Question: B D E F G J K M N Assignment 5.4 Exercises Problem 4: Calculating Dollar Returns with Exchange Rates 5 Points An American investor

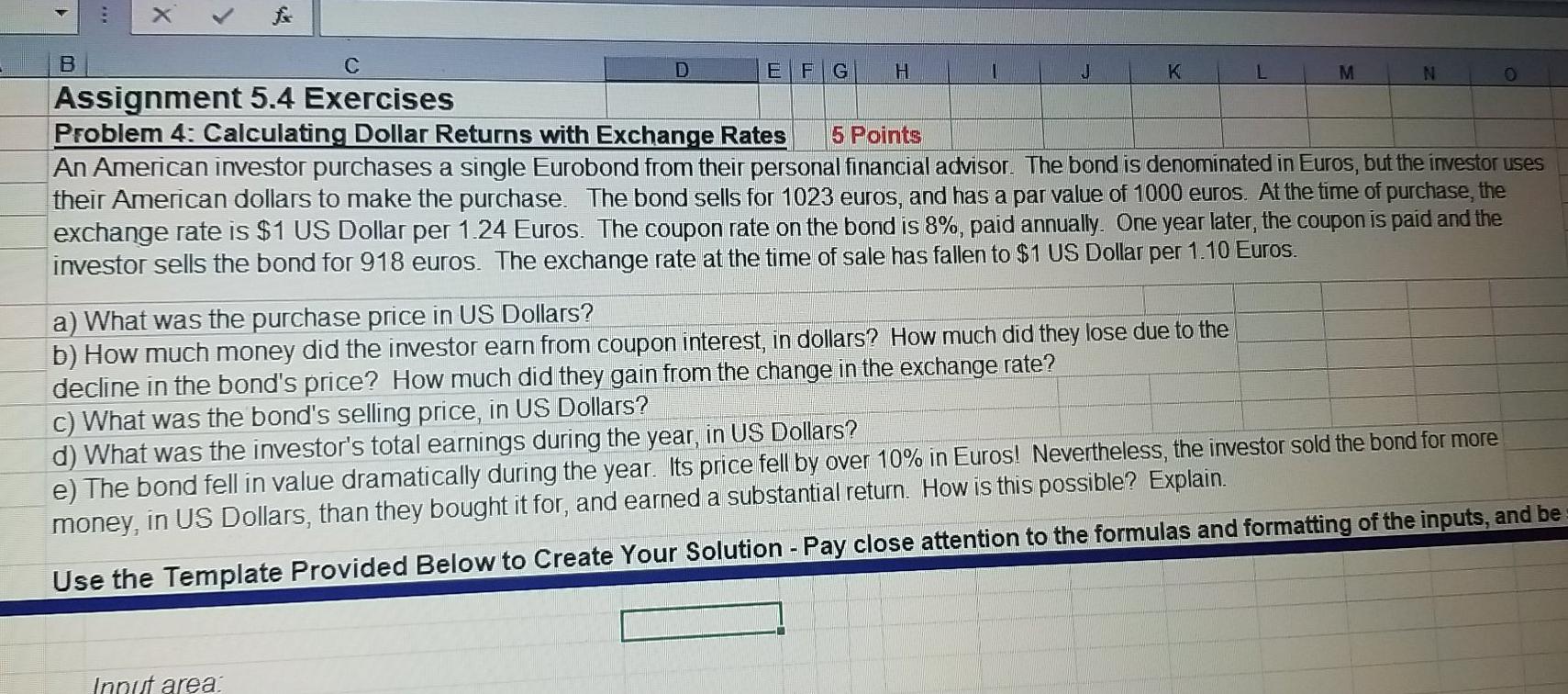

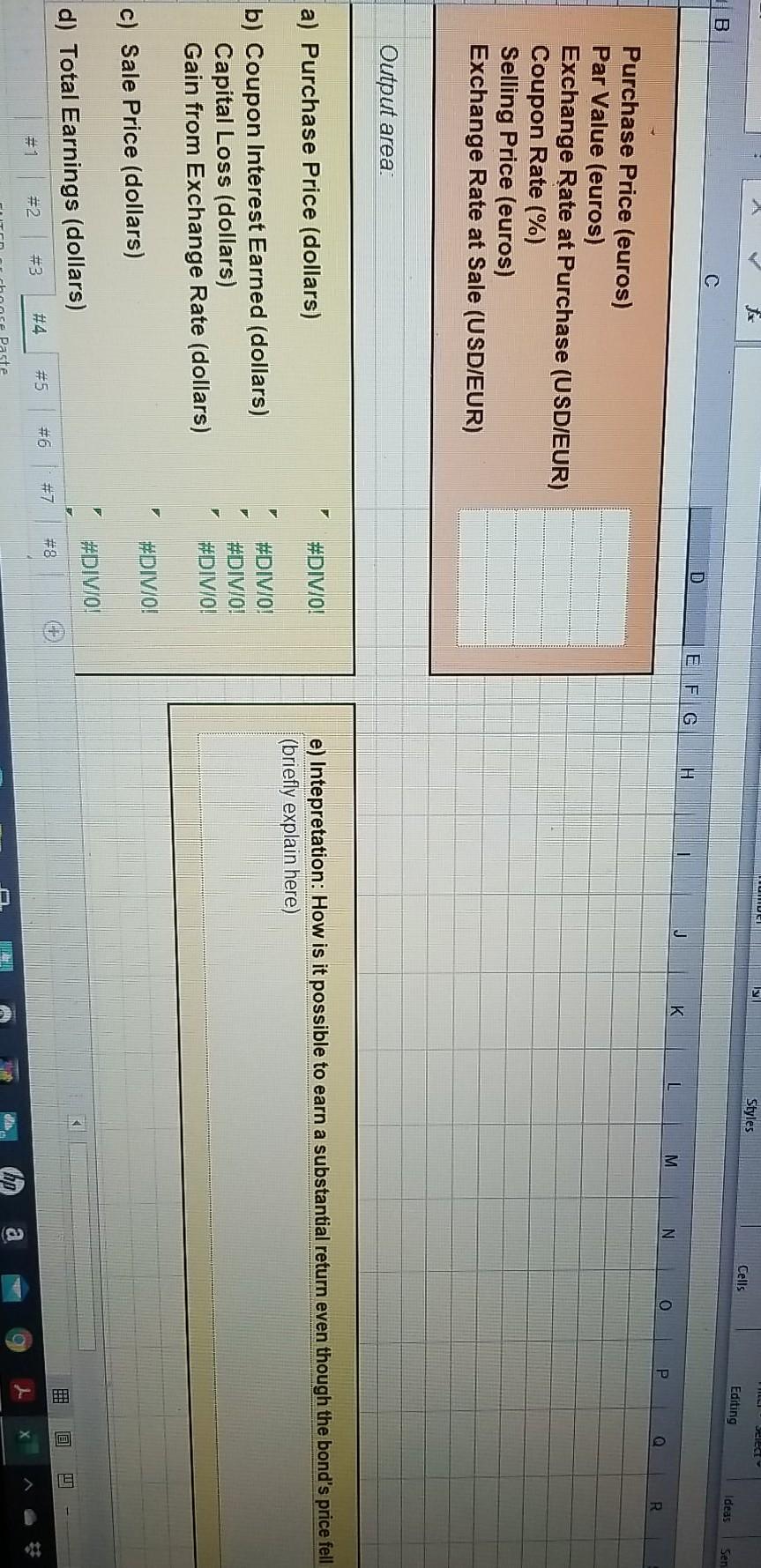

B D E F G J K M N Assignment 5.4 Exercises Problem 4: Calculating Dollar Returns with Exchange Rates 5 Points An American investor purchases a single Eurobond from their personal financial advisor. The bond is denominated in Euros, but the investor uses their American dollars to make the purchase. The bond sells for 1023 euros, and has a par value of 1000 euros. At the time of purchase, the exchange rate is $1 US Dollar per 1.24 Euros. The coupon rate on the bond is 8%, paid annually. One year later, the coupon is paid and the investor sells the bond for 918 euros. The exchange rate at the time of sale has fallen to $1 US Dollar per 1.10 Euros a) What was the purchase price in US Dollars? b) How much money did the investor earn from coupon interest, in dollars? How much did they lose due to the decline in the bond's price? How much did they gain from the change in the exchange rate? What was the bond's selling price, in US Dollars? d) What was the investor's total earnings during the year, in US Dollars? e) The bond fell in value dramatically during the year. Its price fell by over 10% in Euros! Nevertheless, the investor sold the bond for more money, in US Dollars, than they bought it for, and earned a substantial return. How is this possible? Explain. Use the Template Provided Below to Create Your Solution - Pay close attention to the formulas and formatting of the inputs, and be Input area: Styles Cells Editing B Ideas Sen D E F G H J K M N O P Q R Purchase Price (euros) Par Value (euros) Exchange Rate at Purchase (USD/EUR) Coupon Rate (%) Selling Price (euros) Exchange Rate at Sale (USD/EUR) Output area a) Purchase Price (dollars) #DIV/0! e) Intepretation: How is it possible to earn a substantial return even though the bond's price fell (briefly explain here) b) Coupon Interest Earned (dollars) Capital Loss (dollars) Gain from Exchange Rate (dollars) #DIVIO! #DIVIO! #DIV/0! 7 #DIV/0! c) Sale Price (dollars) #DIV/0! d) Total Earnings (dollars) #8 EP #7 #5 #4 #3 #2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts