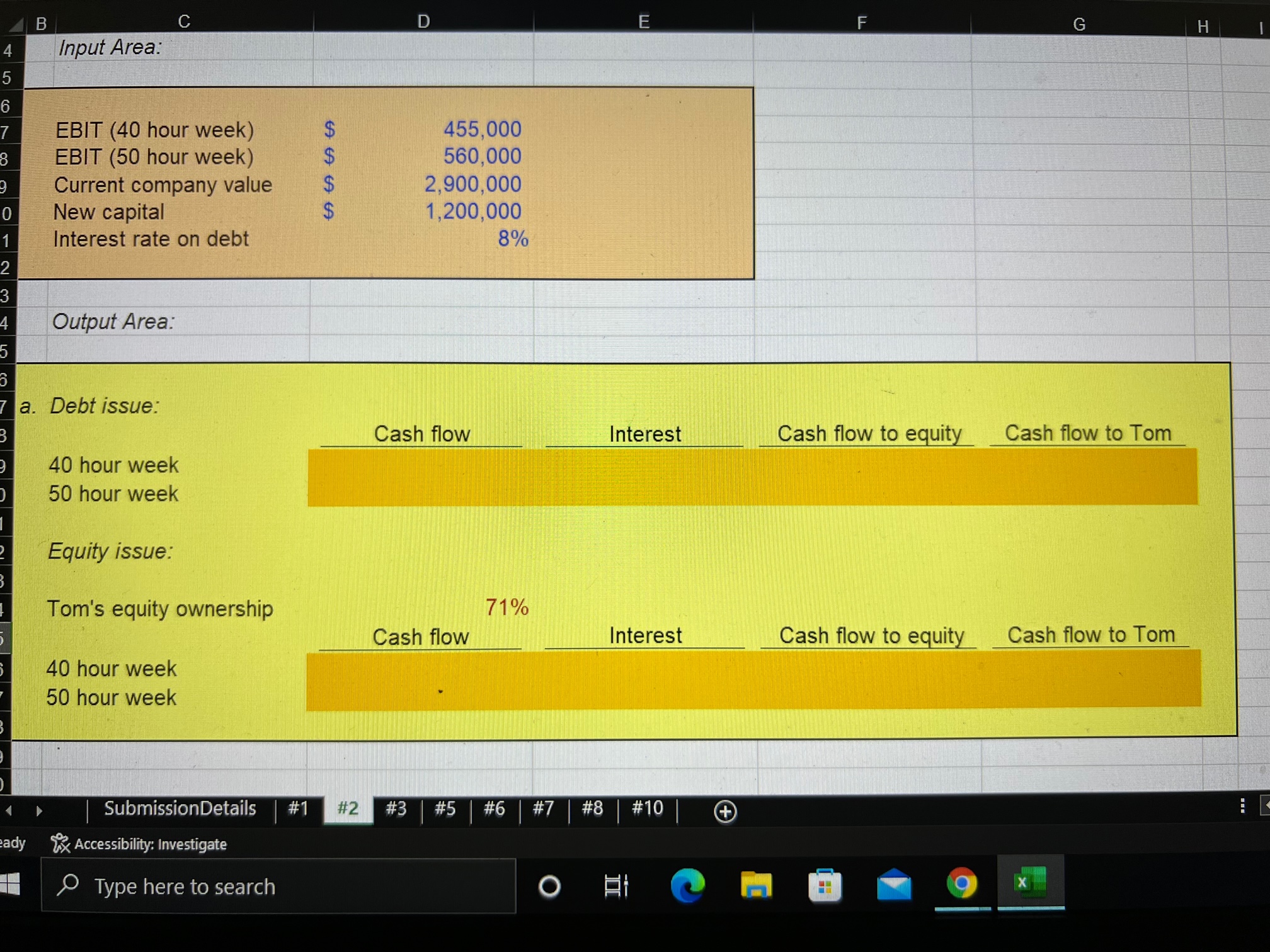

Question: B C D G H Input Area: EBIT (40 hour week) 455,000 EBIT (50 hour week) 560,000 Current company value 2,900,000 New capital 1,200,000 Interest

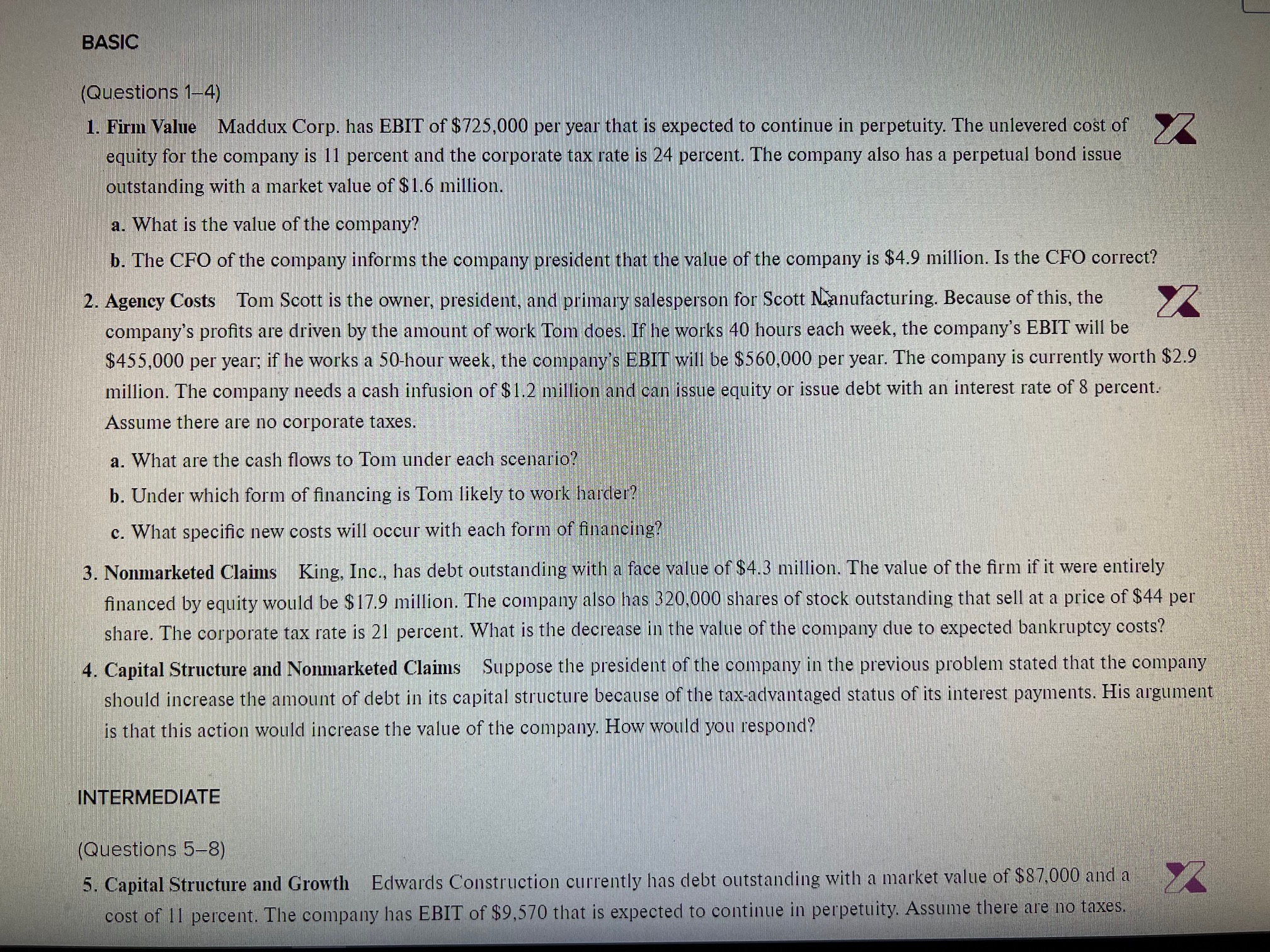

B C D G H Input Area: EBIT (40 hour week) 455,000 EBIT (50 hour week) 560,000 Current company value 2,900,000 New capital 1,200,000 Interest rate on debt 8% Output Area. a. Debt issue: Cash flow Interest Cash flow to equity Cash flow to Tom 40 hour week 50 hour week Equity issue: Tom's equity ownership 71% Cash flow Interest Cash flow to equity_ Cash flow to Tom 40 hour week 50 hour week SubmissionDetails #1 # 2 #3 #5 #6 #7 #8 #10 + ady x Accessibility: Investigate Type here to search O 9 XBASIC (Questions 1-4) 1. Firm Value Maddux Corp. has EBIT of $725,000 per year that is expected to continue in perpetuity. The unlevered cost of equity for the company is 11 percent and the corporate tax rate is 24 percent. The company also has a perpetual bond issue outstanding with a market value of $1.6 million. a. What is the value of the company? b. The CFO of the company informs the company president that the value of the company is $4.9 million. Is the CFO correct? 2. Agency Costs Tom Scott is the owner, president, and primary salesperson for Scott Manufacturing. Because of this, the company's profits are driven by the amount of work Tom does. If he works 40 hours each week, the company's EBIT will be $455,000 per year; if he works a 50-hour week, the company's EBIT will be $560,000 per year. The company is currently worth $2.9 million. The company needs a cash infusion of $1.2 million and can issue equity or issue debt with an interest rate of 8 percent. Assume there are no corporate taxes. a. What are the cash flows to Tom under each scenario? b. Under which form of financing is Tom likely to work harder? c. What specific new costs will occur with each form of financing? 3. Nonmarketed Claims King, Inc., has debt outstanding with a face value of $4.3 million. The value of the firm if it were entirely financed by equity would be $ 17.9 million. The company also has 320,000 shares of stock outstanding that sell at a price of $44 per share. The corporate tax rate is 21 percent. What is the decrease in the value of the company due to expected bankruptcy costs? 4. Capital Structure and Nonmarketed Claims Suppose the president of the company in the previous problem stated that the company should increase the amount of debt in its capital structure because of the tax-advantaged status of its interest payments. His argument is that this action would increase the value of the company. How would you respond? INTERMEDIATE (Questions 5-8) 5. Capital Structure and Growth Edwards Construction currently has debt outstanding with a market value of $87,000 and a cost of 11 percent. The company has EBIT of $9,570 that is expected to continue in perpetuity. Assume there are no taxes