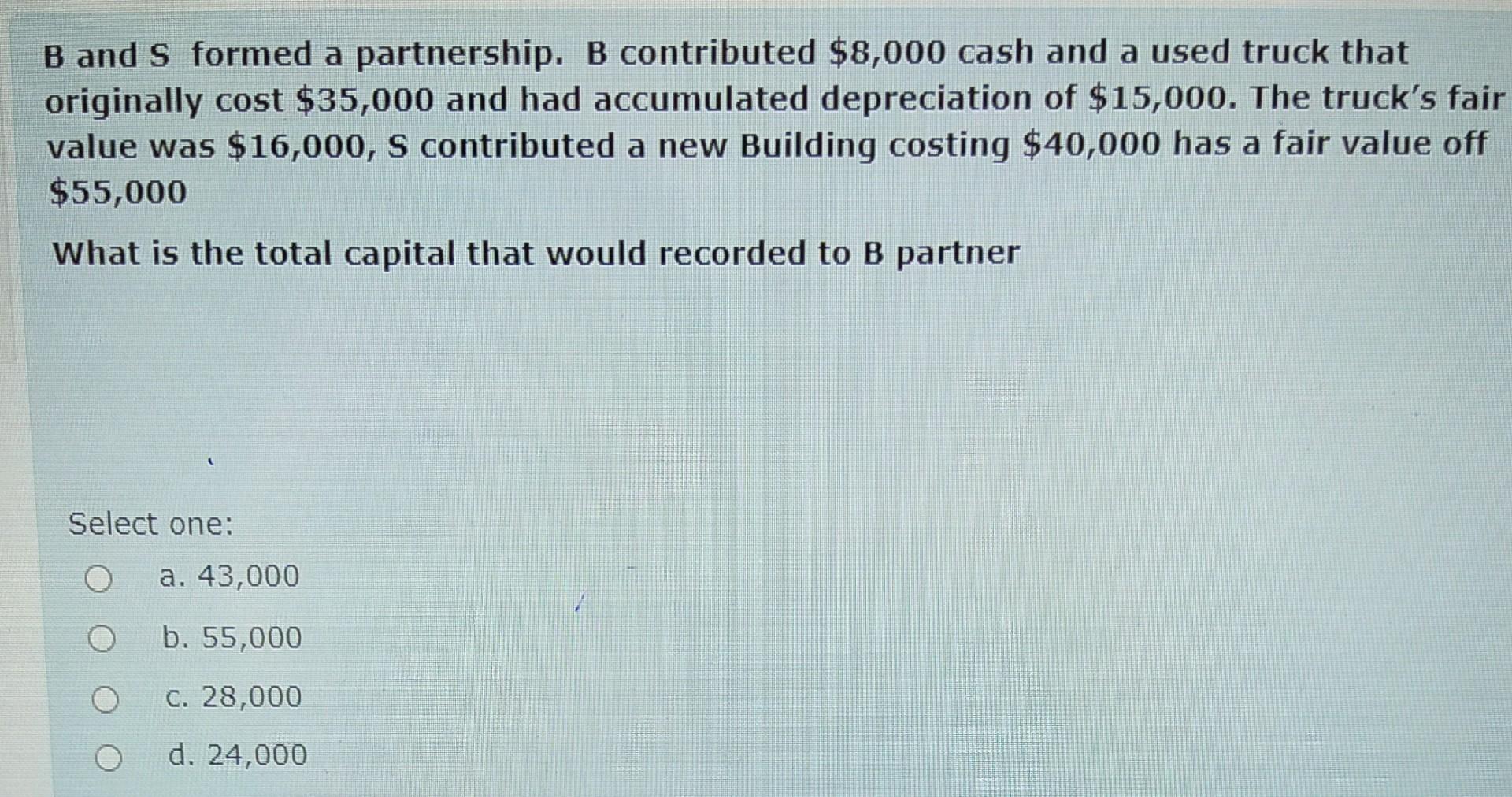

Question: B and s formed a partnership. B contributed $8,000 cash and a used truck that originally cost $35,000 and had accumulated depreciation of $15,000. The

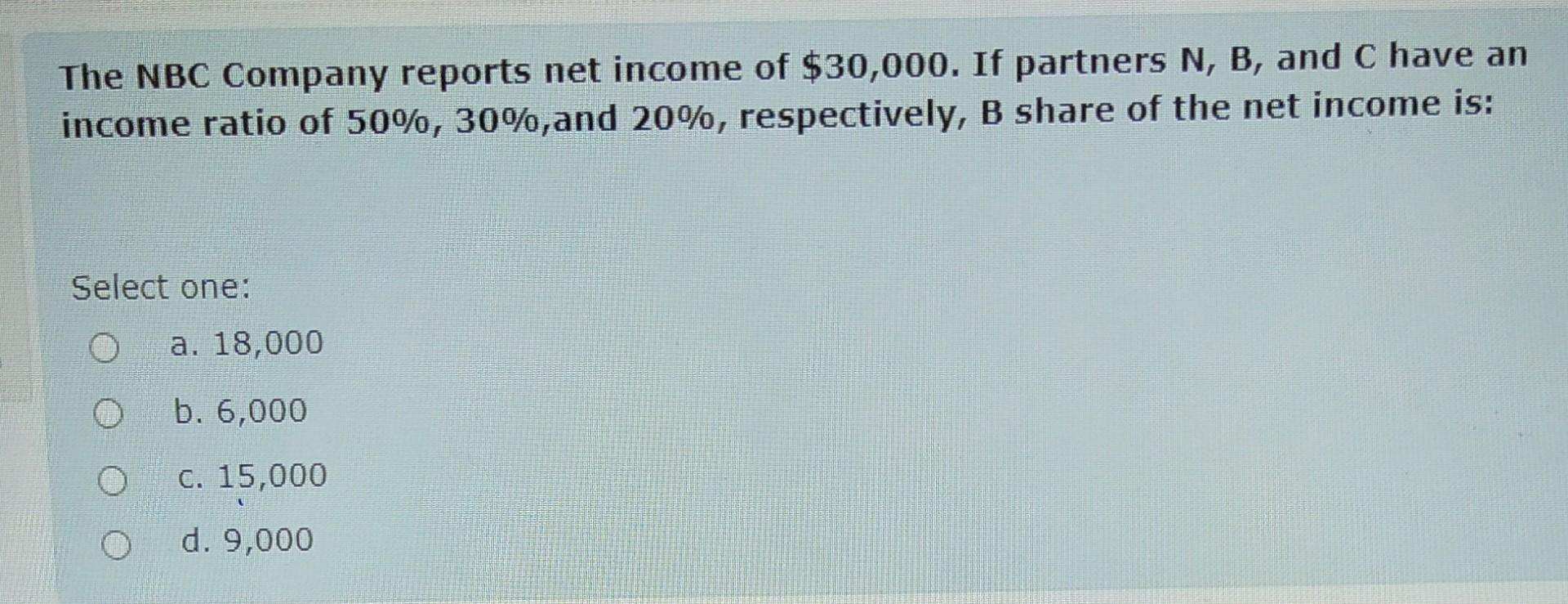

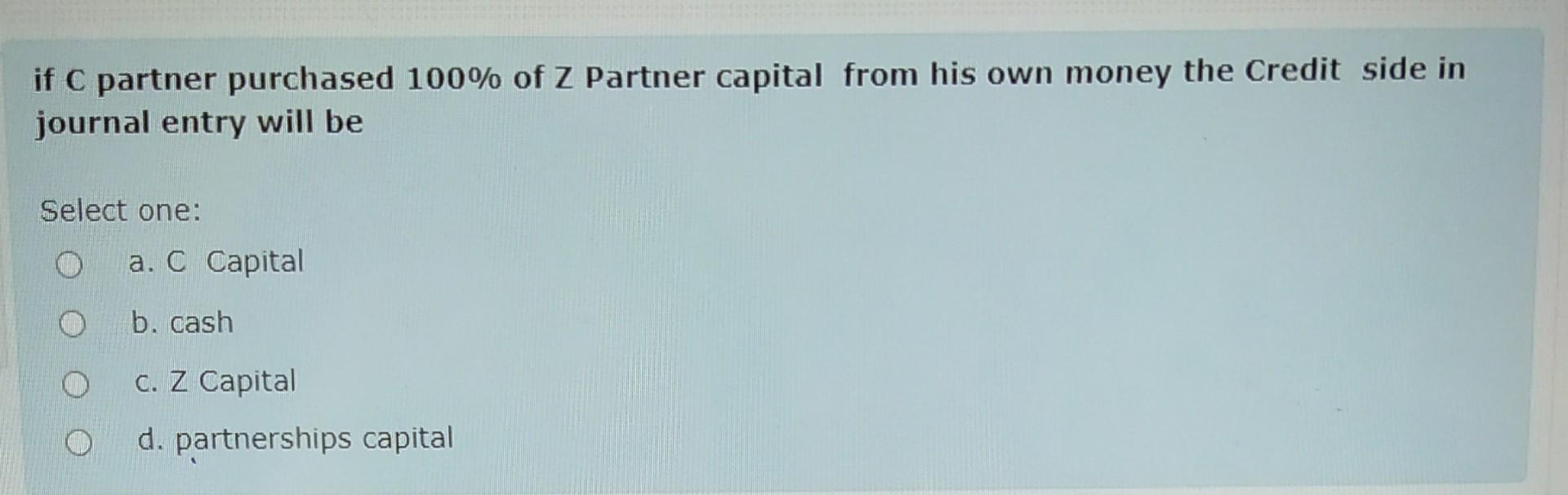

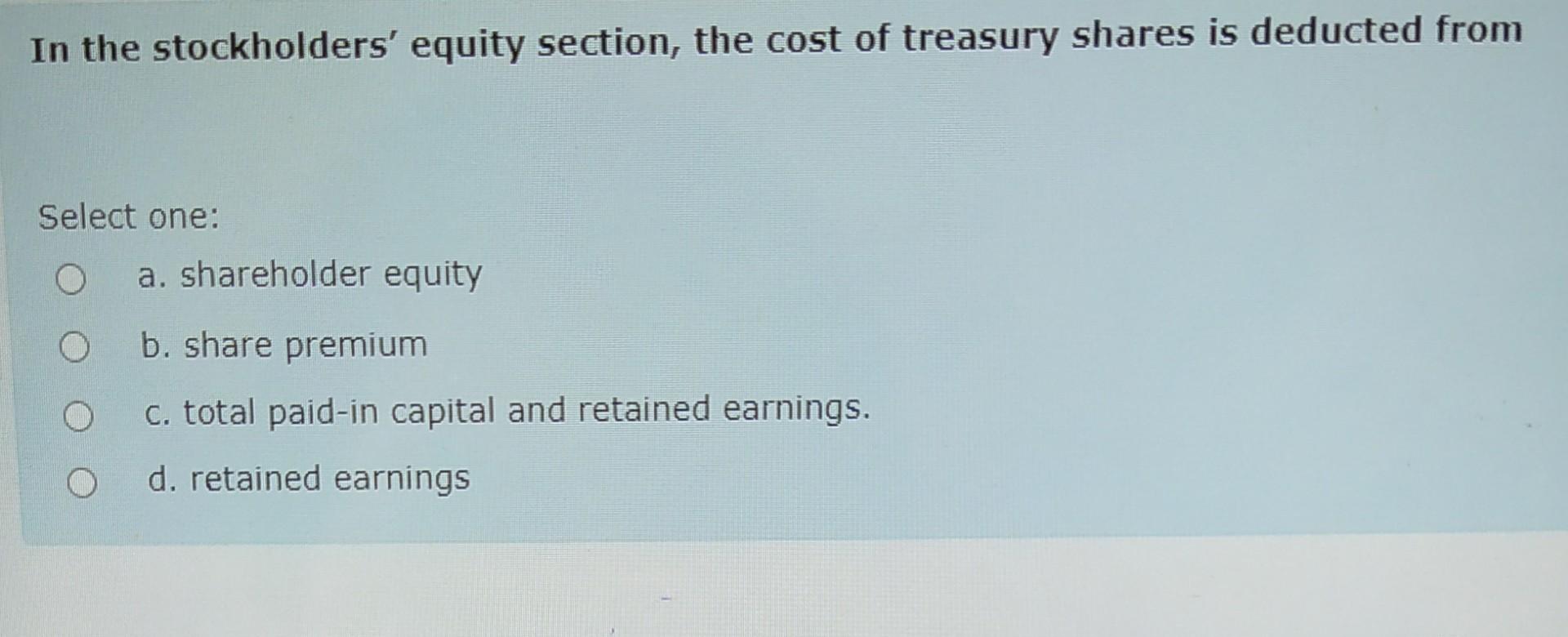

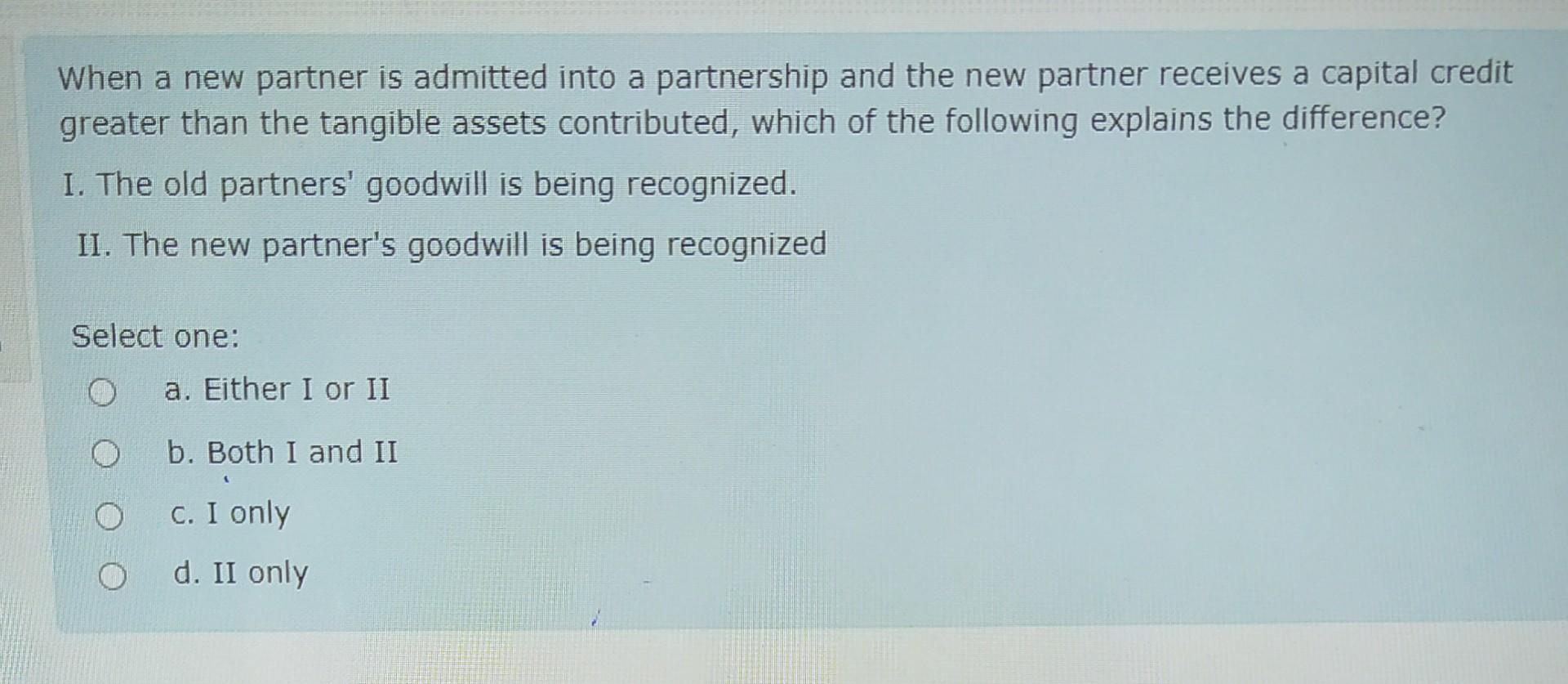

B and s formed a partnership. B contributed $8,000 cash and a used truck that originally cost $35,000 and had accumulated depreciation of $15,000. The truck's fair value was $16,000, s contributed a new Building costing $40,000 has a fair value off $55,000 What is the total capital that would recorded to B partner Select one: a. 43,000 b. 55,000 C. 28,000 d. 24,000 The NBC Company reports net income of $30,000. If partners N, B, and C have an income ratio of 50%, 30%,and 20%, respectively, B share of the net income is: Select one: a. 18,000 b. 6,000 C. 15,000 d. 9,000 if C partner purchased 100% of Z Partner capital from his own money the Credit side in journal entry will be Select one: a. C Capital b. cash C. Z Capital d. partnerships capital In the stockholders' equity section, the cost of treasury shares is deducted from Select one: O a. shareholder equity b. share premium c. total paid-in capital and retained earnings. d. retained earnings When a new partner is admitted into a partnership and the new partner receives a capital credit greater than the tangible assets contributed, which of the following explains the difference? I. The old partners' goodwill is being recognized. II. The new partner's goodwill is being recognized Select one: a. Either I or II b. Both I and II C. I only d. II only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts