Question: b. Comment on the following about Hemming View Ltd. in relation to the industry averages: i. Liquidity position ii. Efficiency level iii. Firm's ability to

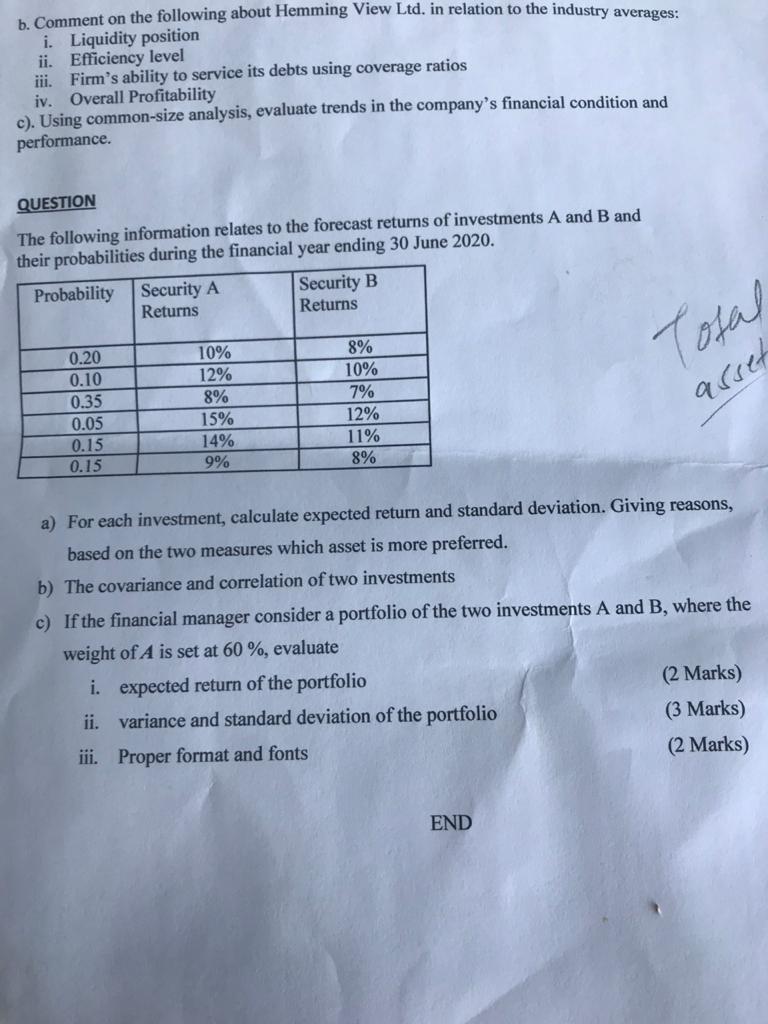

b. Comment on the following about Hemming View Ltd. in relation to the industry averages: i. Liquidity position ii. Efficiency level iii. Firm's ability to service its debts using coverage ratios iv. Overall Profitability c). Using common-size analysis, evaluate trends in the company's financial condition and performance. QUESTION The following information relates to the forecast returns of investments A and B and their probabilities during the financial year ending 30 June 2020. Probability Security A Security B Returns Returns 0.20 10% 8% Tota 0.10 12% 10% 0.35 8% 7% asse 0.05 15% 12% 0.15 14% 1 1% 0.15 9% 8% a) For each investment, calculate expected return and standard deviation. Giving reasons, based on the two measures which asset is more preferred. b) The covariance and correlation of two investments c) If the financial manager consider a portfolio of the two investments A and B, where the weight of A is set at 60 %, evaluate i. expected return of the portfolio (2 Marks) ii. variance and standard deviation of the portfolio (3 Marks) iii. Proper format and fonts (2 Marks) END

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts