Question: B eBook An electric utility is considering a new power plant in northern Arizona, Power from the plant would be sold in the Phoenix area,

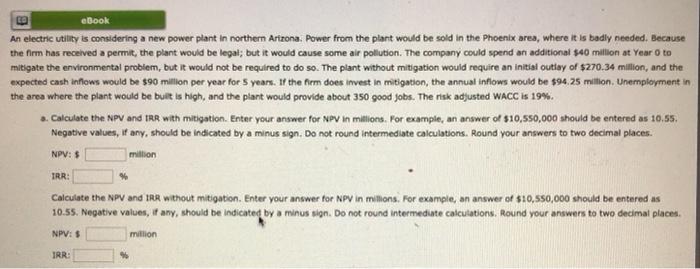

B eBook An electric utility is considering a new power plant in northern Arizona, Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has received a permit, the plant would be legal; but it would cause some air pollution. The company could spend an additional $40 million at Year o to mitigate the environmental problem, but it would not be required to do so. The plant without mitigation would require an initial outlay of $270.34 million, and the expected cash inflows would be $90 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $94.25 million. Unemployment in the area where the plant would be built is high, and the plant would provide about 350 good jobs. The risk adjusted WACC is 19%. Calculate the NPV and TRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round Intermediate calculations. Round your answers to two decimal places NPV: $ million IRR: Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations, Round your answers to two decimal places NPV: 5 million IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts