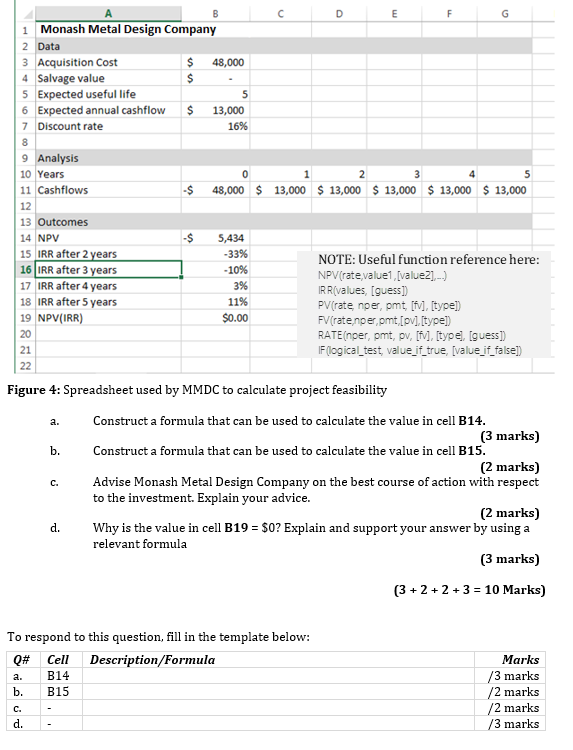

Question: B D F G 5 4 A E 1 Monash Metal Design Company 2 Data 3 Acquisition Cost $ 48,000 4 Salvage value $ 5

B D F G 5 4 A E 1 Monash Metal Design Company 2 Data 3 Acquisition Cost $ 48,000 4 Salvage value $ 5 Expected useful life 6 Expected annual cashflow $ 13,000 7 Discount rate 16% 8 9 Analysis 10 Years 0 1 2 3 5 11 Cashflows -$ 48,000 $13,000 $ 13,000 $ 13,000 $ 13,000 $ 13,000 12 13 Outcomes 14 NPV -$ 5,434 15 IRR after 2 years -33% NOTE: Useful function reference here: 16 IRR after 3 years - 10% NPV(rate,value1 [value21...) 17 IRR after 4 years 3% IRR values, (guess]) 18 IRR after 5 years 11% PV(rate nper, pmt, [F], [type]) 19 NPV(IRR) $0.00 FV (ratenper pmt [pvl. [type]) 20 RATE(nper, pmt, pv, [f], [type], [guess] 21 IF(logical_test, value_if_true, [value_if_false]) 22 Figure 4: Spreadsheet used by MMDC to calculate project feasibility a. b. Construct a formula that can be used to calculate the value in cell B14. (3 marks) Construct a formula that can be used to calculate the value in cell B15. (2 marks) Advise Monash Metal Design Company on the best course of action with respect to the investment. Explain your advice. (2 marks) Why is the value in cell B19 = $0? Explain and support your answer by using a relevant formula (3 marks) d. (3 + 2 + 2 + 3 = 10 Marks) To respond to this question, fill in the template below: Q# Cell Description/Formula B14 a. b. B15 Marks /3 marks /2 marks /2 marks /3 marks C. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts