Question: (B) From the issuer's perspectives, explain the relationship between call risk premiums and the level of interest rates in the economy. (6 Marks) On June

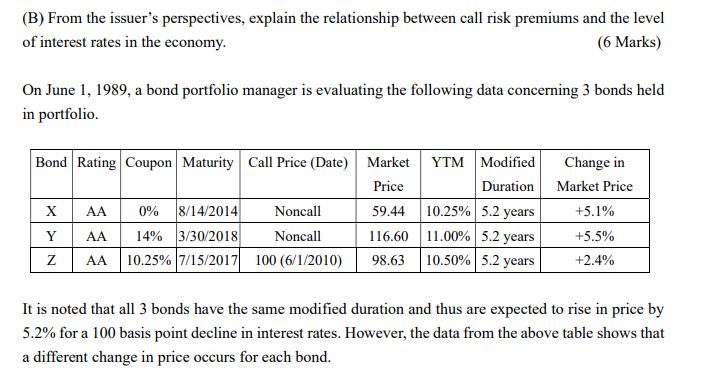

(B) From the issuer's perspectives, explain the relationship between call risk premiums and the level of interest rates in the economy. (6 Marks) On June 1, 1989, a bond portfolio manager is evaluating the following data concerning 3 bonds held in portfolio Change in Market Price Bond Rating Coupon Maturity Call Price (Date) Market YTM Modified Price Duration X AA 0% 8/14/2014 Noncall 59.44 10.25% 5.2 years Y AA 14% 3/30/2018 Noncall 116.60 11.00% 5.2 years Z AA 10.25% 7/15/2017 100 (6/1/2010) 98.63 10.50% 5.2 years +5.1% +5.5% +2.4% It is noted that all 3 bonds have the same modified duration and thus are expected to rise in price by 5.2% for a 100 basis point decline in interest rates. However, the data from the above table shows that a different change in price occurs for each bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts