Question: b. Determine the payback period for the new machine. Problem B Graham Company currently uses four machines to produce 400,000 units annually. The machines were

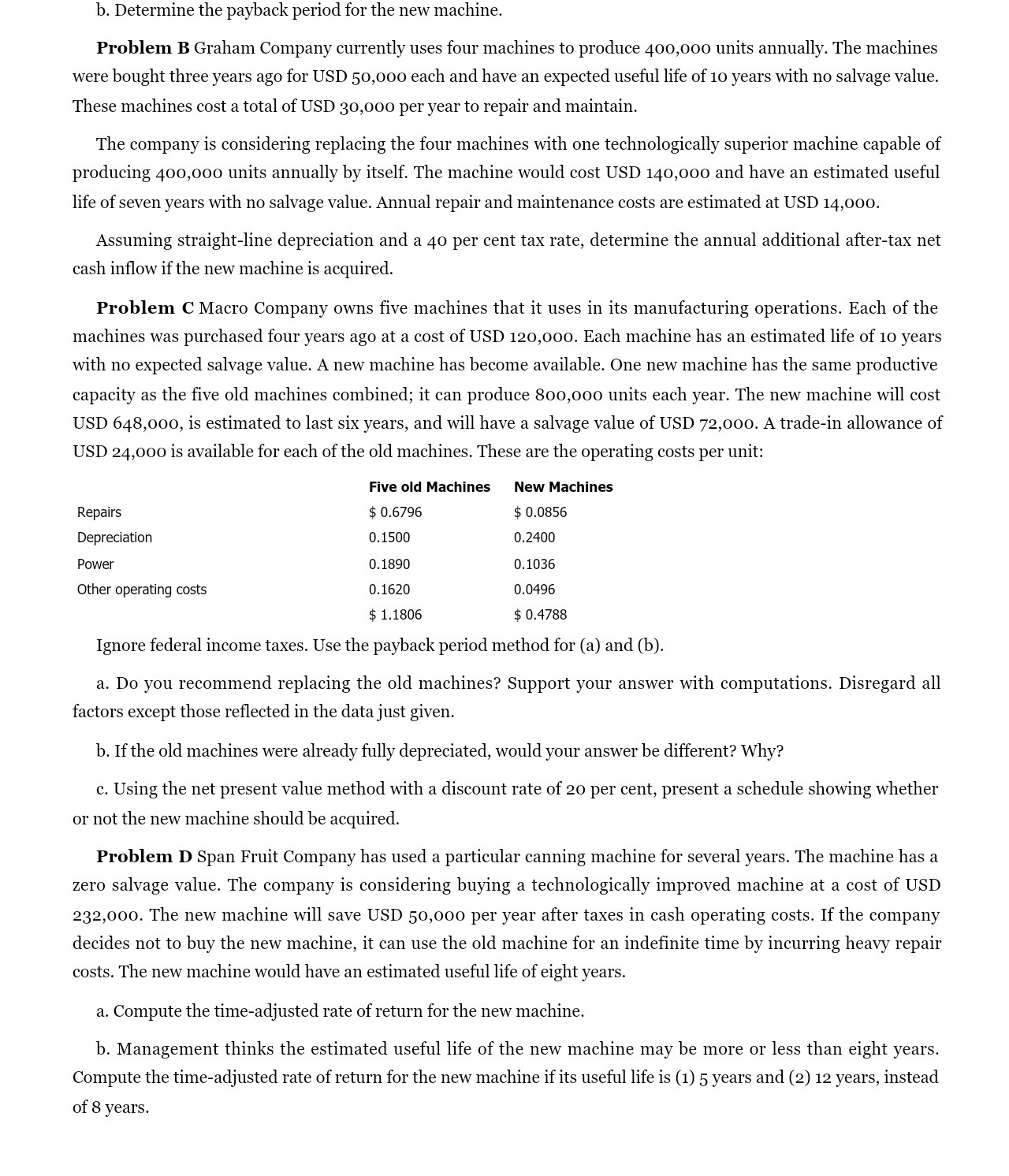

b. Determine the payback period for the new machine. Problem B Graham Company currently uses four machines to produce 400,000 units annually. The machines were bought three years ago for USD 50,000 each and have an expected useful life of 10 years with no salvage value. These machines cost a total of USD 30,000 per year to repair and maintain. The company is considering replacing the four machines with one technologically superior machine capable of producing 400,000 units annually by itself. The machine would cost USD 140,000 and have an estimated useful life of seven years with no salvage value. Annual repair and maintenance costs are estimated at USD 14,000. Assuming straight-line depreciation and a 40 per cent tax rate, determine the annual additional aftertax net cash inow if the new machine is acquired. Problem C Macro Company owns ve machines that it uses in its manufacturing operations. Each of the machines was purchased four years ago at a cost of USD 120,000. Each machine has an estimated life of 10 years with no expected salvage value. A new machine has become available. One new machine has the same productive capacity as the ve old machines combined; it can produce 800,000 units each year. The new machine will cost USD 648,000, is estimated to last six years, and will have a salvage value of USD 72,000. A trade-in allowance of USD 24,000 is available for each of the old machines. These are the operating costs per unit: Five old Machines New Machines Repairs $06796 $ 0.0856 Depreciation 0.1500 0.2400 Power 0.1890 0.1036 Other operating costs 0.1620 0.0496 $ 1.1305 $ 0.4738 Ignore federal income taxes. Use the payback period method for (a) and (b). a. Do you recommend replacing the old machines? Support your answer with computations. Disregard all factors except those reected in the data just given. b. If the old machines were already fully depreciated, would your answer be different? Why? c. Using the net present value method with a discount rate of 20 per cent, present a schedule showing whether or not the new machine should be acquired. Problem D Span Fruit Company has used a particular canning machine for several years. The machine has a zero salvage value. The company is considering buying a technologically improved machine at a cost of USD 232,000. The new machine will save USD 50,000 per year after taxes in cash operating costs. If the company decides not to buy the new machine, it can use the old machine for an indenite time by incurring heavy repair costs. The new machine would have an estimated useful life of eight years. a. Compute the time-adjusted rate of return for the new machine. b. Management thinks the estimated useful life of the new machine may be more or less than eight years. Compute the time-adjusted rate of return for the new machine if its useful life is [1) 5 years and {2) 12 years, instead of 8 years