Question: B) Based on the information provided, prepare the consolidation journal entries necessary to allocate the non-controlling interest in Grandchild Ltd as at 30 June 2020.

B) Based on the information provided, prepare the consolidation journal entries necessary to allocate the non-controlling interest in Grandchild Ltd as at 30 June 2020. (Only NCI entries are required in this question)

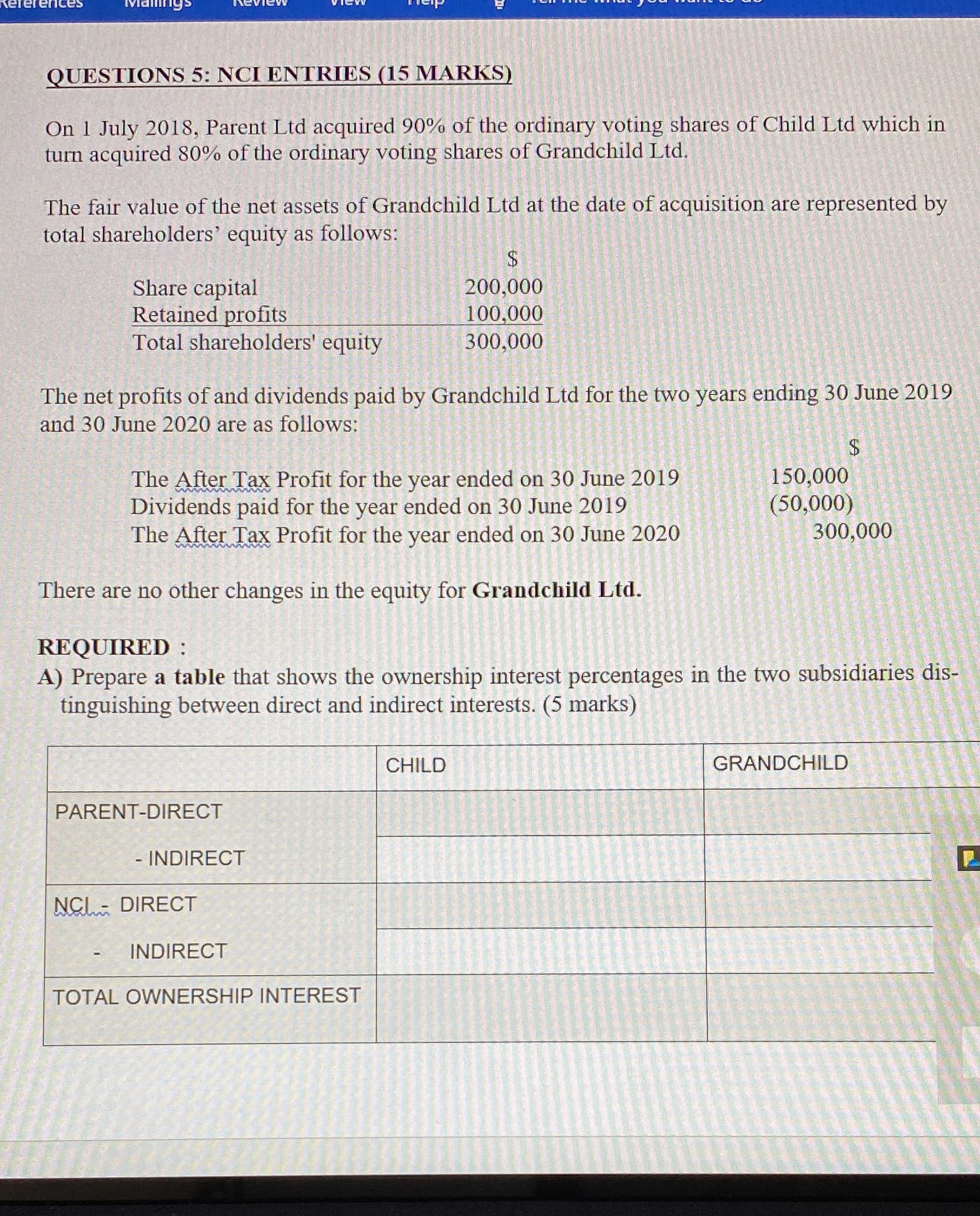

QUESTIONS 5: NCI ENTRIES (15 MARKS) On 1 July 2018, Parent Lid acquired 90% of the ordinary voting shares of Child Ltd which in turn acquired 80% of the ordinary voting shares of Grandchild Ltd. The fair value of the net assets of Grandchild Ltd at the date of acquisition are represented by total shareholders' equity as follows: Share capital 200,000 Retained profits 100,000 Total shareholders' equity 300,000 The net profits of and dividends paid by Grandchild Lid for the two years ending 30 June 2019 and 30 June 2020 are as follows: $ The After Tax Profit for the year ended on 30 June 2019 150,000 Dividends paid for the year ended on 30 June 2019 (50,000) The After Tax Profit for the year ended on 30 June 2020 300,000 There are no other changes in the equity for Grandchild Ltd. REQUIRED : A) Prepare a table that shows the ownership interest percentages in the two subsidiaries dis- tinguishing between direct and indirect interests. (5 marks) CHILD GRANDCHILD PARENT-DIRECT - INDIRECT NCL - DIRECT INDIRECT TOTAL OWNERSHIP INTEREST

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts