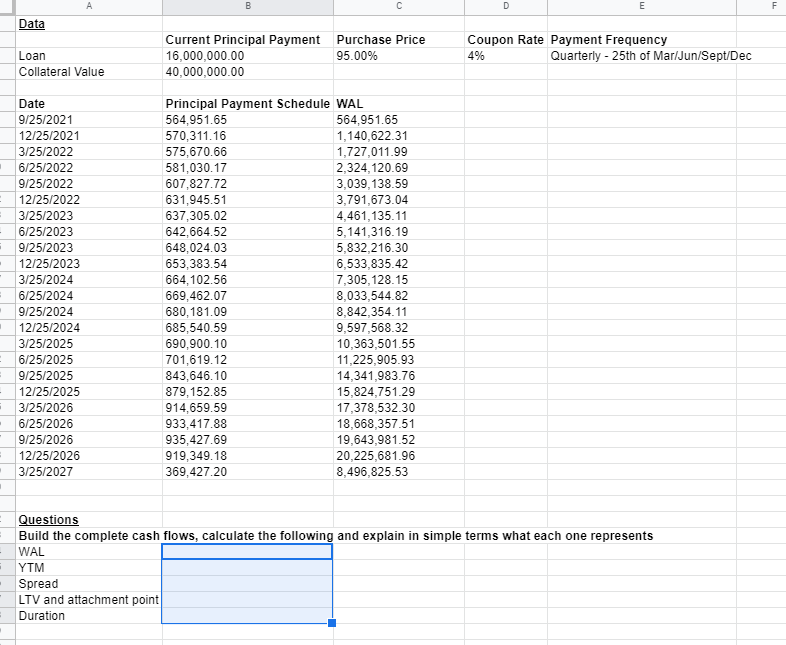

Question: B D E F Data Current Principal Payment Purchase Price 16,000,000.00 95.00% 40,000,000.00 Coupon Rate Payment Frequency 4% Quarterly - 25th of Mar/Jun/Sept/Dec Loan Collateral

B D E F Data Current Principal Payment Purchase Price 16,000,000.00 95.00% 40,000,000.00 Coupon Rate Payment Frequency 4% Quarterly - 25th of Mar/Jun/Sept/Dec Loan Collateral Value - . . Date 9/25/2021 12/25/2021 3/25/2022 6/25/2022 9/25/2022 12/25/2022 3/25/2023 6/25/2023 9/25/2023 12/25/2023 3/25/2024 6/25/2024 9/25/2024 12/25/2024 3/25/2025 6/25/2025 9/25/2025 12/25/2025 3/25/2026 6/25/2026 9/25/2026 12/25/2026 3/25/2027 Principal Payment Schedule WAL 564,951.65 564,951.65 570,311.16 1,140,622.31 575,670.66 1,727,011.99 581,030.17 2,324,120.69 607,827.72 3,039,138.59 631,945.51 3,791,673.04 637,305.02 4,461,135.11 642,664.52 5,141,316.19 648,024.03 5,832.216.30 653,383.54 6,533,835.42 664, 102.56 7,305,128.15 669,462.07 8,033,544.82 680, 181.09 8,842,354.11 685,540.59 9,597,568.32 690,900.10 10,363,501.55 701,619.12 11,225,905.93 843,646.10 14,341,983.76 879,152.85 15,824,751.29 914,659.59 17,378,532.30 933,417.88 18,668,357.51 935,427.69 19,643,981.52 919,349.18 20,225,681.96 369,427.20 8,496,825.53 . . - . . . . - - Questions Build the complete cash flows, calculate the following and explain in simple terms what each one represents WAL YTM Spread LTV and attachment point Duration . - B D E F Data Current Principal Payment Purchase Price 16,000,000.00 95.00% 40,000,000.00 Coupon Rate Payment Frequency 4% Quarterly - 25th of Mar/Jun/Sept/Dec Loan Collateral Value - . . Date 9/25/2021 12/25/2021 3/25/2022 6/25/2022 9/25/2022 12/25/2022 3/25/2023 6/25/2023 9/25/2023 12/25/2023 3/25/2024 6/25/2024 9/25/2024 12/25/2024 3/25/2025 6/25/2025 9/25/2025 12/25/2025 3/25/2026 6/25/2026 9/25/2026 12/25/2026 3/25/2027 Principal Payment Schedule WAL 564,951.65 564,951.65 570,311.16 1,140,622.31 575,670.66 1,727,011.99 581,030.17 2,324,120.69 607,827.72 3,039,138.59 631,945.51 3,791,673.04 637,305.02 4,461,135.11 642,664.52 5,141,316.19 648,024.03 5,832.216.30 653,383.54 6,533,835.42 664, 102.56 7,305,128.15 669,462.07 8,033,544.82 680, 181.09 8,842,354.11 685,540.59 9,597,568.32 690,900.10 10,363,501.55 701,619.12 11,225,905.93 843,646.10 14,341,983.76 879,152.85 15,824,751.29 914,659.59 17,378,532.30 933,417.88 18,668,357.51 935,427.69 19,643,981.52 919,349.18 20,225,681.96 369,427.20 8,496,825.53 . . - . . . . - - Questions Build the complete cash flows, calculate the following and explain in simple terms what each one represents WAL YTM Spread LTV and attachment point Duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts