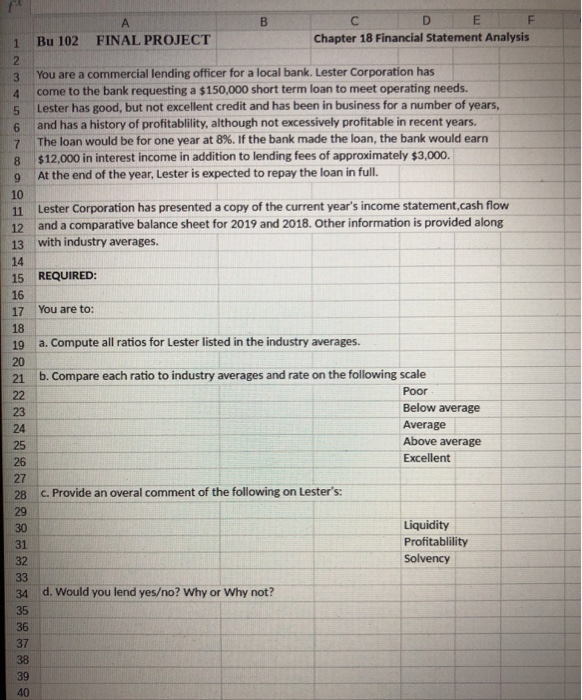

Question: B FINAL PROJECT E F Chapter 18 Financial Statement Analysis Bu 102 You are a commercial lending officer for a local bank. Lester Corporation has

B FINAL PROJECT E F Chapter 18 Financial Statement Analysis Bu 102 You are a commercial lending officer for a local bank. Lester Corporation has come to the bank requesting a $150,000 short term loan to meet operating needs. Lester has good, but not excellent credit and has been in business for a number of years, and has a history of profitablility, although not excessively profitable in recent years. The loan would be for one year at 8%. If the bank made the loan, the bank would earn $12,000 in interest income in addition to lending fees of approximately $3,000. At the end of the year, Lester is expected to repay the loan in full. Lester Corporation has presented a copy of the current year's income statement cash flow and a comparative balance sheet for 2019 and 2018. Other information is provided along with industry averages. REQUIRED: You are to: a. Compute all ratios for Lester listed in the industry averages. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 b. Compare each ratio to industry averages and rate on the following scale Poor Below average Average Above average Excellent C. Provide an overal comment of the following on Lester's: Liquidity Profitablility Solvency d. Would you lend yeso? Why or Why not? B FINAL PROJECT E F Chapter 18 Financial Statement Analysis Bu 102 You are a commercial lending officer for a local bank. Lester Corporation has come to the bank requesting a $150,000 short term loan to meet operating needs. Lester has good, but not excellent credit and has been in business for a number of years, and has a history of profitablility, although not excessively profitable in recent years. The loan would be for one year at 8%. If the bank made the loan, the bank would earn $12,000 in interest income in addition to lending fees of approximately $3,000. At the end of the year, Lester is expected to repay the loan in full. Lester Corporation has presented a copy of the current year's income statement cash flow and a comparative balance sheet for 2019 and 2018. Other information is provided along with industry averages. REQUIRED: You are to: a. Compute all ratios for Lester listed in the industry averages. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 b. Compare each ratio to industry averages and rate on the following scale Poor Below average Average Above average Excellent C. Provide an overal comment of the following on Lester's: Liquidity Profitablility Solvency d. Would you lend yeso? Why or Why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts