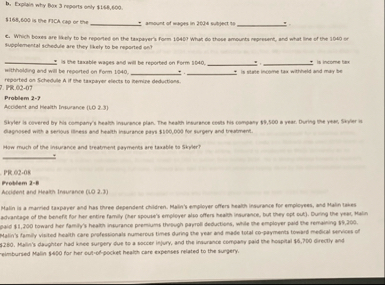

Question: b . Explain why Box 3 ruperts only $ 1 6 8 , 6 0 0 . $ 1 6 8 , 6 0 0

b Explain why Box ruperts only $

$ is the HCA cap or the amount of mops in siffect the

C Which boxes are likely to be repoled en the taspayery form What do these amounta moreuent, and what line of the or supplemental schedule are they thely to be reported en

: I the taxable wages and will be reported on Form : is income tiex withiniting and will be reperted on Form E is state incernet las writicald and may be reported on sichedule A if the taspayer alects to Revire deductions.

PR

Problem

Accident and Health Insurance

Simer is covered by Rig company's health insurance plan. The health insurance evels his ceneany a year. Doring the yas, Sipler in dagnesed with a serous firess asd twath inturance pays $ for surgery and treamant.

How much of the insurance and treatment sayments are taxable Skiler?

PR

Freblem

Acdifient and peakn Insurance

Malin is a married tapperer and has three dependent children. Malin's enyloyer offers healh insuranie for employees, and Malin lases advancage of the behefin for her entire family her spouse's emplieyer also offers health insurahok, but they ept out Durne the yeac, Main Malin's family visited health care profescionaly numerous times during the year and made total cepayments tomard medical arrices el Malin's daughter had knee surpery sue to a soccer infory, and the insurance compativ paid the houpital $ directly and reimbursed Malin $ for her bulofpocket health care expenses related to the surgery.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock