Question: b. Explain in detail (with supporting calculations and explaining the influence of the spread effect and the GAP effect) how you would adjust your balance

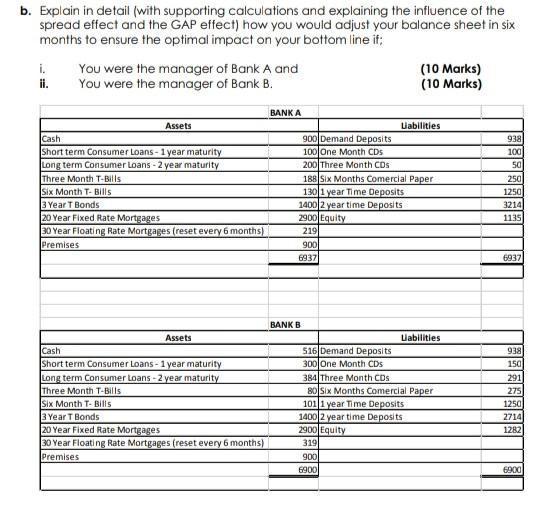

b. Explain in detail (with supporting calculations and explaining the influence of the spread effect and the GAP effect) how you would adjust your balance sheet in six months to ensure the optimal impact on your bottom line it; i. You were the manager of Bank A and (10 Marks) You were the manager of Bank B. (10 Marks) ii. Assets Cash Short term Consumer Loans - 1 year maturity Long term Consumer Loans - 2 year maturity Three Month T-Bills Six Month T- Bills 3 Year T Bonds 20 Year Fixed Rate Mortgages 30 Year Floating Rate Mortgages (reset every 6 months) Premises BANKA Uabilities 900 Demand Deposits 100 One Month CDs 200 Three Month CDs 188 Six Months Comercial Paper 130 1 year Time Deposits 1400 2 year time Deposits 2900 Equity 219 900 6937 938 100 50 250 1250 3214 1135 6937 938 150 BANKB Assets Uabilities Cash 516 Demand Deposits Short term Consumer Loans - 1 year maturity 300 One Month CDS Long term Consumer Loans - 2 year maturity 384 Three Month CDs Three Month T-Bills 80 Six Months Comercial Paper Six Month T- Bills 101 1 year Time Deposits 3 Year T Bonds 1400 2 year time Deposits 20 Year Fixed Rate Mortgages 2900 Equity 30 Year Floating Rate Mortgages (reset every 6 months) 319 Premises 900 6900 291 275 1250 2714 1282 6900 b. Explain in detail (with supporting calculations and explaining the influence of the spread effect and the GAP effect) how you would adjust your balance sheet in six months to ensure the optimal impact on your bottom line it; i. You were the manager of Bank A and (10 Marks) You were the manager of Bank B. (10 Marks) ii. Assets Cash Short term Consumer Loans - 1 year maturity Long term Consumer Loans - 2 year maturity Three Month T-Bills Six Month T- Bills 3 Year T Bonds 20 Year Fixed Rate Mortgages 30 Year Floating Rate Mortgages (reset every 6 months) Premises BANKA Uabilities 900 Demand Deposits 100 One Month CDs 200 Three Month CDs 188 Six Months Comercial Paper 130 1 year Time Deposits 1400 2 year time Deposits 2900 Equity 219 900 6937 938 100 50 250 1250 3214 1135 6937 938 150 BANKB Assets Uabilities Cash 516 Demand Deposits Short term Consumer Loans - 1 year maturity 300 One Month CDS Long term Consumer Loans - 2 year maturity 384 Three Month CDs Three Month T-Bills 80 Six Months Comercial Paper Six Month T- Bills 101 1 year Time Deposits 3 Year T Bonds 1400 2 year time Deposits 20 Year Fixed Rate Mortgages 2900 Equity 30 Year Floating Rate Mortgages (reset every 6 months) 319 Premises 900 6900 291 275 1250 2714 1282 6900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts