Question: b. Form the table above, list which options are in-the money (both call and puts) Times New... v 12 A BI U v ab x.

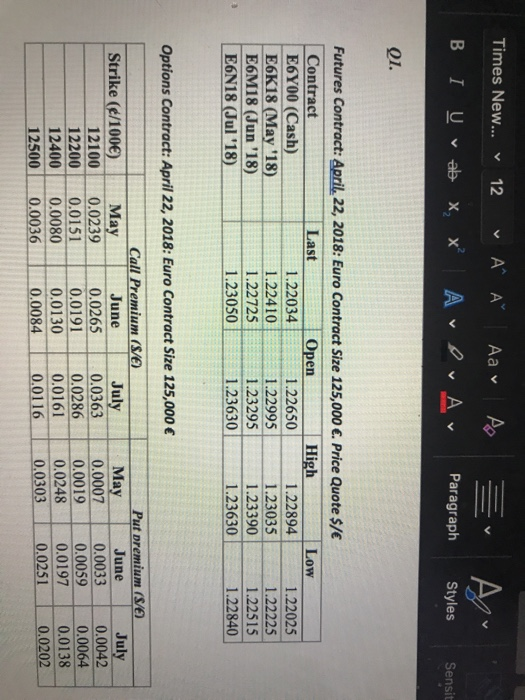

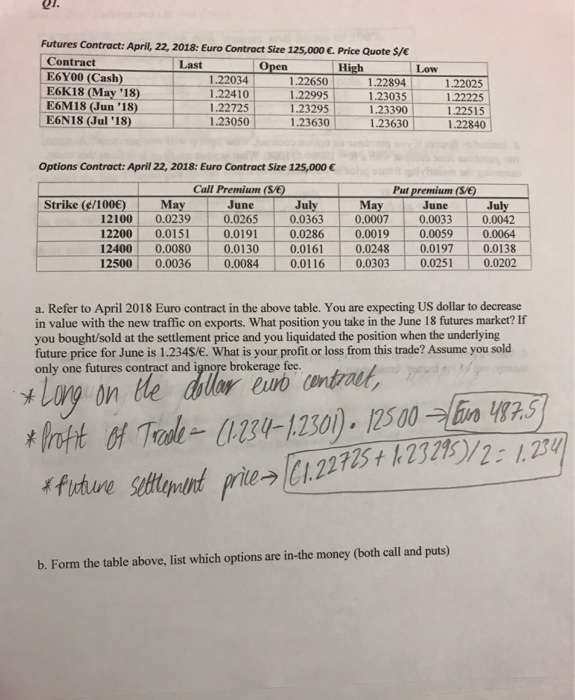

b. Form the table above, list which options are in-the money (both call and puts) Times New... v 12 A BI U v ab x. x A Aa v p Avv Av E v Paragraph Alu Styles Sensit Q1. Futures Contract: April 22, 2018: Euro Contract Size 125,000 . Price Quote $/ Contract Open High Low E6Y00 (Cash) 1.22034 1.22650 1.22894 E6K18 (May (18) 1.22410 1.22995 1.230351 E6M18 (Jun '18) 1.22725 1.23295 1.23390 E6N18 (Jul '18) 1.23050 1.23630 1.23630 1.22025 .22225 1.22515 1.22840 Options Contract: April 22, 2018: Euro Contract Size 125,000 Call Premium (SVO) Strike (/100) May June July 12100 0.0239 10.0265 0.0363 12200 0.0151 0.0191 0.0286 12400 0.0080 0.0130 0.0161 125000.0036 0.0084 0.0116 Put premium (SVO) May June July 0.0007 0.0033 0.0042 0.0019 0.0059 0.0064 0.0248 0.0197 0.0138 0.0303 0.0251 0.0202 UI. Low Futures Contract: April, 22, 2018: Euro Contract Size 125,000 Price Quote S/ Contract Last Open High E6Y00 (Cash) 1.22034 1.22650 1.22894 E6K18 (May '18) 1.22410 1.22995 1 .23035 E6M18 Jun '18) 1.22725 1.23295 1 .23390 E6N18 (Jul '18) 1.23050 1.23630 1.23630 1.22025 1.22225 1.22515 1.22840 Options Contract: April 22, 2018: Euro Contract Size 125,000 Strike (/1000) 12100 12200 12400 12500 Call Premium (S/E) May June July 0.0239 0.0265 0.0363 0.0151 0.0191 0.0286 0.0080 0.0130 0.0161 0.0036 0.0084 0.0116 Put premium (S/E) May June 0.0007 0.0033 0.0019 0.0059 0.0248 0.0197 0.0303 0.0251 July 0.0042 0.0064 0.0138 0.0202 a. Refer to April 2018 Euro contract in the above table. You are expecting US dollar to decrease in value with the new traffic on exports. What position you take in the June 18 futures market? If you bought/sold at the settlement price and you liquidated the position when the underlying future price for June is 1.2345/. What is your profit or loss from this trade? Assume you sold only one futures contract and ignore brokerage fee. * Long on the dollar euro centralt, * Profit of Trade - (1.234-1.2301). 12500 Euro 487,5] * future settlement price > [C1.22725 + 1.23295)/2=1,234 b. Form the table above, list which options are in-the money (both call and puts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts