Question: b CHAPTER 6 ASSIGNMENT- ACTIVITY BASED COSTING You are a managerial accountant for KortCo, a go-kort manufacturer that produces both standard and custom go-karts for

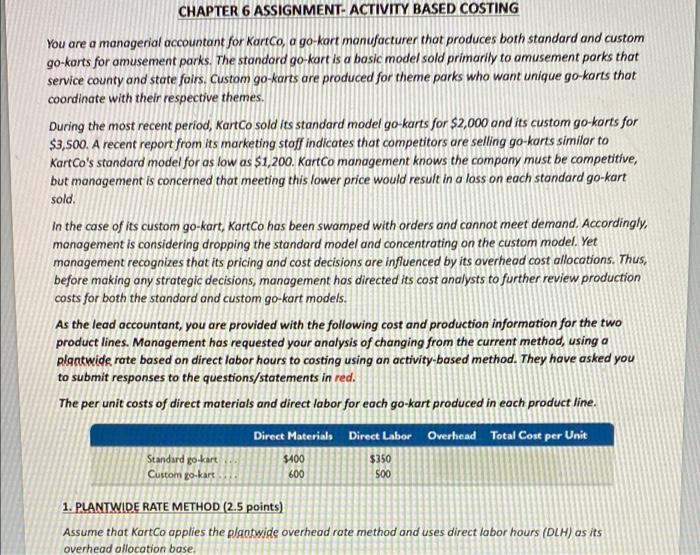

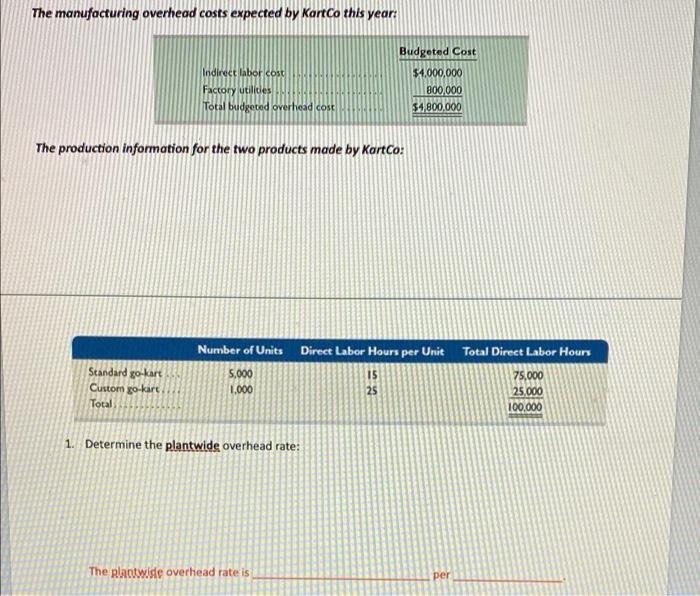

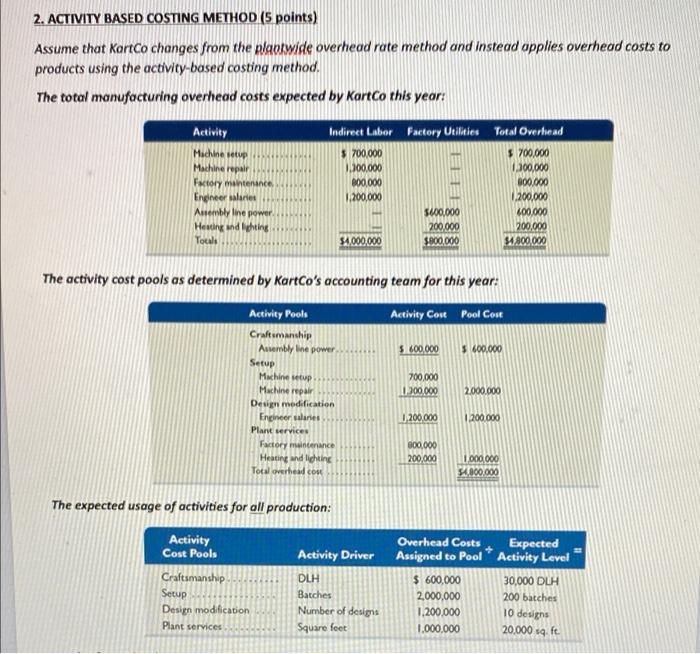

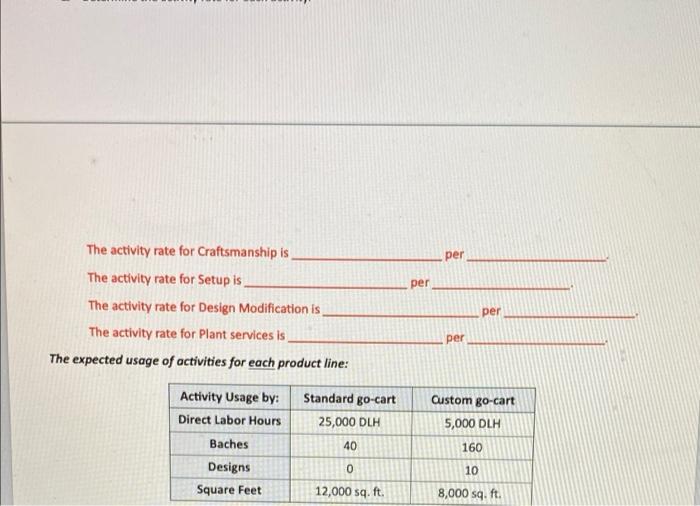

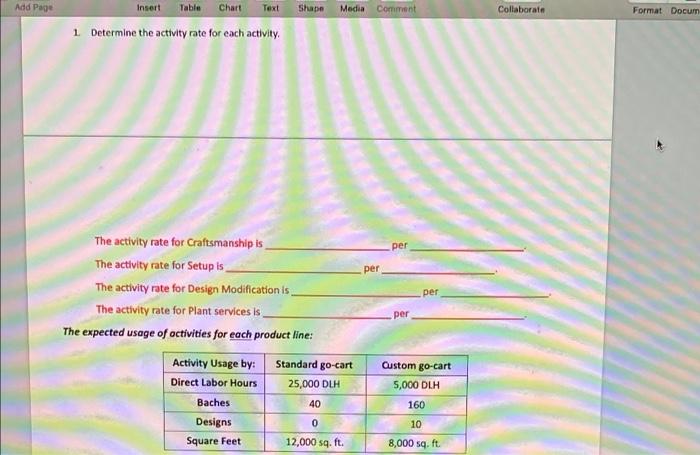

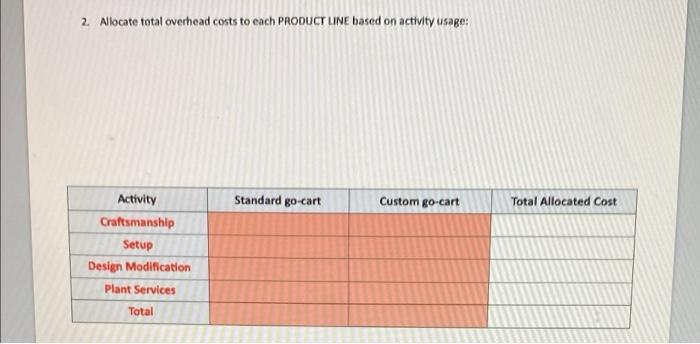

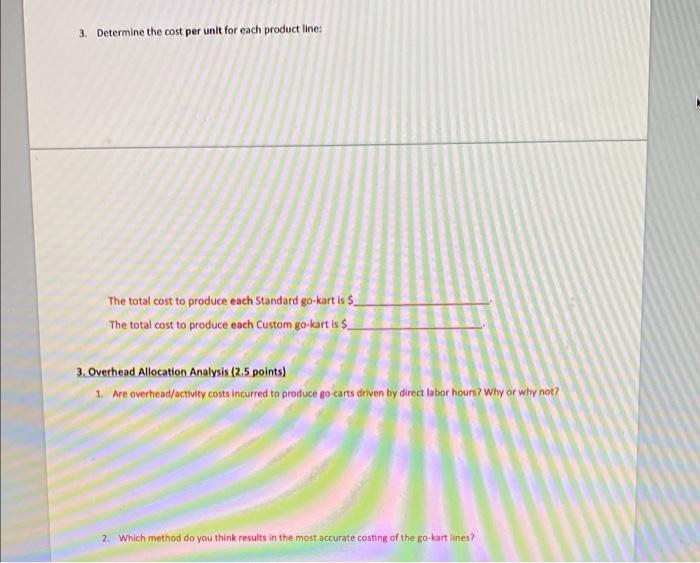

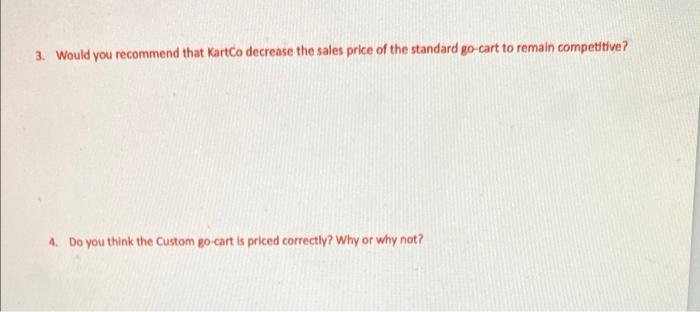

CHAPTER 6 ASSIGNMENT- ACTIVITY BASED COSTING You are a managerial accountant for KortCo, a go-kort manufacturer that produces both standard and custom go-karts for amusement parks. The standard go-kart is a basic model sold primarily to amusement porks that service county and state folrs. Custom go-karts are produced for theme parks who want unique go-karts thot coordinate with their respective themes. During the most recent period, KartCo sold its standard model go-karts for $2,000 and its custom go-korts for $3,500. A recent report from its marketing stoff indicates that competitors are selling go-karts similar to KartCo's standard model for as low as $1,200. KartCo management knows the company must be competitive, but management is concerned that meeting this lower price would result in a loss on each standard go-kart sold in the case of its custom go-kart, KortCo has been swamped with orders and connot meet demand. Accordingly, management is considering dropping the standard model and concentrating on the custom model. Yet management recognizes that its pricing and cost decisions are influenced by its overhead cost allocations. Thus, before making any strategic decisions, management has directed its cost analysts to further review production costs for both the standard and custom go-kart models. As the lead accountant, you are provided with the following cost and production information for the two product lines. Management has requested your analysis of changing from the current method, using a plantwide rate based on direct lobor hours to costing using an activity-based method. They have asked you to submit responses to the questions/statements in red. The per unit costs of direct materials and direct labor for each go-kart produced in each product line. Standard go-kart Custom go-kart Direct Materials Direct Labor Overhead Total Cost per Unit $400 $350 600 500 1. PLANTWIDE RATE METHOD (2.5 points) Assume that KartCo applies the plaotwide overhead rate method and uses direct lobor hours (DLH) as its overhead allocation base, The manufacturing overhead costs expected by KartCo this year: Budgeted Cost $4,000,000 Indirect labor cost Factory utilides Total budgeted overhead cost 800.000 $4,800,000 The production information for the two products made by KartCo: Total Direct Labor Hours Number of Units Direct Labor Hours per Unit 5.000 1.000 25 Standard go-kart Custom go kart Total 15 75.000 25.000 100.000 1. Determine the plantwide overhead rate: The plantwide overhead rate is per 2. ACTIVITY BASED COSTING METHOD (5 points) Assume that KortCo changes from the play wide overhead rate method and instead applies overhead costs to products using the activity-based costing method. The total manufacturing overhead costs expected by KortCo this year: Total Overhead Activity Machine setup Machine repair Factory mantenance Engineer salaries Assembly line power Heuting and lichting Touls Indirect Labor Factory Utilities $ 700.000 1.100.000 800,000 1.200,000 5600,000 200,000 $4,000,000 $800.000 $ 700.000 1300,000 800,000 1.200.000 400.000 200,000 1.800.000 The activity cost pools as determined by KartCo's accounting team for this year: Activity Pools Activity Cost Pool Cost $ 600.000 5 600.000 700,000 300.000 2.000.000 Craftsmanship Assembly line power Setup Machine up Machine repair Design modification Engineer salaries Plant services Factory macenance Heating and lighting Total overhead con 1,200,000 1.200.000 300,000 200,000 1.000.000 1.800.000 The expected usage of activities for all production: Activity Cost Pools Craftsmanship Setup Design modification Plant services Overhead Costs Expected Activity Driver Assigned to Pool Activity Level DLH $ 600,000 30,000 DLH Batches 2,000,000 200 batches Number of designs 1.200.000 10 designs Square feet 1,000,000 20,000 sq.ft per per The activity rate for Craftsmanship is The activity rate for Setup is The activity rate for Design Modification is The activity rate for Plant services is The expected usage of activities for each product line: per per Standard go-cart 25,000 DLH Custom go-cart 5,000 DLH Activity Usage by: Direct Labor Hours Baches Designs Square Feet 40 160 0 10 12,000 sq. ft. 8,000 sq. ft. Add Page Insert Table Chart Text Shape Media Comment Collaborate Format Docum 1 Determine the activity rate for each activity per per The activity rate for Craftsmanship is The activity rate for Setup is The activity rate for Design Modification is The activity rate for Plant services is The expected usage of activities for each product line: per per Activity Usage by: Direct Labor Hours Baches Designs Square Feet Standard go-cart 25,000 DLH 40 Custom go-cart 5,000 DLH 160 10 8,000 sq.ft 0 12,000 sq. ft. 2. Allocate total overhead costs to each PRODUCT LINE based on activity usage: Standard go-cart Custom go-cart Total Allocated Cost Activity Craftsmanship Setup Design Modification Plant Services Total 3. Determine the cost per unit for each product line: The total cost to produce each Standard go-kart is $_ The total cost to produce each Custom go-kart is $ 3. Overhead Allocation Analysis (2.5 points) 1. Are overhead/activity costs incurred to produce go carts driven by direct labor hours? Why or why not? 2. Which method do you think results in the most accurate costing of the go-kart lines? 3. Would you recommend that Karto decrease the sales price of the standard go-cart to remain competitive? 4. Do you think the Custom go-cart is priced correctly? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts