Question: b) Consider a swap, a cap and a floor with the same characteristics (i.e. the same floating interest rate, strike (or fixed) interest rate, notional,

b)

Consider a swap, a cap and a floor with the same characteristics (i.e. the same floating

interest rate, strike (or fixed) interest rate, notional, and payment dates). The fixed

interest rate is exogenously given; it is not necessarily equal to the fair swap rate.

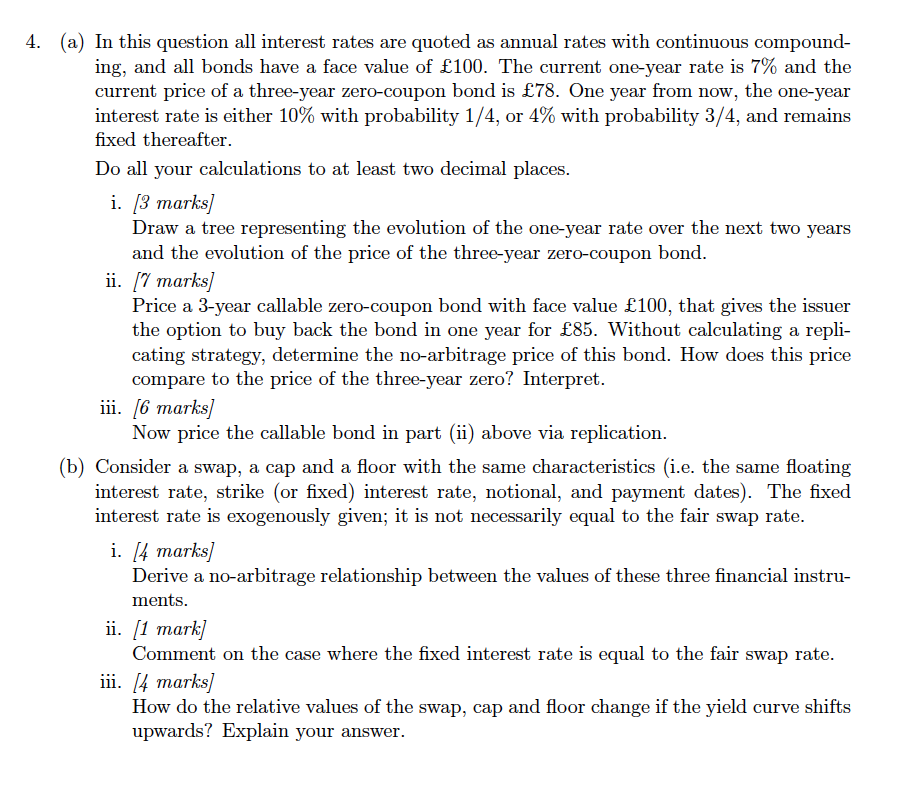

4. (a) In this question all interest rates are quoted as annual rates with continuous compound- ing, and all bonds have a face value of 100. The current one-year rate is 7% and the current price of a three-year zero-coupon bond is 78. One year from now, the one-year interest rate is either 10% with probability 1/4, or 4% with probability 3/4, and remains fixed thereafter. Do all your calculations to at least two decimal places. i. [3 marks] Draw a tree representing the evolution of the one-year rate over the next two years and the evolution of the price of the three-year zero-coupon bond. ii. [1 marks] Price a 3-year callable zero-coupon bond with face value 100, that gives the issuer the option to buy back the bond in one year for 85. Without calculating a repli- cating strategy, determine the no-arbitrage price of this bond. How does this price compare to the price of the three-year zero? Interpret. iii. [6 marks] Now price the callable bond in part (ii) above via replication. (b) Consider a swap, a cap and a floor with the same characteristics (i.e. the same floating interest rate, strike (or fixed) interest rate, notional, and payment dates). The fixed interest rate is exogenously given; it is not necessarily equal to the fair swap rate. i. [4 marks] Derive a no-arbitrage relationship between the values of these three financial instru- ments. ii. [1 mark] Comment on the case where the fixed interest rate is equal to the fair swap rate. iii. [4 marks) How do the relative values of the swap, cap and floor change if the yield curve shifts upwards? Explain your answer. 4. (a) In this question all interest rates are quoted as annual rates with continuous compound- ing, and all bonds have a face value of 100. The current one-year rate is 7% and the current price of a three-year zero-coupon bond is 78. One year from now, the one-year interest rate is either 10% with probability 1/4, or 4% with probability 3/4, and remains fixed thereafter. Do all your calculations to at least two decimal places. i. [3 marks] Draw a tree representing the evolution of the one-year rate over the next two years and the evolution of the price of the three-year zero-coupon bond. ii. [1 marks] Price a 3-year callable zero-coupon bond with face value 100, that gives the issuer the option to buy back the bond in one year for 85. Without calculating a repli- cating strategy, determine the no-arbitrage price of this bond. How does this price compare to the price of the three-year zero? Interpret. iii. [6 marks] Now price the callable bond in part (ii) above via replication. (b) Consider a swap, a cap and a floor with the same characteristics (i.e. the same floating interest rate, strike (or fixed) interest rate, notional, and payment dates). The fixed interest rate is exogenously given; it is not necessarily equal to the fair swap rate. i. [4 marks] Derive a no-arbitrage relationship between the values of these three financial instru- ments. ii. [1 mark] Comment on the case where the fixed interest rate is equal to the fair swap rate. iii. [4 marks) How do the relative values of the swap, cap and floor change if the yield curve shifts upwards? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts