Question: b. Debbie, age 40, is a single parent with a 4-year-old son. She earns $700,000 annually as an audit manager in an accountancy firm. As

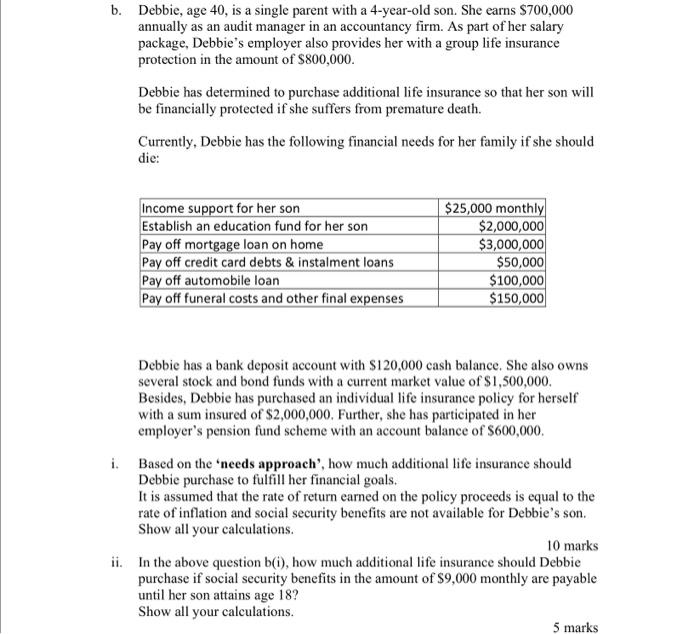

b. Debbie, age 40, is a single parent with a 4-year-old son. She earns $700,000 annually as an audit manager in an accountancy firm. As part of her salary package, Debbie's employer also provides her with a group life insurance protection in the amount of $800,000. Debbie has determined to purchase additional life insurance so that her son will be financially protected if she suffers from premature death. Currently, Debbie has the following financial needs for her family if she should die: Income support for her son Establish an education fund for her son Pay off mortgage loan on home Pay off credit card debts & instalment loans Pay off automobile loan Pay off funeral costs and other final expenses $25,000 monthly $2,000,000 $3,000,000 $50,000 $100,000 $150,000 Debbie has a bank deposit account with $120,000 cash balance. She also owns several stock and bond funds with a current market value of $1,500,000 Besides, Debbie has purchased an individual life insurance policy for herself with a sum insured of $2,000,000. Further, she has participated in her employer's pension fund scheme with an account balance of $600,000 i. Based on the needs approach', how much additional life insurance should Debbie purchase to fulfill her financial goals. It is assumed that the rate of return earned on the policy proceeds is equal to the rate of inflation and social security benefits are not available for Debbie's son. Show all your calculations. 10 marks ii. In the above question b(i), how much additional life insurance should Debbie purchase if social security benefits in the amount of $9,000 monthly are payable until her son attains age 18? Show all your calculations. 5 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts