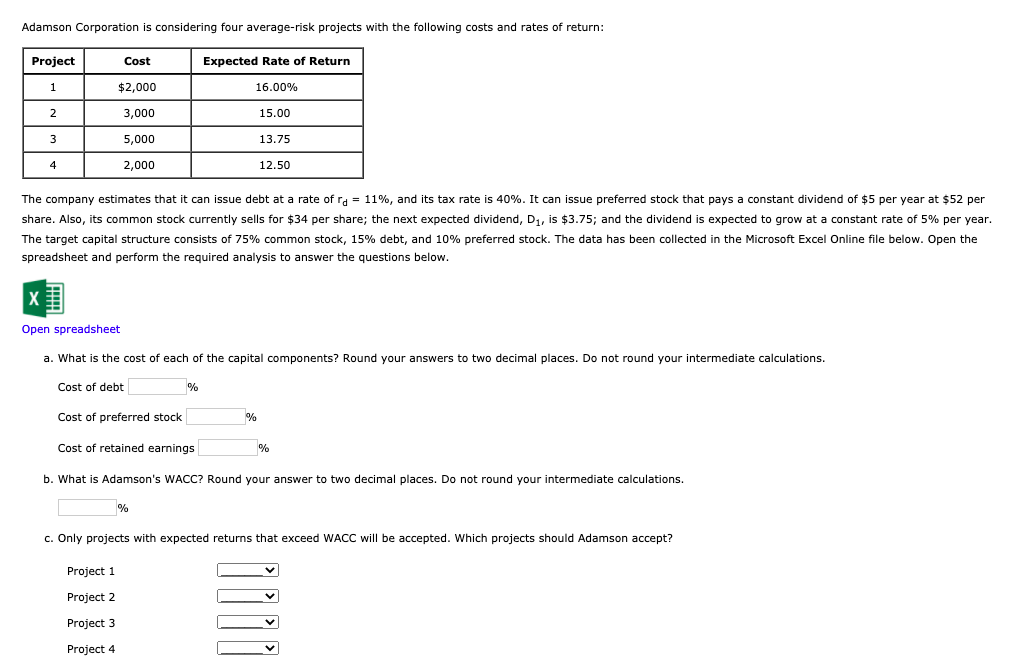

Question: B D E F G H I J K L M N 0 P Q WACC and optimal capital budget 2 3 Cost of debt,

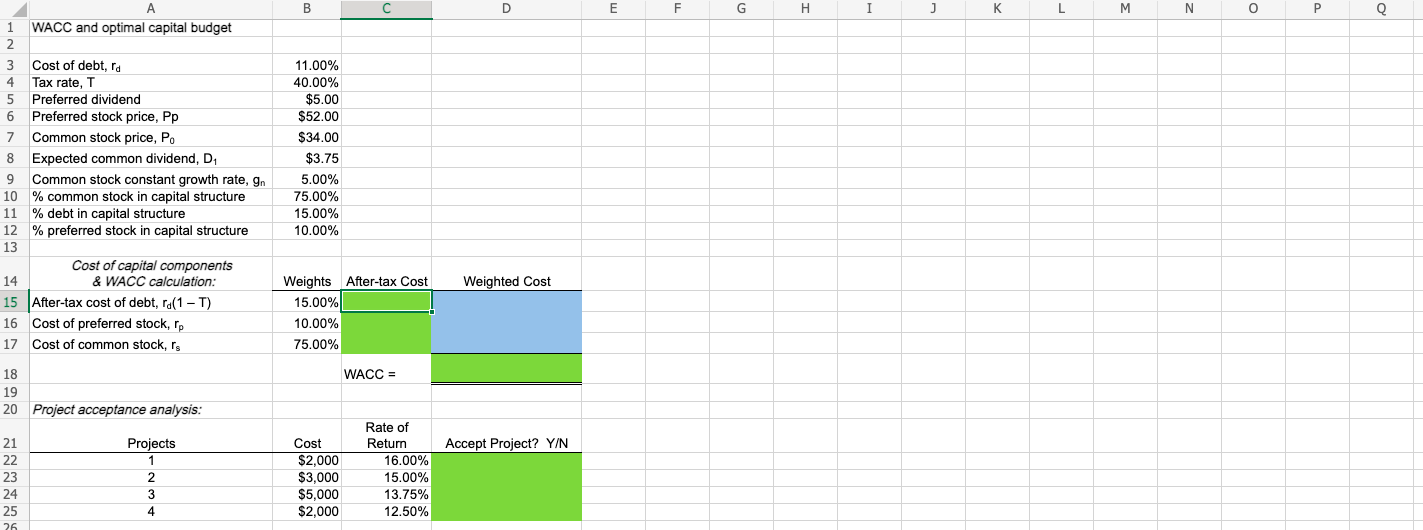

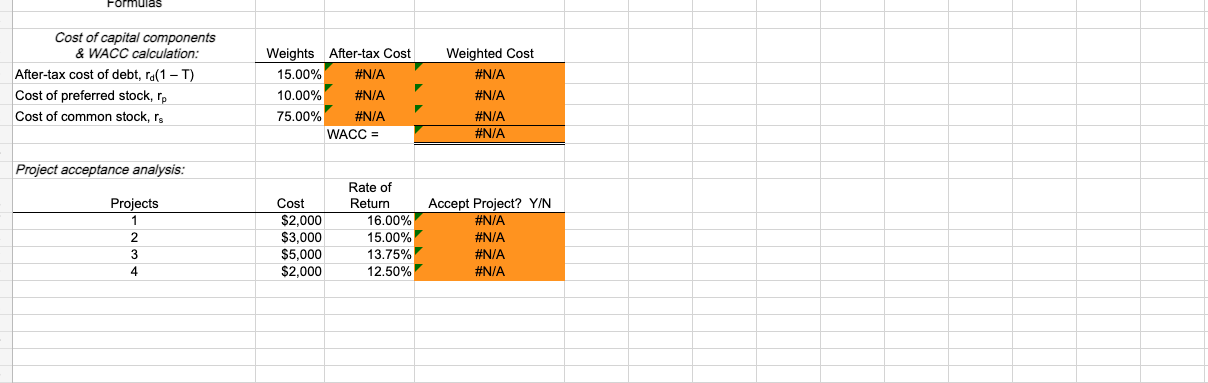

B D E F G H I J K L M N 0 P Q WACC and optimal capital budget 2 3 Cost of debt, rd 4 Tax rate, T 5 Preferred dividend 6 Preferred stock price, Pp 7 Common stock price, Po 8 Expected common dividend, D 9 Common stock constant growth rate, in 10 % common stock in capital structure 11 % debt in capital structure 12 % preferred stock in capital structure 13 Cost of capital components 14 & WACC calculation: 15 After-tax cost of debt, ra(1-T) 16 Cost of preferred stock, rp 17 Cost of common stock, rs 18 19 20 Project acceptance analysis: 11.00% 40.00% $5.00 $52.00 $34.00 $3.75 5.00% 75.00% 15.00% 10.00% Weighted Cost Weights After-tax Cost 15.00% 10.00% 75.00% WACC = 21 Accept Project? Y/N 22 23 24 25 26 Projects 1 2 3 4 Cost $2,000 $3,000 $5,000 $2,000 Rate of Retum 16.00% 15.00% 13.75% 12.50% Formulas Cost of capital components & WACC calculation: After-tax cost of debt, ra(1-T) Cost of preferred stock, rp Cost of common stock, rs Weights After-tax Cost 15.00% #N/A 10.00% #N/A 75.00% #N/A WACC = Weighted Cost #N/A #N/A #N/A #N/A Project acceptance analysis: Projects 1 2 3 4 Cost $2,000 $3,000 $5,000 $2,000 Rate of Return 16.00% 15.00% 13.75% 12.50% Accept Project? Y/N #N/A #N/A #N/A #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts