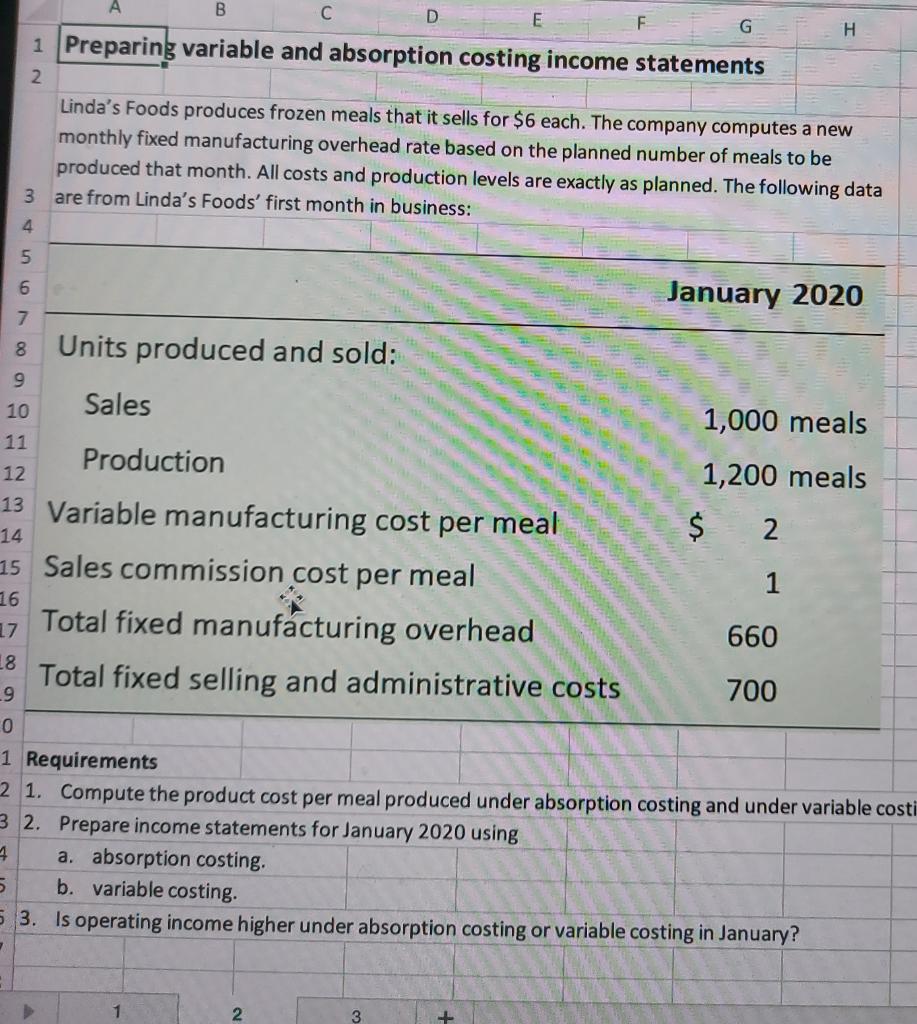

Question: B F G H 1 Preparing variable and absorption costing income statements 2. Linda's Foods produces frozen meals that it sells for $6 each. The

B F G H 1 Preparing variable and absorption costing income statements 2. Linda's Foods produces frozen meals that it sells for $6 each. The company computes a new monthly fixed manufacturing overhead rate based on the planned number of meals to be produced that month. All costs and production levels are exactly as planned. The following data 3 are from Linda's Foods' first month in business: 5 000 W January 2020 7 8 Units produced and sold: 9 14 16 10 Sales 1,000 meals 11 Production 12 1,200 meals 13 Variable manufacturing cost per meal $ 2 15 Sales commission cost per meal 1 17 Total fixed manufacturing overhead 660 8 Total fixed selling and administrative costs 700 9 0 1 Requirements 2 1. Compute the product cost per meal produced under absorption costing and under variable costi 3 2. Prepare income statements for January 2020 using 1 a. absorption costing. 5 b. variable costing. 53. Is operating income higher under absorption costing or variable costing in January? 1 2 3 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts