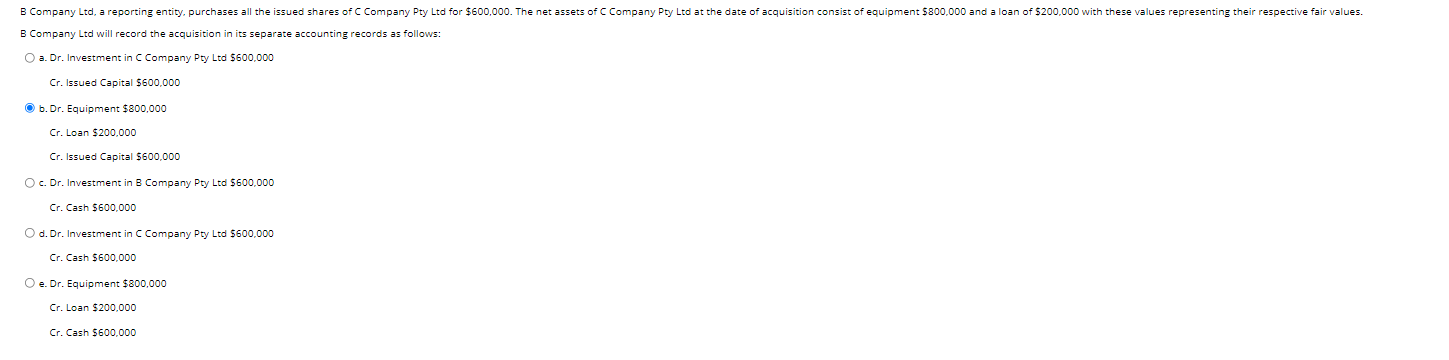

Question: B Company Ltd, a reporting entity, purchases all the issued shares of C Company Pty Ltd for $600,000. The net assets of Company Pty Ltd

B Company Ltd, a reporting entity, purchases all the issued shares of C Company Pty Ltd for $600,000. The net assets of Company Pty Ltd at the date of acquisition consist of equipment 5800,000 and a loan of $200,000 with these values representing their respective fair values. B Company Ltd will record the acquisition in its separate accounting records as follows: a. Dr. Investment in c Company Pty Ltd $600,000 Cr. Issued Capital $600.000 b. Dr. Equipment $800,000 Cr. Loan $200,000 Cr. Issued Capital $600,000 O c. Dr. Investment in B Company Pty Ltd $600,000 Cr. Cash 5600,000 O d. Dr. Investment in c Company Pty Ltd 5600,000 Cr. Cash 5600,000 Oe. Dr. Equipment $800,000 Cr. Loan $200,000 Cr. Cash S600,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts