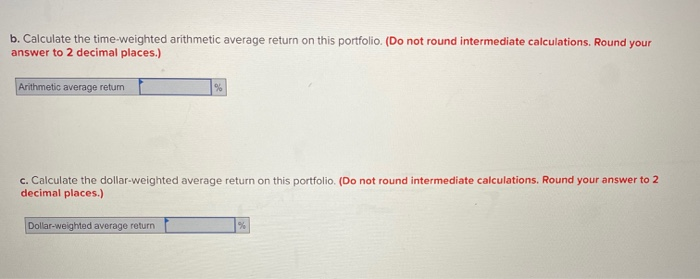

Question: b. Calculate the time-weighted arithmetic average return on this portfolio. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Arithmetic average retum

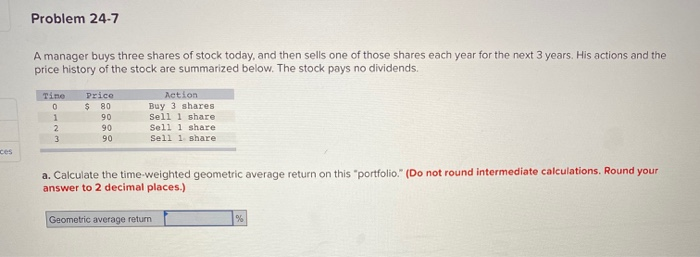

b. Calculate the time-weighted arithmetic average return on this portfolio. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Arithmetic average retum c. Calculate the dollar-weighted average return on this portfolio. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Dollar-weighted average return % Problem 24-7 A manager buys three shares of stock today, and then sells one of those shares each year for the next 3 years. His actions and the price history of the stock are summarized below. The stock pays no dividends. Tiine 0 Price $ 80 90 notion Buy 3 shares Sell l share Sell share Sell Share 90 a. Calculate the time weighted geometric average return on this "portfolio." (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Geometric average return IS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts