Question: b Assignment Soved Help Suli Save & Esis On January 1, Year 1, Spike Ltd purchased land trom outsiders for $200,000. On December 31, Year

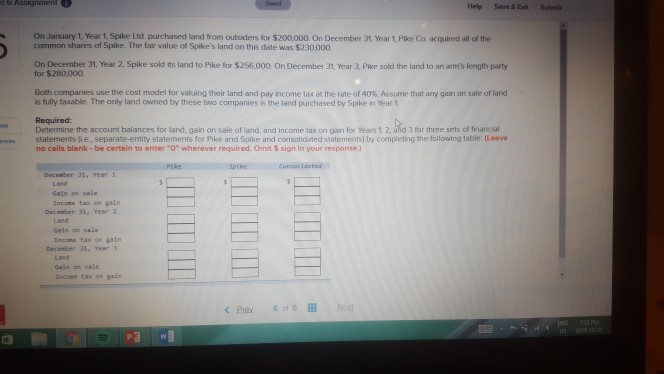

b Assignment Soved Help Suli Save & Esis On January 1, Year 1, Spike Ltd purchased land trom outsiders for $200,000. On December 31, Year 1, Pike Co acquired all of the common shares of Spike The fair value of Spike's land on this date was $230,000 On December 31, Year 2, Spike sold its land to Pike for $256.000 On December 31, Year 3, Pike sold the land to an arm's-length party for $280,000 Both comparnies use the cost model for valuing their land and pay income tax at the rate of 40 % Assume that ary gain on sale of land is fully taxable The only land owned by these two companies is the land purchased by Spike in Year 1 Required: Determine the account balances for land, gain on sale of land, and income tax on gan for Years 1,2, and 3 for three sets of financial statements (Le, separate-entity statements for Pike and Spike and consalidated statements) by completing the following table: Leave no cells blank-be certain to enter "O" wherever required. Omit $ sign in your response) nces PERe Sotke Consol tdated December 31, Year 11 Land Gain on sale Incone tax on gain December 31, Year 21 Land Gain on sele Incone tax on gain December 31, Year 31 Land Gain on sale income tax on gain 6 of 6 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts