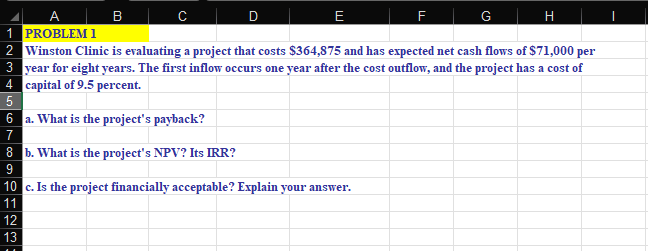

Question: B F G . B D E F G H 1 PROBLEM 1 2 Winston Clinic is evaluating a project that costs $364,875 and has

B F G . B D E F G H 1 PROBLEM 1 2 Winston Clinic is evaluating a project that costs $364,875 and has expected net cash flows of $71,000 per 3 year for eight years. The first inflow occurs one year after the cost outflow, and the project has a cost of 4 capital of 9.5 percent 5 6a. What is the project's payback? 7 8 b. What is the project's NPV? Its IRR? 9 10 c. Is the project financially acceptable? Explain your answer. 11 12 13

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock