Question: b. Company DEF is analyzing whether to issue debt or preference shares. The corporate tax rate is 45%. Interest income is taxed at 30%. The

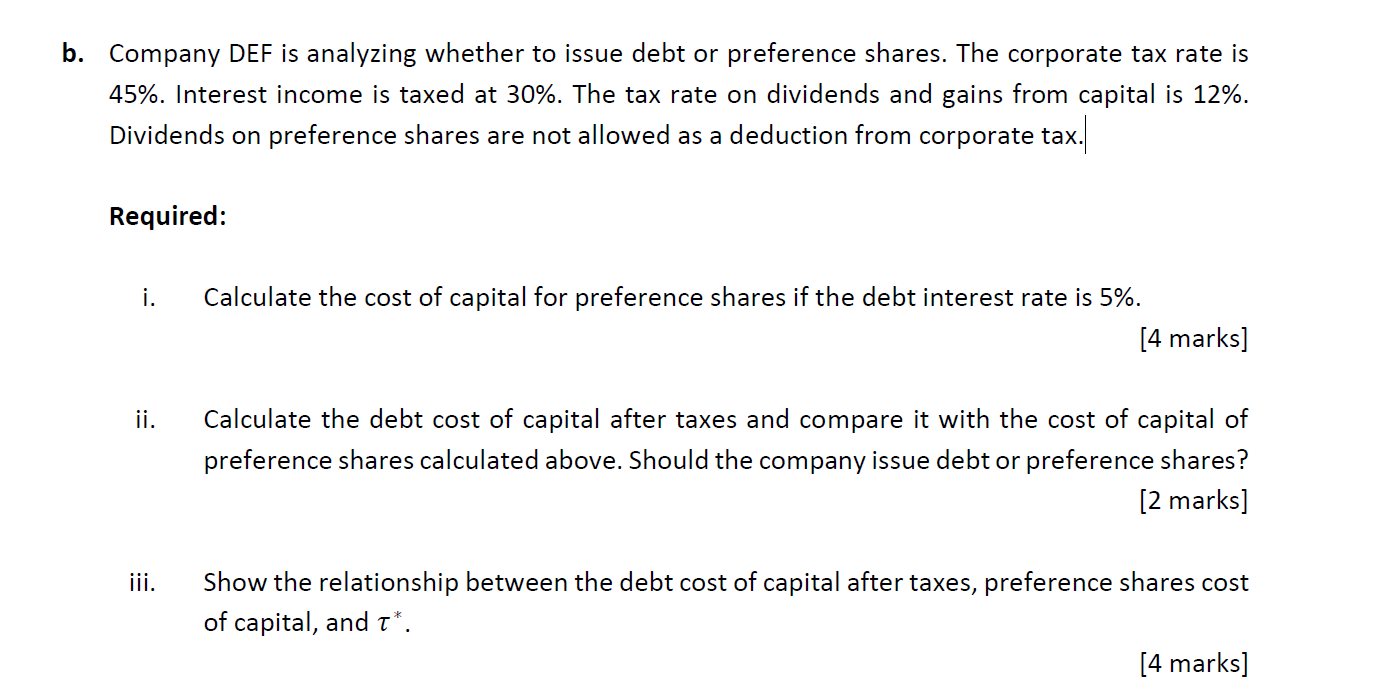

b. Company DEF is analyzing whether to issue debt or preference shares. The corporate tax rate is 45%. Interest income is taxed at 30%. The tax rate on dividends and gains from capital is 12%. Dividends on preference shares are not allowed as a deduction from corporate tax. Required: i. Calculate the cost of capital for preference shares if the debt interest rate is 5%. [4 marks] ii. Calculate the debt cost of capital after taxes and compare it with the cost of capital of preference shares calculated above. Should the company issue debt or preference shares? [2 marks] iii. Show the relationship between the debt cost of capital after taxes, preference shares cost of capital, and t*. [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts