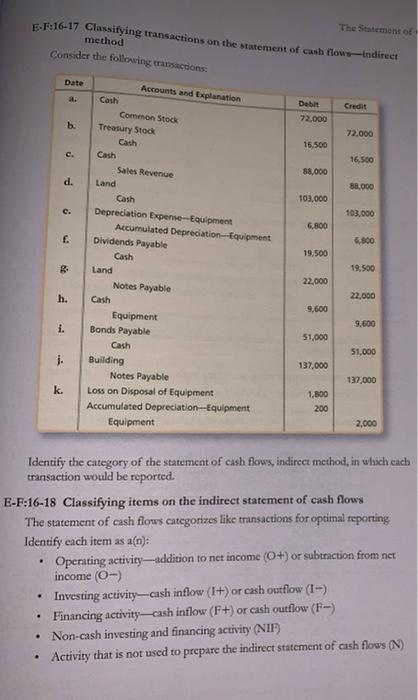

Question: b. c. . e C. E-F:16-17 Classifying transactions on the statement of cash flows-Indirect The Setement of method Consider the following transactions Date Accounts and

b. c. . e C. E-F:16-17 Classifying transactions on the statement of cash flows-Indirect The Setement of method Consider the following transactions Date Accounts and explanation a. Cash Debit Credit Common Stock 72,000 b. Treasury Stod 72.000 Cash 16,500 Cash 16,500 Sales Revenue 88,000 d. Land 88.000 Cash 103,000 103,000 Depreciation Experie-Equipment 6,800 Accumulated Depreciation --Equipment 5,800 f Dividends Payable 19,500 Cash 19.500 B Land 22,000 Notes Payable 22,000 h. Cash 9,600 Equipment 9.600 i. Bonds Payable 51,000 Cash 51,000 . Building 137.000 Notes Payable 137,000 k. Loss on Disposal of Equipment 1,500 200 Accumulated Depreciation--Equipment 2,000 Equipment Identify the category of the statement of cash flows, indirect method, in which each transaction would be reported. E-F:16-18 Classifying items on the indirect statement of cash flows The statement of cash flows categorizes like transactions for optimal reporting Identify each item as an): Operating activity-addition to net income (O+) or subtraction from net income (0) Investing activity-cash inflow (I+) or cash outflow (I--) Financing activity-cash inflow (F+) or cash outflow (F-) Non-cash investing and financing activity (NIF) Activity that is not used to prepare the indirect statement of cash flows (N)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts