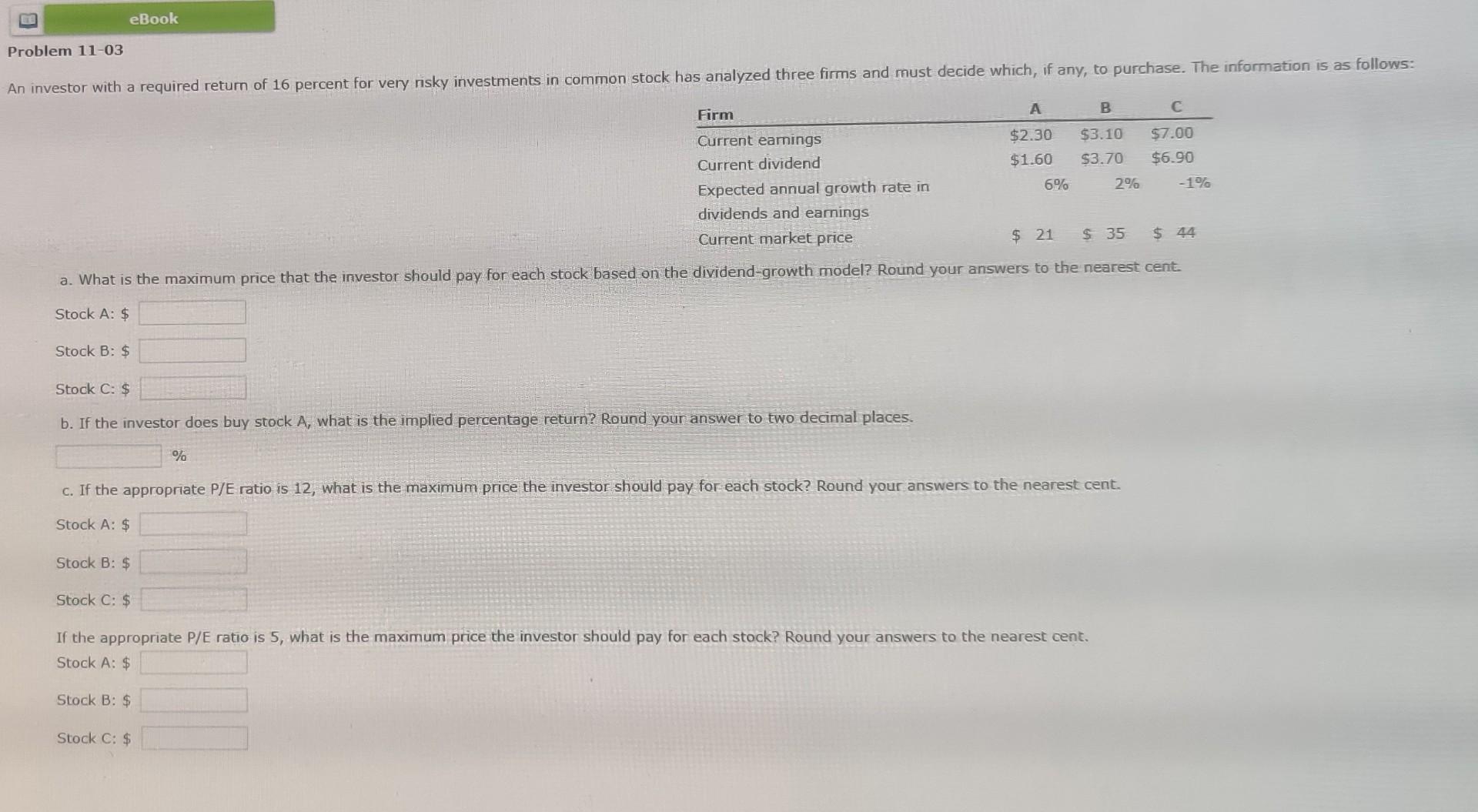

Question: B eBook Problem 11-03 An investor with a required return of 16 percent for very risky investments in common stock has analyzed three firms and

B eBook Problem 11-03 An investor with a required return of 16 percent for very risky investments in common stock has analyzed three firms and must decide which, if any, to purchase. The information is as follows: B Firm $3.10 $2.30 $1.60 $7.00 $6.90 $3.70 6% 2% Current eamings Current dividend Expected annual growth rate in dividends and earings Current market price -1% $ 21 $ 35 $ 44 a. What is the maximum price that the investor should pay for each stock based on the dividend-growth model? Round your answers to the nearest cent. Stock A: $ Stock B: $ Stock C: $ b. If the investor does buy stock A, what is the implied percentage return? Round your answer to two decimal places. % C. If the appropriate P/E ratio is 12, what is the maximum price the investor should pay for each stock? Round your answers to the nearest cent. Stock A: $ Stock B: $ Stock C: $ If the appropriate P/E ratio is 5, what is the maximum price the investor should pay for each stock? Round your answers to the nearest cent. Stock A: $ Stock B: $ Stock C: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts