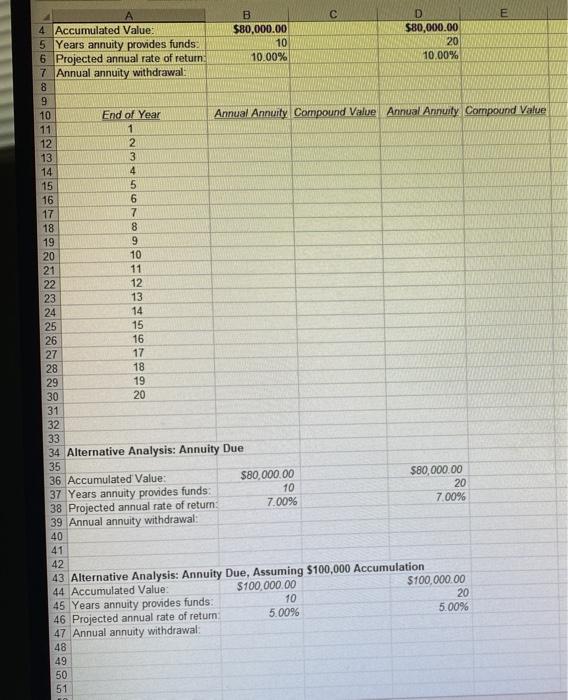

Question: B D E 4 Accumulated Value: $80,000.00 $80,000.00 5 Years annuity provides funds. 10 20 6 Projected annual rate of return 10.00% 10,00% 7 Annual

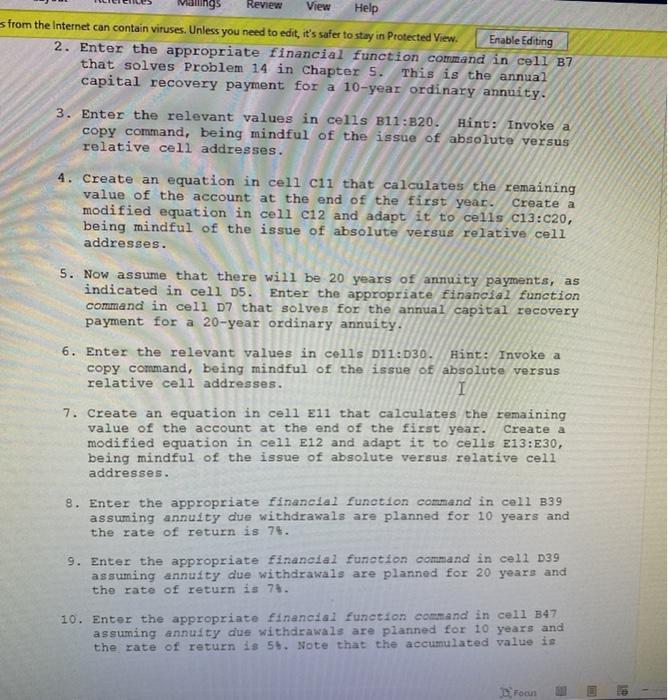

B D E 4 Accumulated Value: $80,000.00 $80,000.00 5 Years annuity provides funds. 10 20 6 Projected annual rate of return 10.00% 10,00% 7 Annual annuity withdrawal 8 9 10 End of Year Annual Annuity Compound Value Annual Annuity Compound Valve 11 1 12 2 13 3 14 4 15 5 16 6 17 7 18 8 19 9 20 10 21 11 22 12 23 13 24 14 25 15 26 16 27 17 28 18 29 19 30 20 31 32 33 34 Alternative Analysis: Annuity Due 35 36. Accumulated Value: $80,000.00 $80,000.00 10 20 37 Years annuity provides funds 7.00% 7.00% 38 Projected annual rate of return; 39 Annual annuity withdrawal: 40 41 42 43 Alternative Analysis: Annuity Due, Assuming $100,000 Accumulation 44 Accumulated Value: $100,000.00 $100,000.00 10 20 45 Years annuity provides funds: 5.00% 5.00% 46 Projected annual rate of retum 47 Annual annuity withdrawal 48 49 50 51 Manings Review View Help s from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing 2. Enter the appropriate financial function command in cell B7 that solves Problem 14 in Chapter 5. This is the annual capital recovery payment for a 10-year ordinary annuity. 3. Enter the relevant values in cells B11:B20. Hint: Invoke a copy command, being mindful of the issue of absolute versus relative cell addresses. 4. Create an equation in cell cii that calculates the remaining value of the account at the end of the first year. Create a modified equation in cell c12 and adapt it to cells c13:020, being mindful of the issue of absolute versus relative cell addresses. 5. Now assume that there will be 20 years of annuity payments, as indicated in cell 05. Enter the appropriate financial function command in cell D7 that solves for the annual capital recovery payment for a 20-year ordinary annuity. 6. Enter the relevant values in cells D11:030. Hint: Invoke a copy command, being mindful of the issue of absolute versus relative cell addresses. I 7. Create an equation in cell E11 that calculates the remaining value of the account at the end of the first year. Create a modified equation in cell E12 and adapt it to cells E13:E30, being mindful of the issue of absolute versus relative cell addresses. 8. Enter the appropriate Financial function command in cell B39 assuming annuity due withdrawals are planned for 10 years and the rate of return is 74. 9. Enter the appropriate financial function command in cell 039 assuming annuity due withdrawals are planned for 20 years and the rate of return is 74. 10. Enter the appropriate financial function command in cell B47 assuming annuity due withdrawals are planned for 10 years and the rate of return is 55. Note that the accumulated value is Foan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts