Question: b) Belli Craft Ent. Received a bank statement from ABC Bank, which shown a difference with the cash book. The cash book indicates a balance

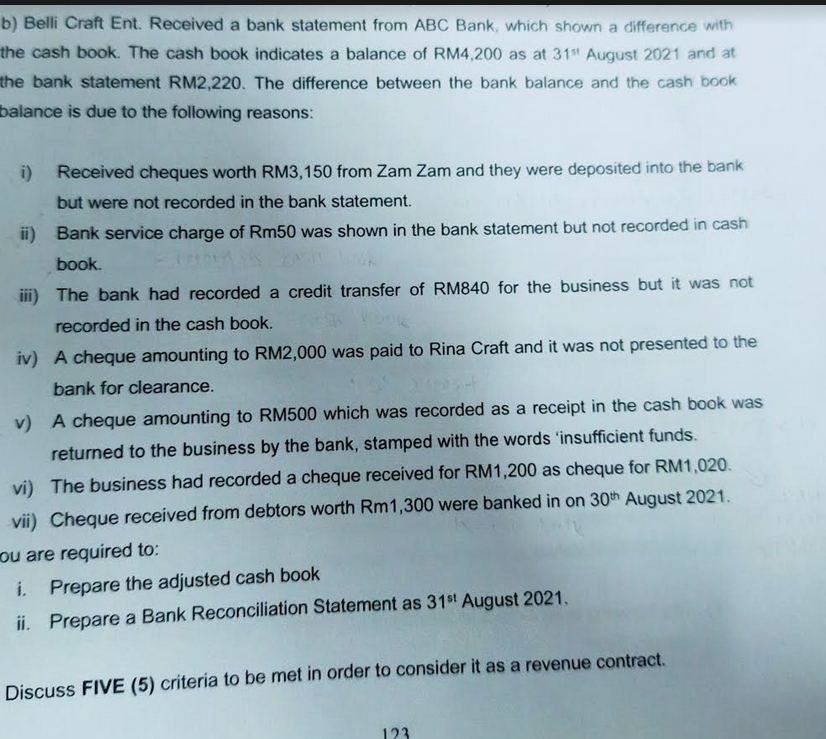

b) Belli Craft Ent. Received a bank statement from ABC Bank, which shown a difference with the cash book. The cash book indicates a balance of RM4,200 as at 31 " August 2021 and at the bank statement RM2,220. The difference between the bank balance and the cash book balance is due to the following reasons: i) Received cheques worth RM3,150 from Zam Zam and they were deposited into the bank but were not recorded in the bank statement. ii) Bank service charge of Rm50 was shown in the bank statement but not recorded in cash book. iii) The bank had recorded a credit transfer of RM840 for the business but it was not recorded in the cash book. iv) A cheque amounting to RM2,000 was paid to Rina Craft and it was not presented to the bank for clearance. v) A cheque amounting to RM500 which was recorded as a receipt in the cash book was returned to the business by the bank, stamped with the words 'insufficient funds. vi) The business had recorded a cheque received for RM1,200 as cheque for RM1,020. vii) Cheque received from debtors worth Rm1,300 were banked in on 30th August 2021. ou are required to: i. Prepare the adjusted cash book ii. Prepare a Bank Reconciliation Statement as 31st August 2021. Discuss FIVE (5) criteria to be met in order to consider it as a revenue contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts