Question: B. Conclusions about capital budgeting The decision process Before making capital budgeting dedsions, finance professionals often generate, review, analyze, select, and implement long-term investment proposals

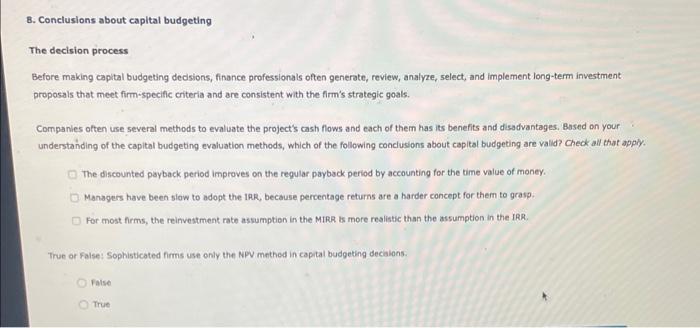

B. Conclusions about capital budgeting The decision process Before making capital budgeting dedsions, finance professionals often generate, review, analyze, select, and implement long-term investment proposals that meet firm-specific criteria and are consistent with the firm's strategic goals. Companies often use several methods to evaluate the project's cash flows and each of them has its benefits and disadvantages. Based on your understanding of the capital budgeting evaluation methods, which of the following conclusions about capital budgeting are valid? Check anl that apply. The discounted payback period improves on the regular payback period by accounting for the time value of money. Managers have been slow to adopt the 1aR, because percentage returns are a harder concept for them to grasp. For most frms, the reinvestment rate assumption in the MIRR is more reslistic than the assumption in the IRR. True or False: Sophisticated firms use only the NPV methed in capital budgeting decialons. False True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts