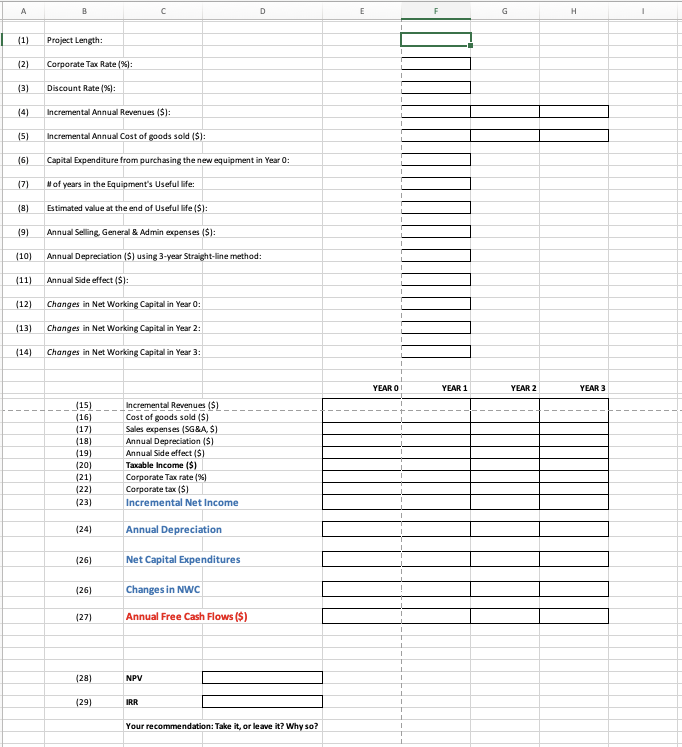

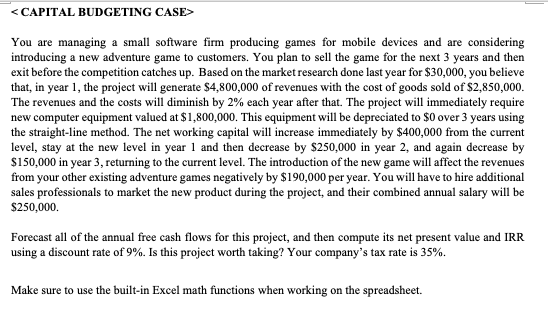

Question: B D E E G H (1) Project Length: (2) Corporate Tax Rate(%): (3) Discount Rate(%): (4) Incremental Annual Revenues ($): (5) Incremental Annual Cost

B D E E G H (1) Project Length: (2) Corporate Tax Rate(%): (3) Discount Rate(%): (4) Incremental Annual Revenues ($): (5) Incremental Annual Cost of goods sold ($): (6) Capital Expenditure from purchasing the new equipment in Year O: Hof years in the Equipment's Useful life: (7) (8) Estimated value at the end of Useful life ($): (9) Annual Selling, General & Admin expenses ($): (10) Annual Depreciation ($) using 3-year Straight-line method: (11) Annual Side effect (S): (12) Changes in Net Working Capital in Year : (13) Changes in Net Working Capital in Year 2: (14) Changes in Net Working Capital in Year 3: YEAR O YEAR 1 YEAR 2 YEAR 3 (15) (16) (17) (18) (19) (20) (21) (22) (23) Incremental Revenues ($) Cost of goods sold ($) Sales expenses (SG&A, S) Annual Depreciation (S) Annual Side effect ($) Taxable income ($) Corporate Tax rate (%) Corporate tax ($) Incremental Net Income (24) Annual Depreciation (26) Net Capital Expenditures (26) Changes in NWC (27) Annual Free Cash Flows ($) (28) NPV (29) IRR Your recommendation: Take it, or leave it? Why so?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts