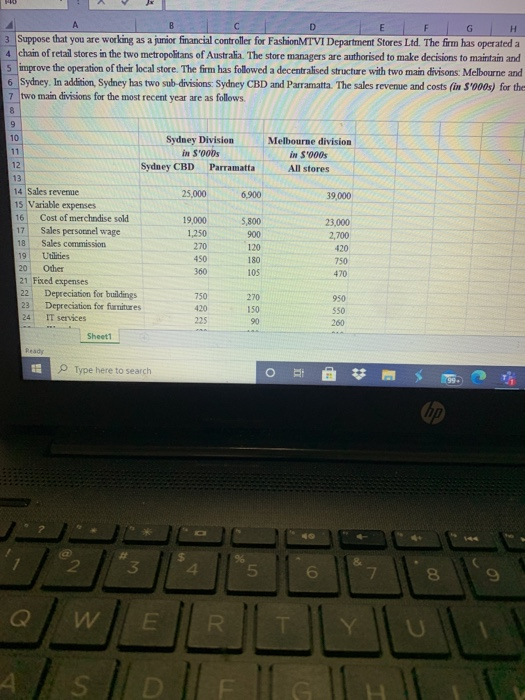

Question: B D E H 3. Suppose that you are working as a junior financial controller for FashionMTVI Department Stores Ltd. The firm has operated a

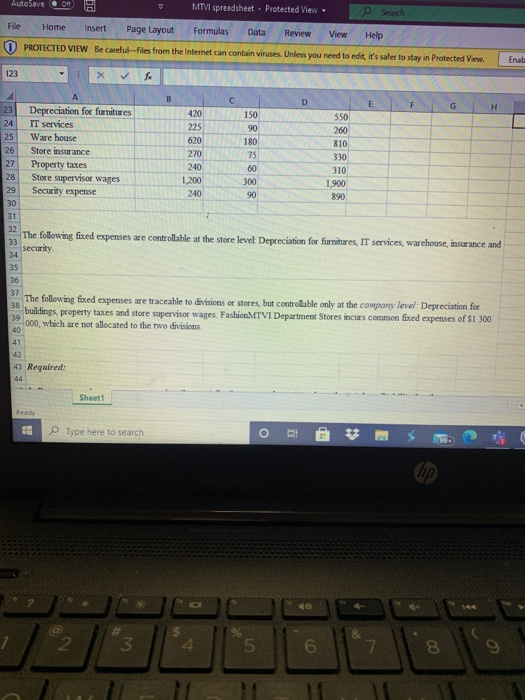

B D E H 3. Suppose that you are working as a junior financial controller for FashionMTVI Department Stores Ltd. The firm has operated a 4 chain of retail stores in the two metropolitans of Australia. The store managers are authorised to make decisions to maintain and 5 improve the operation of their local store. The firm has followed a decentralised structure with two main divisons: Melbourne and 6 Sydney. In addition, Sydney has two sub-divisions: Sydney CBD and Parramatta. The sales revenue and costs (in s'000s) for the 7 two main divisions for the most recent year are as follows. 8 9 10 Sydney Division Melbourne division 11 in Soobs in S'000 12 Sydney CBD Parramatta All stores 13 14 Sales revenue 25,000 6.900 39,000 15 Variable expenses 16 Cost of merchndise sold 19,000 5,800 23,000 17 Sales personnel wage 1,250 900 2,700 18 Sales commission 270 120 420 19 Utilities 450 180 750 20 Other 360 105 470 21 Fixed expenses 22 Depreciation for buildings 750 270 23 Depreciation for furnitures 420 150 $50 24 IT services 225 90 260 950 Sheet1 Ready Type here to search 99 ) 2 3 S 4 5 6 & 7 8 9 T Y well R. AslloELT IH AutoSave T MTV spreadsheet - Protected View e Search File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protected View Enat 123 1 G B D H 23 Depreciation for furnitures 420 150 550 24 IT services 225 90 260 25 Warehouse 620 180 810 26 Store insurance 270 75 330 27 Property taxes 240 60 310 28 Store supervisor wages 1,200 300 1,900 29 Security expense 240 90 890 30 31 32 The following fixed expenses are controllable at the store level Depreciation for furnitures, IT services, warehouse, insurance and 33 security 34 35 36 37 The following fixed expenses are traceable to divisions or stores, but controllable only at the company level: Depreciation for 38 buildings, property taxes and store supervisor wages FashionMTVI Department Stores incurs common fixed expenses of $1 300 39 000, which are not allocated to the two divisions 40 41 43 Required: Sheet1 Type here to search O i 99. 4 2 3 4 5 6 7. 8 9 AutoSave MTV spreadsheet - Protected View File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit, es sales to stay in Protected View Enable Editing 123 34 D H 35 36 37 The following fixed expenses are traceable to divisions or stores, but controllable only at the company level: Depreciation for buildings, property taxes and store supervisor wages. FashionMTVI Department Stores incurs comme fixed expenses of $1 300 000, which are not allocated to the two divisions 38 39 40 41 42 43 Required: 44 45 1. Pepare a performance report using the contribution marga format to show the total profitability for the company, 46 the profitability for the two stores that are part of the Sydney division, and the profitability of the Melbourne division 47 as a whole. (10 marks) 48 49 2. As your role of a financial controller, explain to the managing director on how this report could be used to manage the company 50 (5 mars 51 (Please write your answer to the question (2) here: 52 53 54 35 Sheet1 Ready Type here to search O # E * & 2 $ 4 3 5 6 7 8 9 Q W E R. . U A slollFollHllllk K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts