Question: B D E F G H I A You are starting a family pizza parlor and need to buy a motorcycle for delivery orders. You

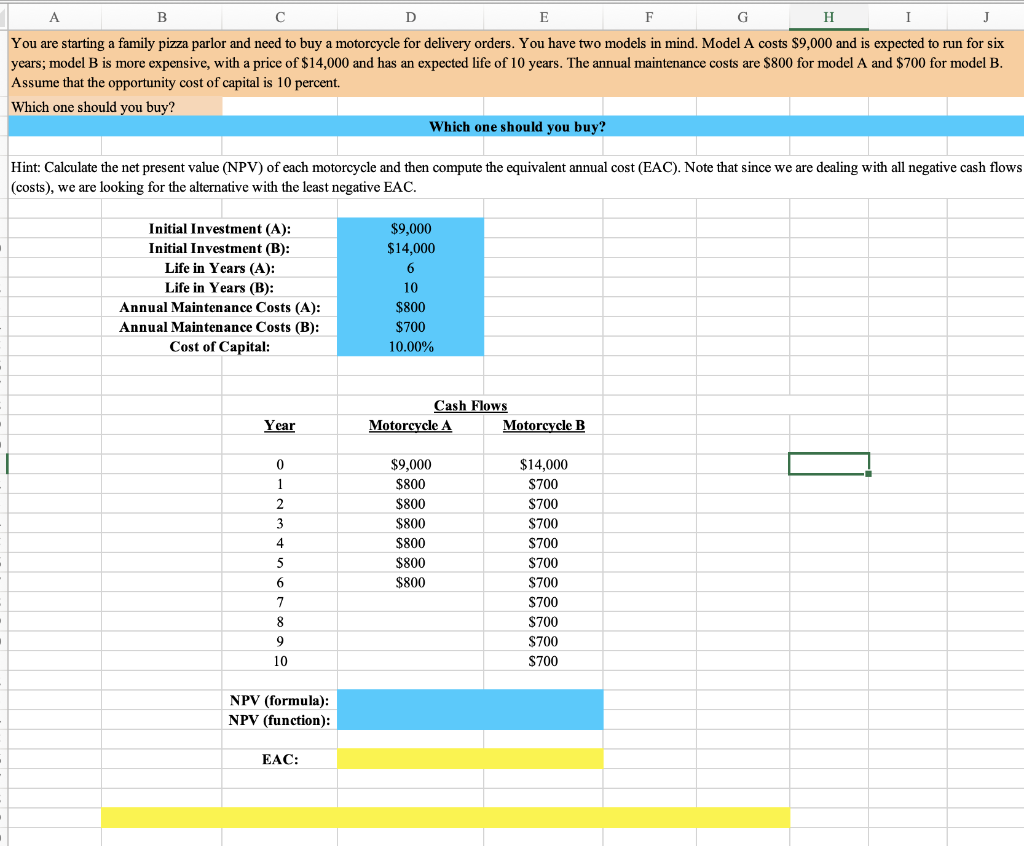

B D E F G H I A You are starting a family pizza parlor and need to buy a motorcycle for delivery orders. You have two models in mind. Model A costs $9,000 and is expected to run for six years; model B is more expensive, with a price of $14,000 and has an expected life of 10 years. The annual maintenance costs are $800 for model A and $700 for model B. Assume that the opportunity cost of capital is 10 percent. Which one should you buy? Which one should you buy? Hint: Calculate the net present value (NPV) of each motorcycle and then compute the equivalent annual cost (EAC). Note that since we are dealing with all negative cash flows (costs), we are looking for the alternative with the least negative EAC. $9,000 Initial Investment (A): Initial Investment (B): $14,000 Life in Years (A): 6 Life in Years (B): 10 Annual Maintenance Costs (A): $800 Annual Maintenance Costs (B): $700 Cost of Capital: 10.00% Motorcycle A Motorcycle B $9,000 $14,000 $800 $700 $800 $700 $800 $700 $800 $700 $800 $700 $800 $700 $700 $700 $700 $700 Year 0 1 2 3 4 5 6 7 8 9 10 NPV (formula): NPV (function): EAC: Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts