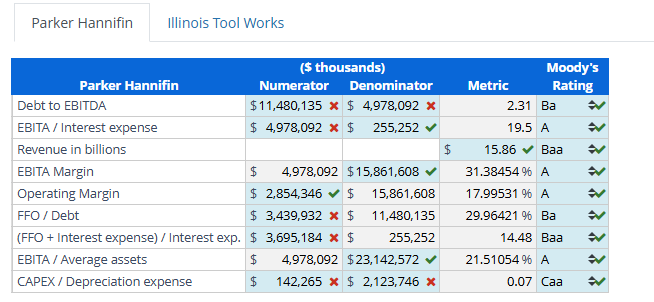

Question: (b). Consider the Moody's rating for each ratio in part a. and determine an overall Moody's rating for the company. Provide rationale for your answers.

(b). Consider the Moody's rating for each ratio in part a. and determine an overall Moody's rating for the company. Provide rationale for your answers.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts