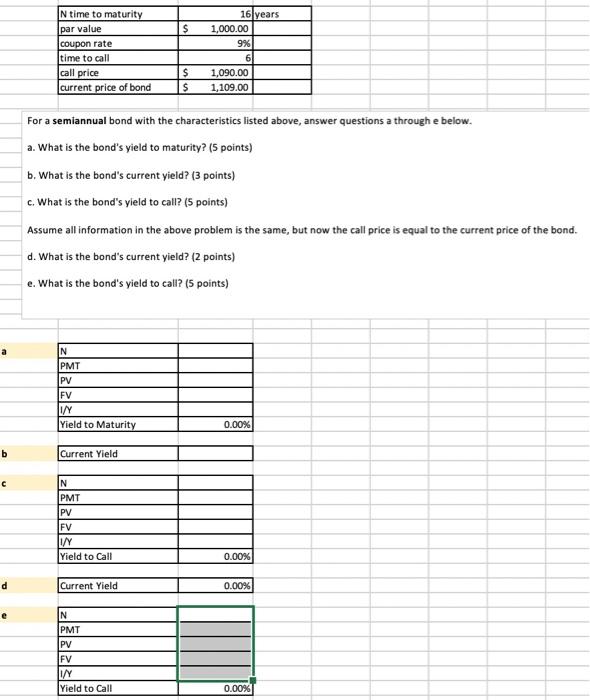

Question: b d N time to maturity par value $ 1,000.00 coupon rate 9% time to call call price $ 1,090.00 current price of bond $

b d N time to maturity par value $ 1,000.00 coupon rate 9% time to call call price $ 1,090.00 current price of bond $ 1,109.00 For a semiannual bond with the characteristics listed above, answer questions a through e below. a. What is the bond's yield to maturity? (5 points) b. What is the bond's current yield? (3 points) c. What is the bond's yield to call? (5 points) Assume all information in the above problem is the same, but now the call price is equal to the current price of the bond. d. What is the bond's current yield? (2 points) e. What is the bond's yield to call? (5 points) N PMT PV FV 0.00% 0.00% 0.00% 0.00% I/Y Yield to Maturity Current Yield N PMT PV FV I/Y Yield to Call Current Yield N PMT PV FV I/Y Yield to Call 16 years 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts