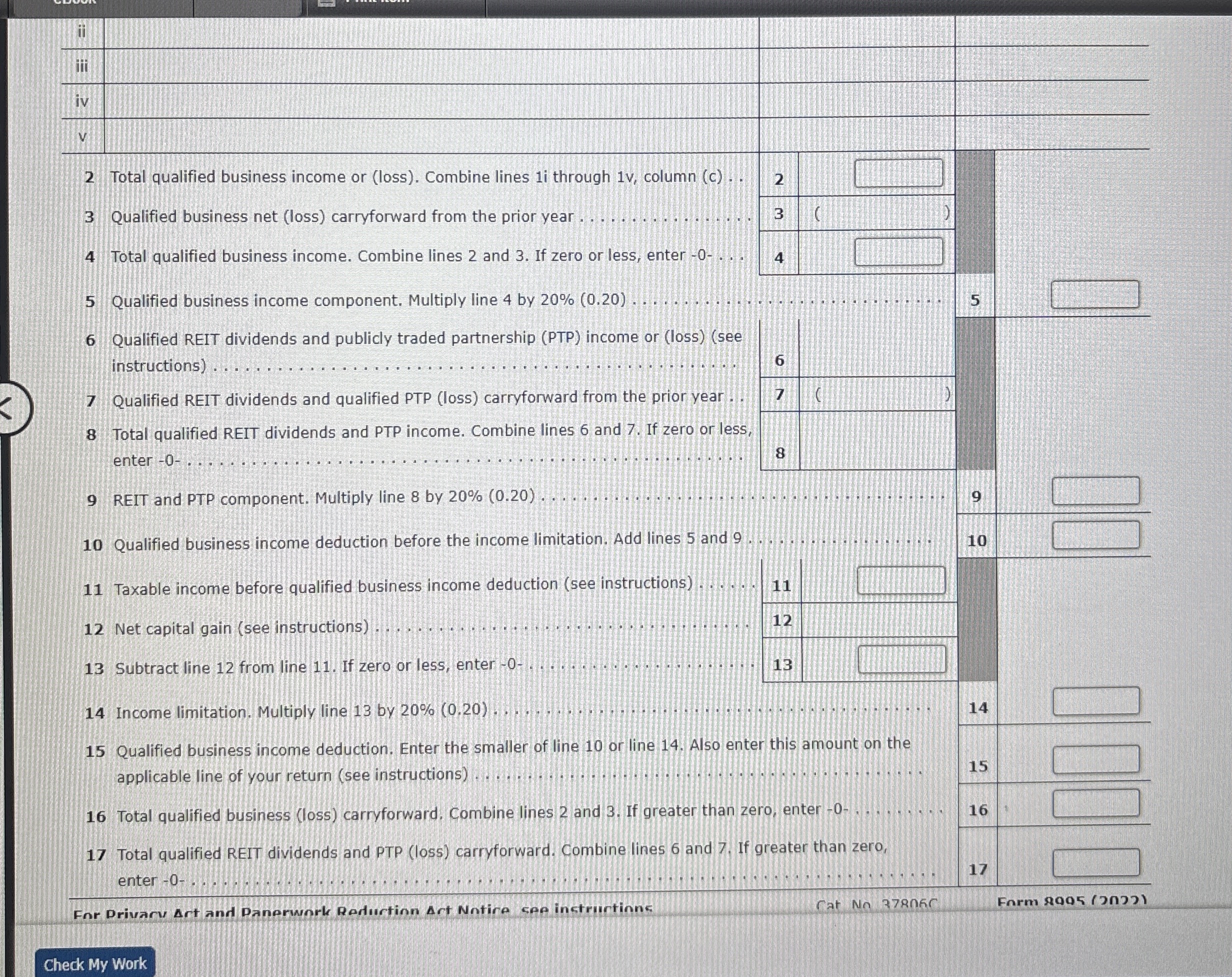

Question: b . Complete Henry's 2 0 2 2 Form 8 9 9 5 ( Qualified Business Income Deduction Simplified Computation ) . Enter all amounts

b Complete Henry's Form Qualified Business Income Deduction Simplified Computation Enter all amounts as positive numbers.

Form

Department of the Treasury

Internal Revenue Service

Names shown on return

Qualified Business Income Deduction Simplified Computation

Attach to your tax return.

Go to

wwwirs.govForm for instructions and the latest information.

OMB NO

Attachment

Sequence No

Your taxpayer identification number

Note: You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions.

Use this form if your taxable income, before your qualified business income deduction, is at or below $ $ if married filing jointly and you aren't a patron of an agricultural or horticultural cooperative.

tabletablea Trade, business, or aggregation nametableb Taxpayeridentification numbertablec Qualified businessincome or lossiHenry Jones Transportation,,iiiiiivTotal qualified business income or loss Combine lines i through v column cQualified business net loss carryforward from the prior year,Total qualified business income. Combine lines and If zero or less, enter Qualified business income component, Multiply line by

For Drivary Art and Danerwnrk Redurtion Act Notire spe inctrurtione

b Complete Henry's Form Qualified Business Income Deduction Simplified Computation Enter all amounts as positive numbers.

Form

Department of the Treasury

Internal Revenue Service

Names shown on return

Qualified Business Income Deduction Simplified Computation

Attach to your tax return.

Go to

wwwirs.govForm for instructions and the latest information.

OMB NO

Attachment

Sequence No

Your taxpayer identification number

Note: You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions.

Use this form if your taxable income, before your qualified business income deduction, is at or below $ $ if married filing jointly and you aren't a patron of an agricultural or horticultural cooperative.

For Drivary Art and Danerwnek Redurtion Act Notire spe inctructione

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock