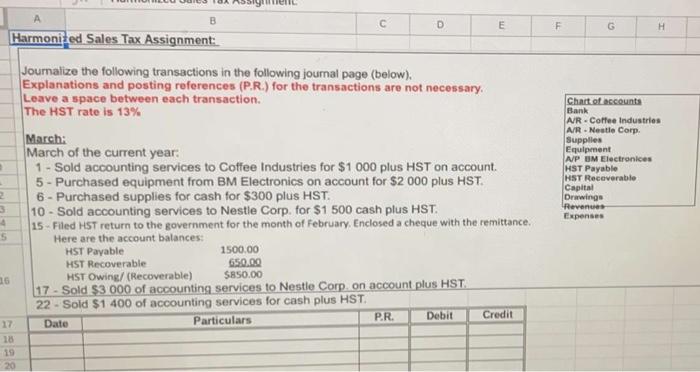

Question: B E F G H D Harmonited Sales Tax Assignment: Joumalize the following transactions in the following joumal page (below). Explanations and posting references (P.R.)

B E F G H D Harmonited Sales Tax Assignment: Joumalize the following transactions in the following joumal page (below). Explanations and posting references (P.R.) for the transactions are not necessary Leave a space between each transaction. The HST rate is 13% March: March of the current year: 1 - Sold accounting services to Coffee Industries for $1 000 plus HST on account 5 - Purchased equipment from BM Electronics on account for $2 000 plus HST. 6 - Purchased supplies for cash for $300 plus HST. 10 - Sold accounting services to Nestle Corp. for $1 500 cash plus HST. 15 - Filed HST return to the government for the month of February, Enclosed a cheque with the remittance. Here are the account balances: HST Payable 1500.00 650.00 HST Owing/ (Recoverable) S8S0.00 17 - Sold $3 000 of accounting services to Nestle Corp. on account plus HST 22 - Sold $1 400 of accounting services for cash plus HST. Date Particulars P.R. Debit Credit Chart of accounts Bank AR - Coffee Industries A/R - Nestle Corp. Supplies Equipment AP EM Electronics HST Payable HST Recoverable Capital Drawings Revenues Expenses 2 3 4 5 HST Recoverable 17 18 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts