Question: b) Given below are the mean and the standard deviation (Stdev) of the returns on a Canadian stock, C, and a riskless asset, F. Assume

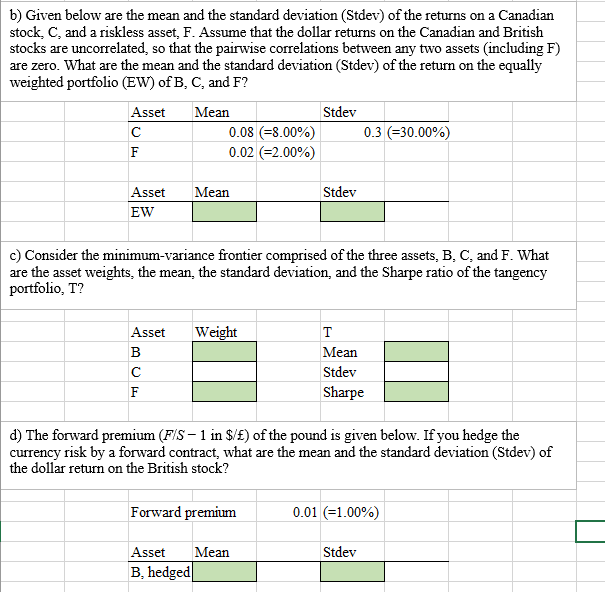

b) Given below are the mean and the standard deviation (Stdev) of the returns on a Canadian stock, C, and a riskless asset, F. Assume that the dollar returns on the Canadian and British stocks are uncorrelated, so that the pairwise correlations between any two assets (including F) are zero. What are the mean and the standard deviation (Stdev) of the return on the equally weighted portfolio (EW) of B, C, and F? Asset Mean Stdev 0.3 =30.00%) 0.08 (=8.00%) 0.02 (=2.00%) F Asset Mean Stdev EW c) Consider the minimum-variance frontier comprised of the three assets, B, C, and F. What are the asset weights, the mean, the standard deviation and the Sharpe ratio of the tangency portfolio, T? Asset Weight T B Mean Stdev F Sharpe d) The forward premium (FIS- 1 in $/) of the pound is given below. If you hedge the currency risk by a forward contract, what are the mean and the standard deviation (Stdev) of the dollar return on the British stock? Forward premium 0.01 (=1.00%) Asset Mean Stdev B, hedged b) Given below are the mean and the standard deviation (Stdev) of the returns on a Canadian stock, C, and a riskless asset, F. Assume that the dollar returns on the Canadian and British stocks are uncorrelated, so that the pairwise correlations between any two assets (including F) are zero. What are the mean and the standard deviation (Stdev) of the return on the equally weighted portfolio (EW) of B, C, and F? Asset Mean Stdev 0.3 =30.00%) 0.08 (=8.00%) 0.02 (=2.00%) F Asset Mean Stdev EW c) Consider the minimum-variance frontier comprised of the three assets, B, C, and F. What are the asset weights, the mean, the standard deviation and the Sharpe ratio of the tangency portfolio, T? Asset Weight T B Mean Stdev F Sharpe d) The forward premium (FIS- 1 in $/) of the pound is given below. If you hedge the currency risk by a forward contract, what are the mean and the standard deviation (Stdev) of the dollar return on the British stock? Forward premium 0.01 (=1.00%) Asset Mean Stdev B, hedged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts