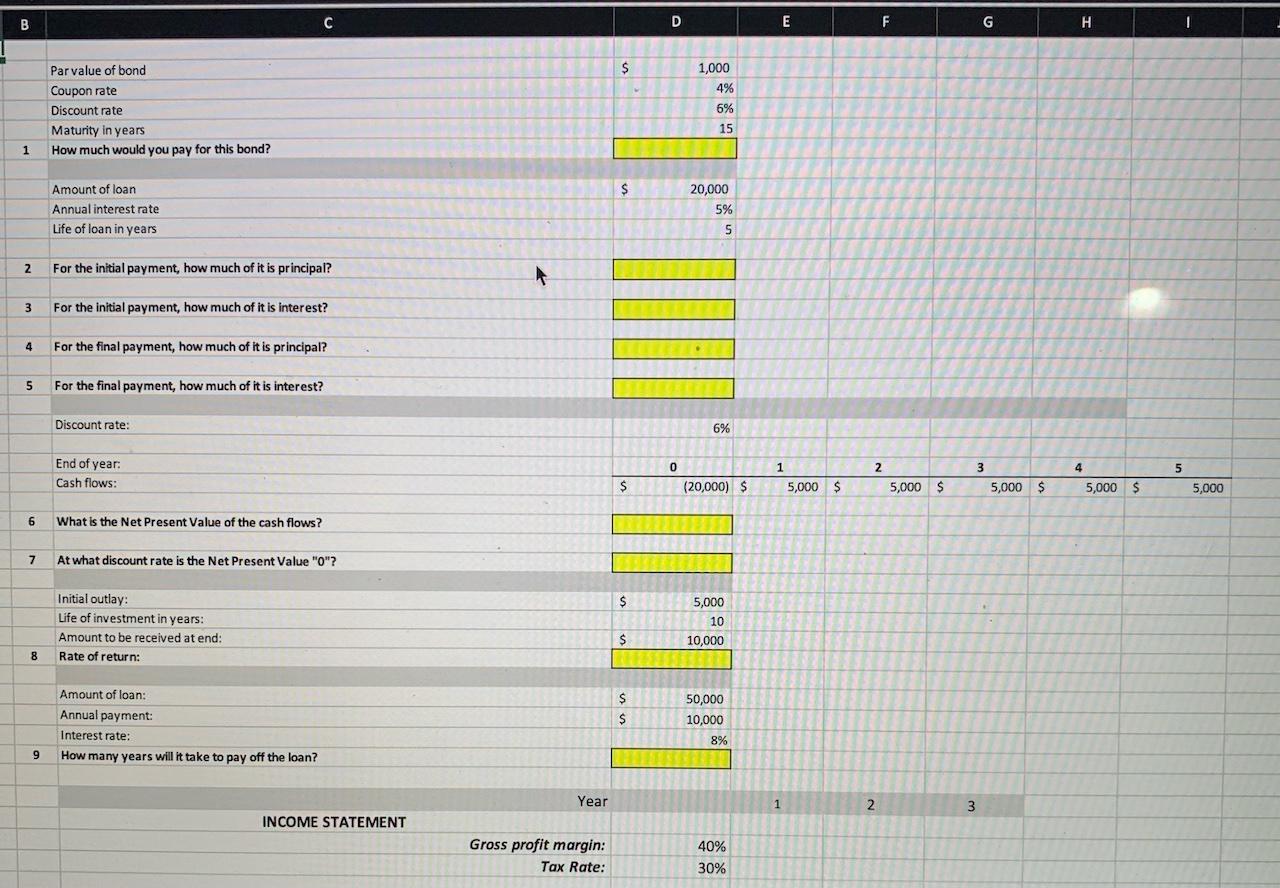

Question: B C D E F G H I $ Par value of bond Coupon rate Discount rate Maturity in years How much would you pay

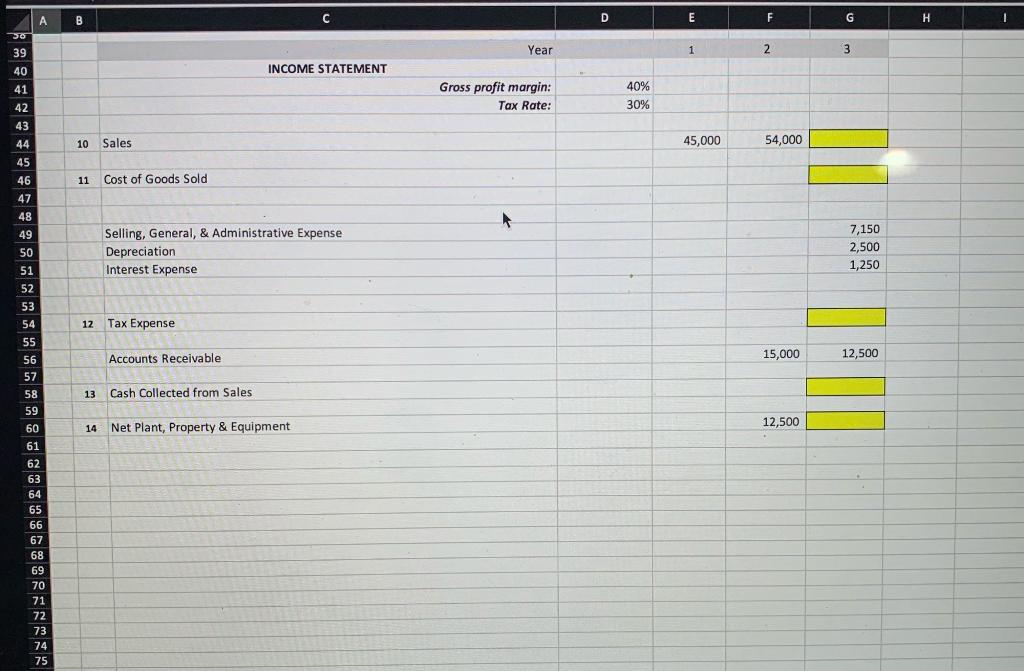

B C D E F G H I $ Par value of bond Coupon rate Discount rate Maturity in years How much would you pay for this bond? 1,000 4% 6% 15 1 $ Amount of loan Annual interest rate Life of loan in years 20,000 5% 5 2 For the initial payment, how much of it is principal? 3 For the initial payment, how much of it is interest? 4 For the final payment, how much of it is principal? 5 For the final payment, how much of it is interest? Discount rate: 6% 0 1 2 End of year: Cash flows: 5 3 5,000 $ 4 5,000 $ $ (20,000) $ 5,000 $ 5,000 $ 5,000 6 What is the Net Present Value of the cash flows? 7 At what discount rate is the Net Present Value ""? $ Initial outlay: Life of investment in years: Amount to be received at end: Rate of return: 5,000 10 10,000 $ 8 $ $ $ 50,000 10.000 Amount of loan: Annual payment: Interest rate: How many years will it take to pay off the loan? 8% 9 Year 1 2 3 INCOME STATEMENT Gross profit margin: Tax Rate: 40% 30% AB D E E F G H 1 30 39 Year 1 2 3 40 INCOME STATEMENT 41 42 Gross profit margin: Tax Rate: 40% 30% 10 Sales 45,000 54,000 43 44 45 46 11 Cost of Goods Sold 47 48 49 50 51 Selling, General, & Administrative Expense Depreciation Interest Expense 7,150 2,500 1,250 52 53 12 Tax Expense Accounts Receivable 15,000 12,500 54 55 56 57 58 59 60 13 Cash Collected from Sales 12,500 14 Net Plant, Property & Equipment 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts