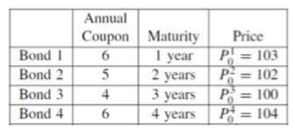

Question: b) Consider five bonds with the following features at date t=0: Using the bootstrapping method, compute the yearly spot curve by calculating the spot rates

b) Consider five bonds with the following features at date t=0:

Using the bootstrapping method, compute the yearly spot curve by calculating the spot rates for all four maturities (use continuous compounding).

c) Calculate all possible forwards rates starting two years from now using the appropriate spot rates from b) (using the continuous compounding formula).

Annual Coupon Maturity 6 5 2 years 4 6 Bond Bond 2 Bond 3 Bond 4 1 year Price P = 103 P. = 102 P = 100 P = 104 3 years 4 years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock