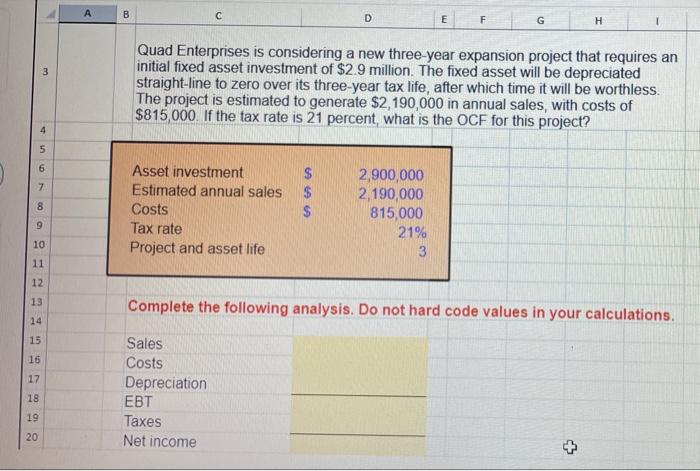

Question: B D E F G H Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million.

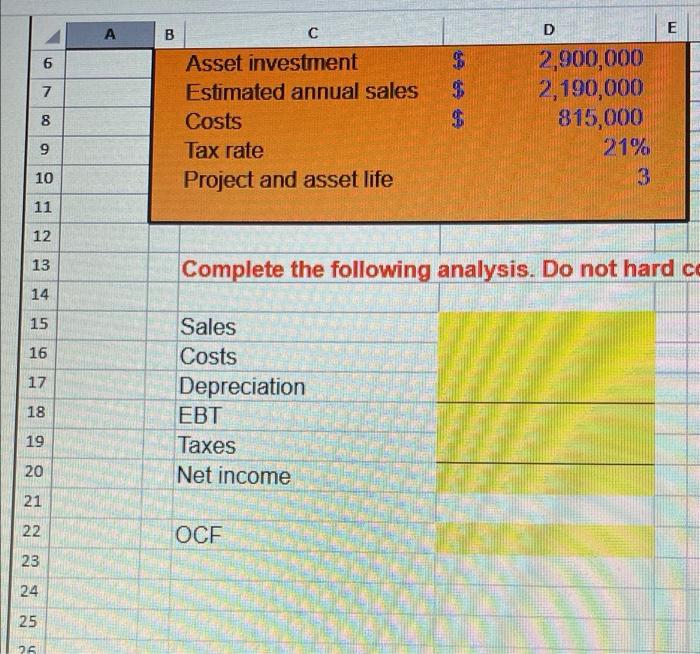

B D E F G H Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. If the tax rate is 21 percent, what is the OCF for this project? 4 5 6 7 Asset investment Estimated annual sales Costs Tax rate Project and asset life $ $ $ 8 2,900,000 2,190,000 815,000 21% 3 9 10 11 min. 12 13 Complete the following analysis. Do not hard code values in your calculations. 14 15 16 17 Sales Costs Depreciation EBT Taxes Net income 18 19 20 E A E D B LO 6 7 7 $ $ $ 00 Asset investment Estimated annual sales Costs Tax rate Project and asset life 8 2,900,000 2,190,000 815,000 21% 3 9 10 11 12 . 13 Complete the following analysis. Do not hard co 14 1 15 16 17 Sales Costs Depreciation Taxes Net income 18 19 20 21 22 OCE 23 24 25 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts