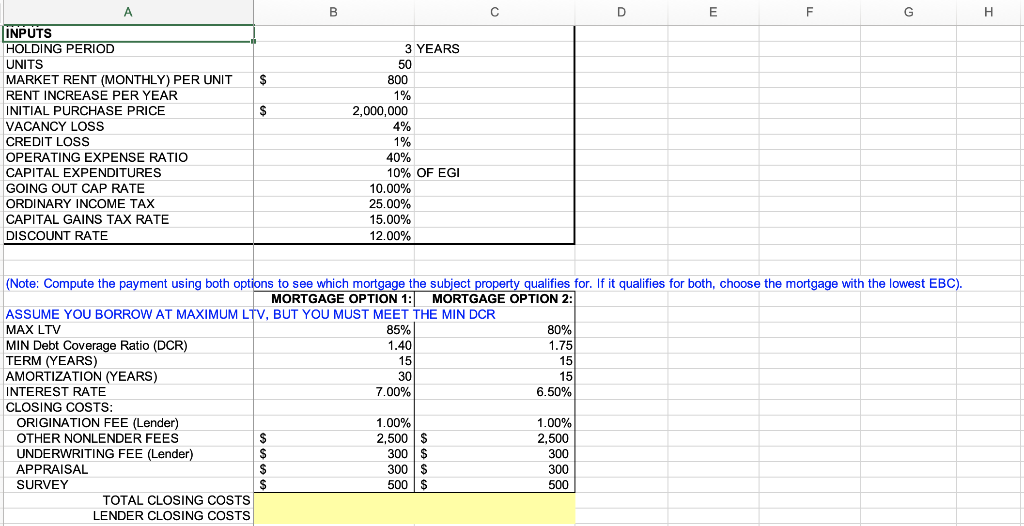

Question: B D E F G H 3 YEARS 50 800 1% $ $ 2,000,000 INPUTS HOLDING PERIOD UNITS MARKET RENT (MONTHLY) PER UNIT RENT INCREASE

B D E F G H 3 YEARS 50 800 1% $ $ 2,000,000 INPUTS HOLDING PERIOD UNITS MARKET RENT (MONTHLY) PER UNIT RENT INCREASE PER YEAR INITIAL PURCHASE PRICE VACANCY LOSS CREDIT LOSS OPERATING EXPENSE RATIO CATA CAPITAL EXPENDITURES GOING OUT CAP RATE ORDINARY INCOME TAX CAPITAL GAINS TAX RATE DISCOUNT RATE 4% 1% 40% 10% OF EGI 10.00% 25.00% 15.00% 12.00% 80% 7.00% (Note: Compute the payment using both options to see which mortgage the subject property qualifies for. If it qualifies for both, choose the mortgage with the lowest EBC). MORTGAGE OPTION 1: MORTGAGE OPTION 2: ASSUME YOU BORROW AT MAXIMUM LTV, BUT YOU MUST MEET THE MIN DCR MAX LTV 85% MIN Debt Coverage Ratio (DCR) 1.40 1.75 TERM (YEARS) 15 15 AMORTIZATION (YEARS) 30 15 INTEREST RATE 6.50% CLOSING COSTS: ORIGINATION FEE (Lender) 1.00% 1.00% OTHER NONLENDER FEES 2,500S 2,500 UNDERWRITING FEE (Lender) 300 $ 300 APPRAISAL 300 $ 300 SURVEY 500 $ 500 TOTAL CLOSING COSTS LENDER CLOSING COSTS B D E F G H 3 YEARS 50 800 1% $ $ 2,000,000 INPUTS HOLDING PERIOD UNITS MARKET RENT (MONTHLY) PER UNIT RENT INCREASE PER YEAR INITIAL PURCHASE PRICE VACANCY LOSS CREDIT LOSS OPERATING EXPENSE RATIO CATA CAPITAL EXPENDITURES GOING OUT CAP RATE ORDINARY INCOME TAX CAPITAL GAINS TAX RATE DISCOUNT RATE 4% 1% 40% 10% OF EGI 10.00% 25.00% 15.00% 12.00% 80% 7.00% (Note: Compute the payment using both options to see which mortgage the subject property qualifies for. If it qualifies for both, choose the mortgage with the lowest EBC). MORTGAGE OPTION 1: MORTGAGE OPTION 2: ASSUME YOU BORROW AT MAXIMUM LTV, BUT YOU MUST MEET THE MIN DCR MAX LTV 85% MIN Debt Coverage Ratio (DCR) 1.40 1.75 TERM (YEARS) 15 15 AMORTIZATION (YEARS) 30 15 INTEREST RATE 6.50% CLOSING COSTS: ORIGINATION FEE (Lender) 1.00% 1.00% OTHER NONLENDER FEES 2,500S 2,500 UNDERWRITING FEE (Lender) 300 $ 300 APPRAISAL 300 $ 300 SURVEY 500 $ 500 TOTAL CLOSING COSTS LENDER CLOSING COSTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts