Question: b. Calculate D'Leon's 2016 current and quick ratios based on the projected balance sheet and income statement data. What can you say about the company's

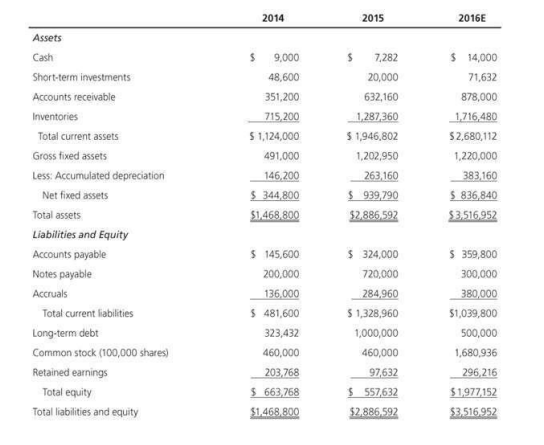

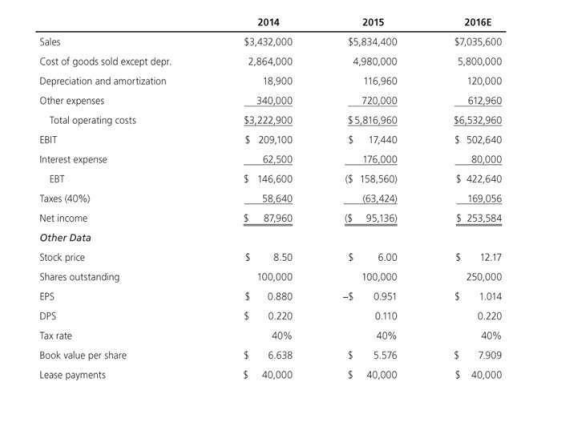

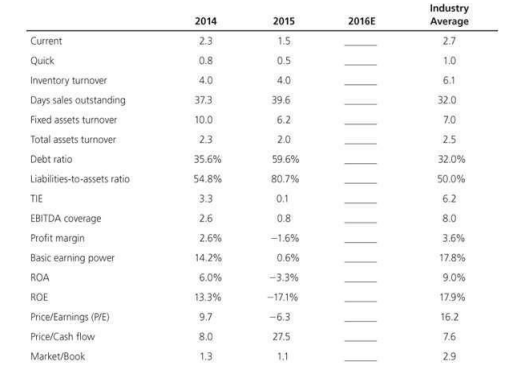

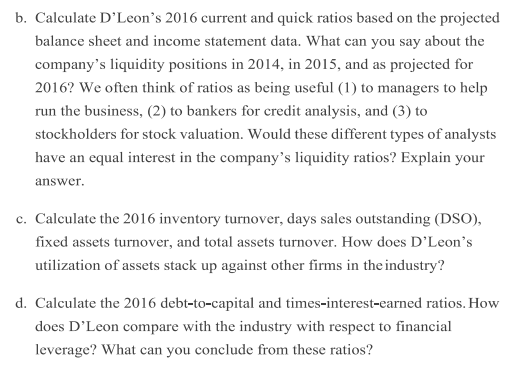

b. Calculate D'Leon's 2016 current and quick ratios based on the projected balance sheet and income statement data. What can you say about the company's liquidity positions in 2014, in 2015, and as projected for 2016? We often think of ratios as being useful (1) to managers to help run the business, (2) to bankers for credit analysis, and (3) to stockholders for stock valuation. Would these different types of analysts have an equal interest in the company's liquidity ratios? Explain your answer. c. Calculate the 2016 inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. How does D'Leon's utilization of assets stack up against other firms in the industry? d. Calculate the 2016 debt-to-capital and times-interest-earned ratios. How does D'Leon compare with the industry with respect to financial leverage? What can you conclude from these ratios? b. Calculate D'Leon's 2016 current and quick ratios based on the projected balance sheet and income statement data. What can you say about the company's liquidity positions in 2014, in 2015, and as projected for 2016? We often think of ratios as being useful (1) to managers to help run the business, (2) to bankers for credit analysis, and (3) to stockholders for stock valuation. Would these different types of analysts have an equal interest in the company's liquidity ratios? Explain your answer. c. Calculate the 2016 inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. How does D'Leon's utilization of assets stack up against other firms in the industry? d. Calculate the 2016 debt-to-capital and times-interest-earned ratios. How does D'Leon compare with the industry with respect to financial leverage? What can you conclude from these ratios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts