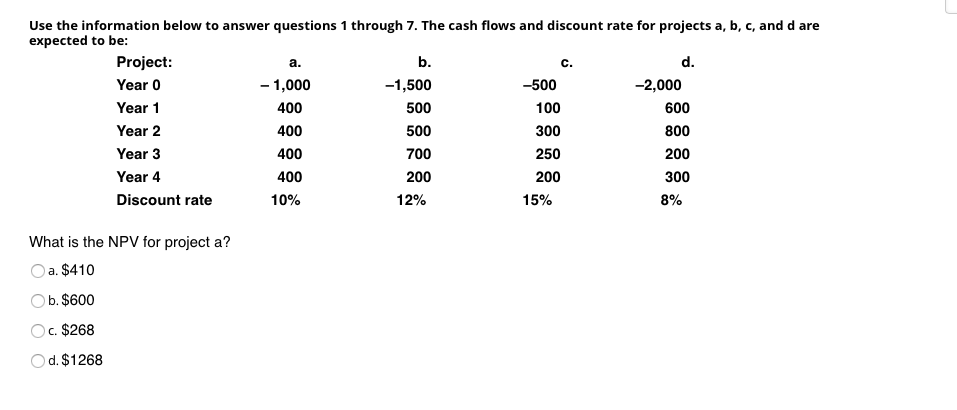

Question: b. d. Use the information below to answer questions 1 through 7. The cash flows and discount rate for projects a, b, c, and d

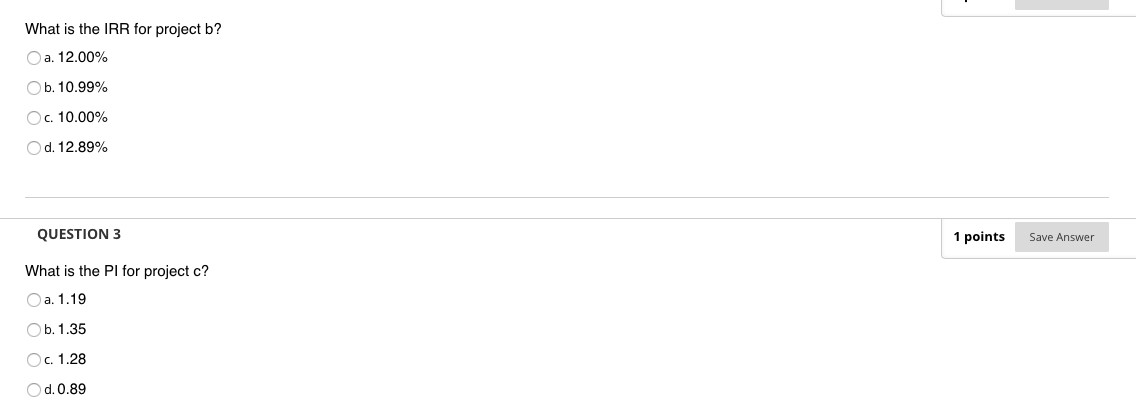

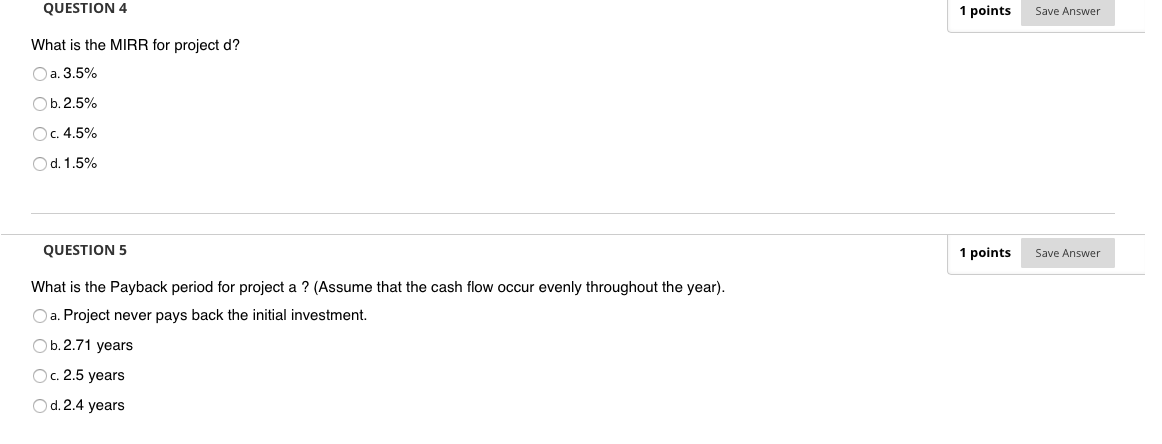

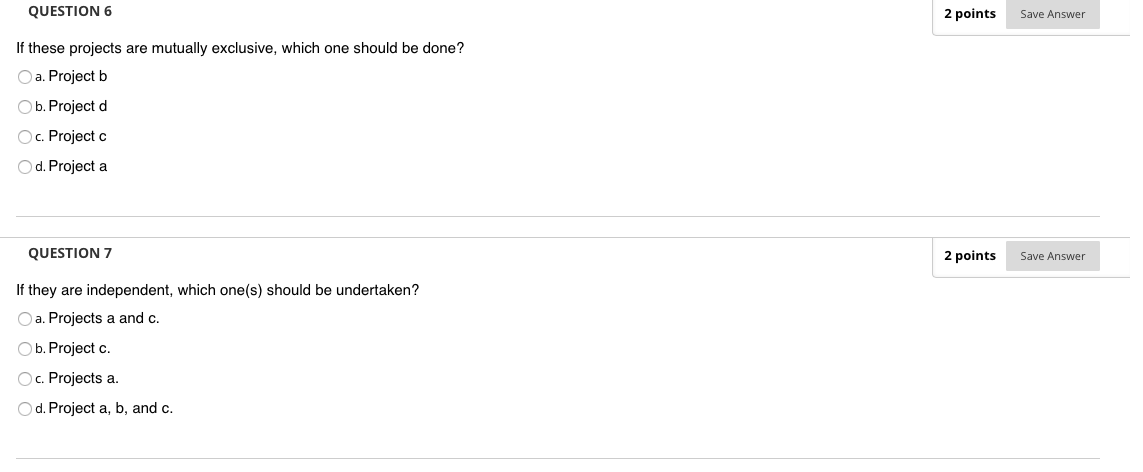

b. d. Use the information below to answer questions 1 through 7. The cash flows and discount rate for projects a, b, c, and d are expected to be: Project: Year 0 - 1,000 -1,500 -500 -2,000 Year 1 400 500 600 Year 2 400 500 Year 3 400 700 250 200 Year 4 400 200 200 300 Discount rate 10% 12% 15% 8% 100 300 800 What is the NPV for project a? a. $410 Ob. $600 Oc. $268 Od. $1268 What is the IRR for project b? a. 12.00% Ob. 10.99% Oc 10.00% d. 12.89% QUESTION 3 1 points Save Answer What is the Pl for project c? O a. 1.19 Ob. 1.35 Oc 1.28 O d. 0.89 QUESTION 4 1 points Save Answer What is the MIRR for project d? Oa. 3.5% Ob.2.5% c.4.5% Od. 1.5% QUESTION 5 1 points Save Answer What is the Payback period for project a ? (Assume that the cash flow occur evenly throughout the year). a. Project never pays back the initial investment. Ob.2.71 years Oc. 2.5 years d. 2.4 years QUESTION 6 2 points Save Answer If these projects are mutually exclusive, which one should be done? a. Project b Ob. Project d c. Project c Od. Project a QUESTION 7 2 points Save Answer If they are independent, which one(s) should be undertaken? a. Projects a and c. Ob. Project c. Oc. Projects a. d. Project a, b, and c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts