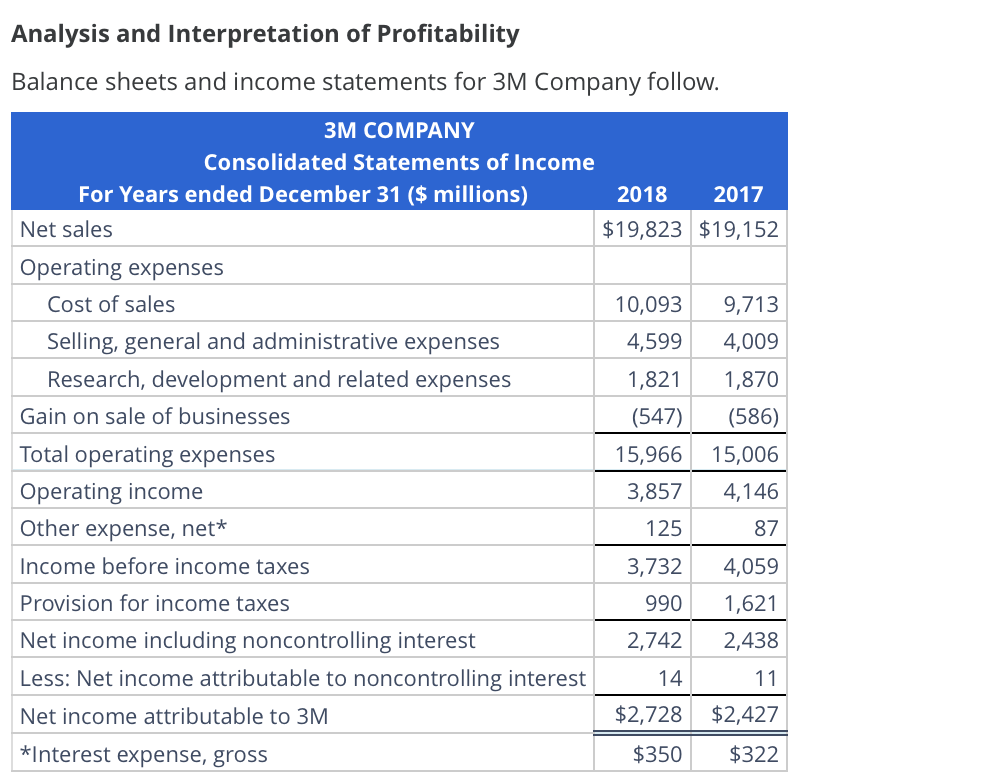

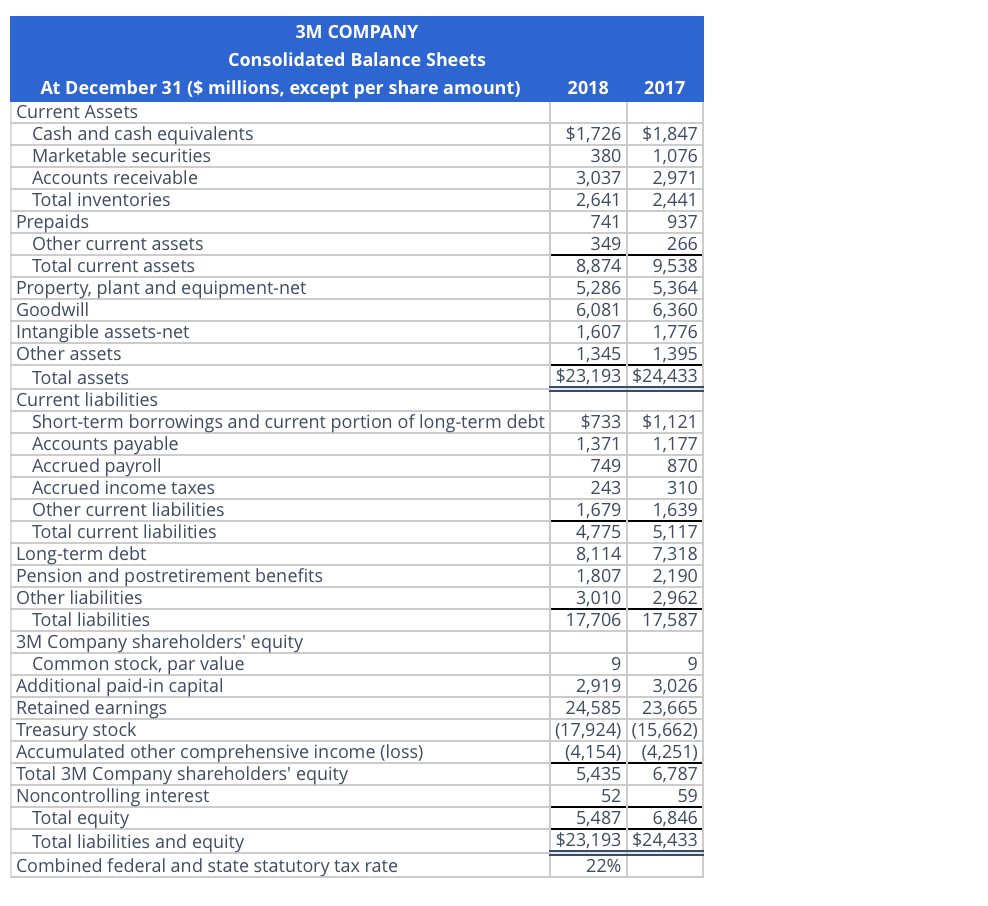

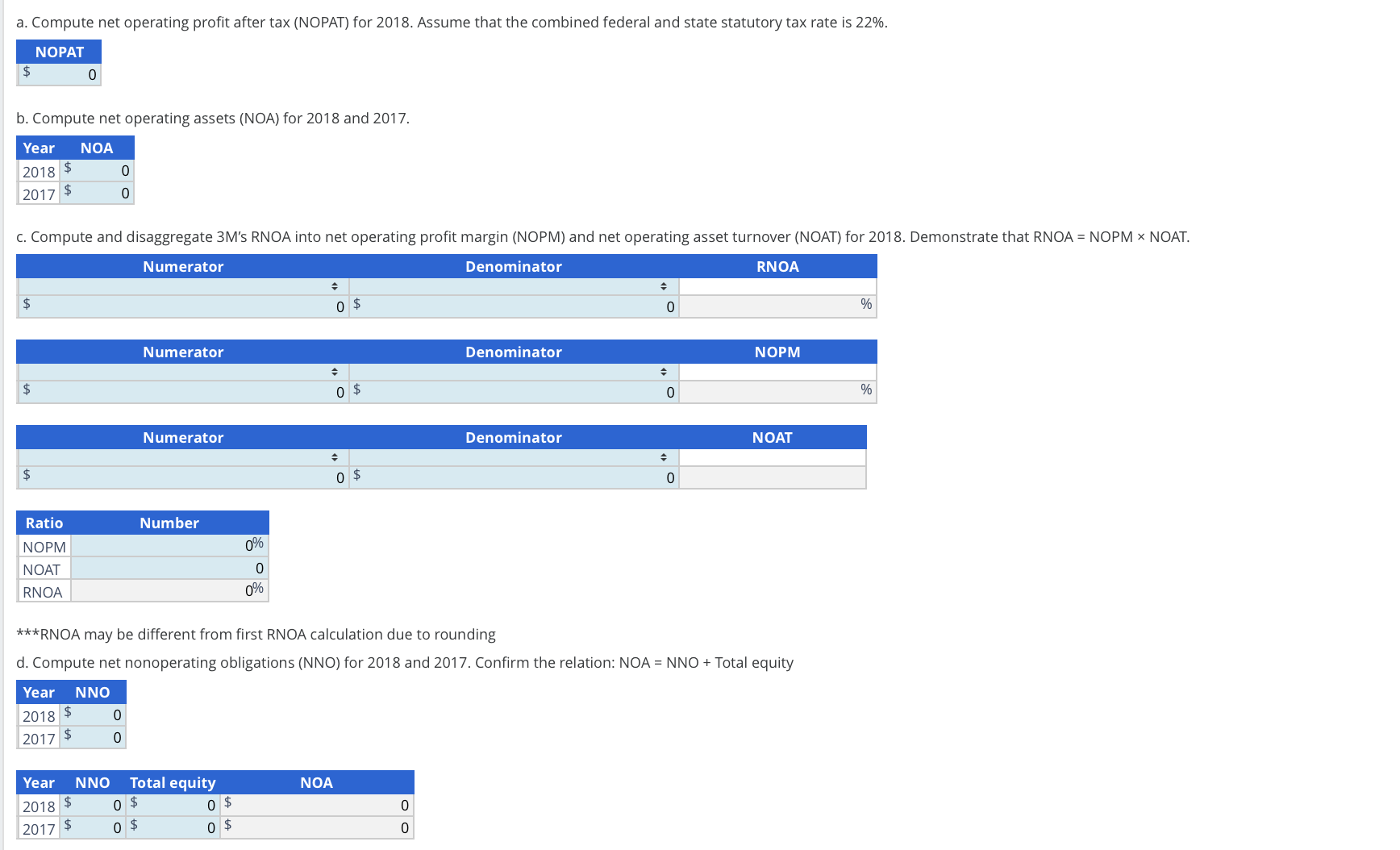

Question: b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating

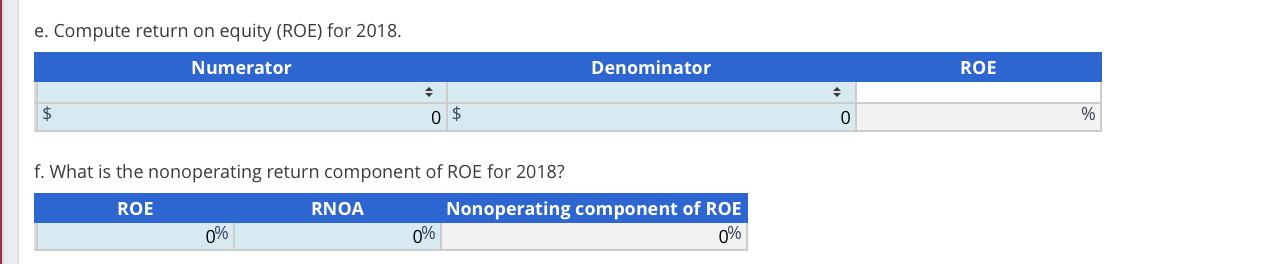

b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. Demonstrate that RNOA = NOPM NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity Analysis and Interpretation of Profitability e. Compute return on equity (ROE) for 2018 . f. What is the nonoperating return component of ROE for 2018 ? b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. Demonstrate that RNOA = NOPM NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity Analysis and Interpretation of Profitability e. Compute return on equity (ROE) for 2018 . f. What is the nonoperating return component of ROE for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts